HP 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

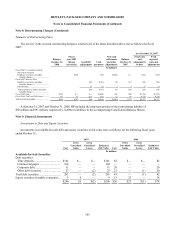

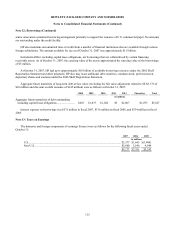

Note 12: Borrowings (Continued)

On February 22, 2007, HP issued an additional $2.0 billion of global notes under the 2006 Shelf Registration Statement.

The global notes included $600 million of notes due March 2012 with a floating interest rate equal to the three-month USD

LIBOR plus 0.11% per annum, $900 million of notes due March 2012 with a fixed interest rate of 5.25% per annum, and

$500 million of notes due March 2017 with a fixed interest rate of 5.40% per annum. HP issued the $600 million notes at par,

and HP issued the $900 million notes and $500 million notes at discounts to par at 99.938% and 99.694%, respectively. HP

used the net proceeds from this offering for general corporate purposes, including funding the repurchase of the notes it

assumed in connection with the Mercury acquisition as described in detail below and repaying short-term commercial paper.

On June 12, 2007, HP issued an additional $2.0 billion of global notes under the 2006 Shelf Registration Statement. The

global notes included $1.0 billion of notes due June 2009 with a floating interest rate equal to the three-month USD LIBOR

plus 0.01% per annum, and $1.0 billion of notes due June 2010 with a floating interest rate equal to the three-month USD

LIBOR plus 0.06% per annum. HP issued these global notes at par. HP used the net proceeds from these offerings for general

corporate purposes, including the redemption of the floating rate global notes due May 22, 2009 in June 2007 and the

repayment of short-term commercial paper.

HP registered the sale of up to $3.0 billion of debt or global securities, common stock, preferred stock, depositary shares

and warrants under a shelf registration statement in March 2002 (the “2002 Shelf Registration Statement”). In

December 2002, HP filed a supplement to the 2002 Shelf Registration Statement, which allows HP to offer from time to time

up to $1.5 billion of Medium-Term Notes, Series B, due nine months or more from the date of issuance (the “Series B

Medium-Term Note Program”). As of October 31, 2007, HP has not issued Medium-Term Notes pursuant to the Series B

Medium-Term Note Program.

HP registered the sale of up to $3.0 billion of Medium-Term Notes under its Euro Medium-Term Note Programme filed

with the Luxembourg Stock Exchange. HP can denominate these notes in any currency, including the euro. HP has not and

will not register these notes in the United States. In July 2006, HP repaid the previously issued 750 million euro notes at

maturity under this programme.

The LYONs are convertible by the holders at an adjusted rate of 15.09 shares of HP common stock for each $1,000 face

value of the LYONs, payable in either cash or common stock at HP’ s election. In December 2000, the HP Board of Directors

authorized a repurchase program for the LYONs that allowed HP to repurchase the LYONs from time to time at varying

prices. The last repurchase under this program occurred in fiscal 2002.

In November 2006, in connection with the Mercury acquisition, HP assumed notes issued by Mercury (the “Mercury

Notes”) with a face value of $300 million, maturing on July 1, 2007 and bearing interest at a rate of 4.75% per annum. As of

July 31, 2007, HP had repurchased or repaid at maturity all of the outstanding Mercury Notes.

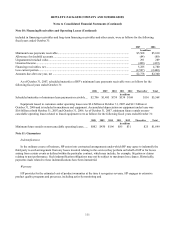

HP has a U.S. commercial paper program with a $6.0 billion capacity. Its subsidiaries are authorized to issue up to an

additional $1.0 billion of commercial paper, of which $500 million of capacity is currently available to be used by

Hewlett-Packard International Bank PLC, a wholly-owned subsidiary of HP, for its Euro Commercial Paper/Certificate of

Deposit Programme.

HP has a $3.0 billion five-year credit facility. Commitment fees, interest rates and other terms of borrowing under the

credit facility vary, based on HP’ s external credit ratings. The credit facility is a

114