HP 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2007

Table of contents

-

Page 1

Annual Report 2007 -

Page 2

... expected development, performance, market share or demand relating to HP's products and services; any statements regarding anticipated operational and ï¬nancial results, including the execution of cost reduction programs; any statements including estimates regarding market size or growth; any... -

Page 3

... proï¬t dollars 30 percent¹ and returned more than $12 billion to stockholders through share repurchases and dividends. We grew revenues across all of our business segments and in each of our regions. Overall, it was an impressive performance by HP's employees and partners around the world. 1 -

Page 4

...cÂClass blade systems helped drive yearÂoverÂyear blade revenue growth of 67 percent, and we increased our industryÂleading market share. In our Personal Systems Group, we continue to beneï¬t as demand shifts toward mobility, consumers and emerging markets. For example, our sales... -

Page 5

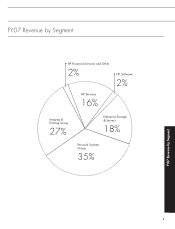

FY07 Revenue by Segment •฀HP฀Financial฀Services฀and฀Other 2% HP Services •฀HP฀Software 2% 16% Imaging & Printing Group Enterprise Storage & Servers Personal Systems Group 35% 3 FY07 Revenue by Segment 27% 18% -

Page 6

...right mix. For example, HP hired 1,000 sales professionals in ï¬scal 2007 to expand our coverage in key accounts and markets, and the company added more than 1,000 salespeople through acquisitions. We also are investing in higherÂmargin categories such as software and services... -

Page 7

We continue to align the company around an operating framework with three key elements: targeted growth, efï¬ciency and capital strategy. 5 -

Page 8

... of our heritage and the values engrained in HP by Bill Hewlett and Dave Packard. Today, our citizenship efforts are built on a foundation of strong corporate accountability and governance, a commitment to environmental responsibility and active investment and involvement in the communities... -

Page 9

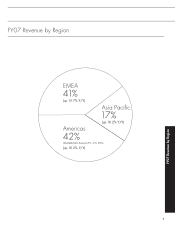

FY07 Revenue by Region EMEA 41% (up 15.7% Y/Y) 17% Americas Asia Paciï¬c (up 18.2% Y/Y) FY07 Revenue by Region 7 42% (Canada/Latin America 9%, U.S. 33%) (up 10.3% Y/Y) -

Page 10

CEO Letter We believe that HP has an unparalleled ability to drive simplicity, innovate and inï¬,uence industry actions in a way that is good for customers, good for business and good for the planet. 8 -

Page 11

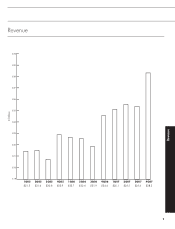

Revenue $30 $29 $28 $27 $26 In billions $25 $24 $23 $22 $21 $20 $19 1Q05 $21.5 2Q05 $21.6 3Q05 $20.8 4Q05 $22.9 1Q06 $22.7 2Q06 $22.6 3Q06 $21.9 4Q06 $24.6 1Q07 $25.1 2Q07 $25.5 3Q07 $25.4 4Q07 $28.3 9 Revenue -

Page 12

... customers, the investment of choice for our stock holders and the employer of choice for our employees. Thank you for your investment in HP. Sincerely, Executive Team Mark V. Hurd Chairman, Chief Executive Ofï¬cer and President R. Todd Bradley Executive Vice President, Personal Systems Group... -

Page 13

...Gross cash¹ Net cash² FY05 $13.9 $8.7 FY06 $16.4 $11.2 FY07 $11.6 $3.4 ¹ Includes cash and cash equivalents, shortÂterm investments and certain liquid longÂterm investments. ² Net cash is deï¬ned as gross cash less total debt. 11 Gross and Net Cash -

Page 14

... retirement in April 2007. He was a director of Compaq Computer Corporation from 1995 until HP's acquisition of Compaq in May 2002. Sari M. Baldauf Director since 2006 Ms. Baldauf served as Executive Vice President and General Manager of the Networks business group... -

Page 15

...Palo Alto, California (Address of principal executive offices) 94-1081436 (I.R.S. employer identification no.) 94304 (Zip code) Registrant' s telephone number, including area code: (650) 857-1501 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common stock, par value... -

Page 16

... Statements and Supplementary Data...Changes in and Disagreements with Accountants on Accounting and Financial Disclosures...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance of the Registrant ...Executive Compensation ...Security... -

Page 17

...of revenue, margins, expenses, tax provisions, earnings, cash flows, benefit obligations, share repurchases or other financial items; any statements of the plans, strategies and objectives of management for future operations, including the execution of cost reduction programs and restructuring plans... -

Page 18

...industry standard servers, desktops, notebooks and printing supplies each accounted for more than 10% of our consolidated net revenue. A summary of our net revenue, earnings from operations and assets for our segments and business units is found in Note 18 to the Consolidated Financial Statements in... -

Page 19

...business goals and automate data center operations and IT processes, enabling IT to deliver more value to the business. Personal Systems Group PSG is the leading provider of personal computers ("PCs") in the world based on unit volume shipped and annual revenue. PSG provides commercial PCs, consumer... -

Page 20

... Group IPG is the leading imaging and printing systems provider in the world for consumer and commercial printer hardware, printing supplies, printing media and scanning devices. IPG is also focused on imaging solutions in the commercial markets, from managed print services solutions to addressing... -

Page 21

... product and service solutions, providing a broad range of value-added financial life-cycle management services. HPFS enables our worldwide customers to acquire complete IT solutions, including hardware, software and services. The group offers leasing, financing, utility programs and asset recovery... -

Page 22

... third-party retail locations for imaging and printing products, as well as other consumer products, including consumer PCs, which provides for a bundled sale opportunity between PCs and IPG products. In addition, IPG manages direct consumer sales online through HP Home & Home Office. Manufacturing... -

Page 23

... production. On occasion, we acquire component inventory in anticipation of supply constraints or enter into longer-term pricing commitments with vendors to improve the priority, price and availability of supply. See "Risk Factors-We depend on third-party suppliers, and our revenue and gross margin... -

Page 24

... to develop, manufacture and market products and services that meet customer requirements for innovation and quality, our revenue and gross margin may suffer," in Item 1A, which is incorporated herein by reference. Patents Our general policy has been to seek patent protection for those inventions... -

Page 25

... has benefited the outsourcing services business as customers look at reducing IT management costs to enable more strategic investments. Our competitors include IBM Global Services, systems integration firms such as Accenture Ltd., outsourcing firms such as Electronic Data Systems Corporation, and... -

Page 26

... lower print quality and reliability, may be offered at lower prices and put pressure on our supplies sales and margins. Other companies also have developed and marketed new compatible cartridges for HP' s laser and inkjet products, particularly in jurisdictions outside of the United States where... -

Page 27

... of NCR, and from July 2000 until March 2003 he was Chief Operating Officer of NCR' s Teradata data-warehousing division. R. Todd Bradley; age 49; Executive Vice President, Personal Systems Group Mr. Bradley was elected Executive Vice President in June 2005. From October 2003 to June 2005, he served... -

Page 28

... March 2007. Previously, he served as Vice President of Finance for HP' s Imaging and Printing Group since May 2002. Randall D. Mott; age 51; Executive Vice President and Chief Information Officer Mr. Mott was elected Executive Vice President and Chief Information Officer in July 2005. From 2000 to... -

Page 29

... may target our key market segments. We compete primarily on the basis of technology, performance, price, quality, reliability, brand, reputation, distribution, range of products and services, ease of use of our products, account relationships, customer training, service and support, security... -

Page 30

...develop, manufacture and market products and services that meet customer requirements for innovation and quality, our revenue and gross margin may suffer. The process of developing new high technology products and services and enhancing existing products and services is complex, costly and uncertain... -

Page 31

... be overlaps in the current products and services of HP and portfolios acquired through mergers and acquisitions that we must manage. In addition, it may be difficult to ensure performance of new customer contracts in accordance with our revenue, margin and cost estimates and to achieve operational... -

Page 32

...in decreased revenue, gross margin, earnings or growth rates and problems with our ability to manage inventory levels and collect customer receivables. We could experience such economic weakness and reduced spending, particularly in our consumer and financial services businesses, due to increases in... -

Page 33

...the future, gross margin declines in certain businesses, reflecting the effect of items such as competitive pricing pressures, inventory write-downs, charges associated with the cancellation of planned production line expansion, and increases in pension and post-retirement benefit expenses. Economic... -

Page 34

... southern United States, when completed, could increase the impact on us of a natural disaster or other business disruption occurring in that geographic area. If we fail to manage the distribution of our products and services properly, our revenue, gross margin and profitability could suffer. We use... -

Page 35

... operate on narrow product margins and have been negatively affected by business pressures. Considerable trade receivables that are not covered by collateral or credit insurance are outstanding with our distribution and retail channel partners. Revenue from indirect sales could suffer, and... -

Page 36

... order to secure supplies for the provision of products or services, at times we may make advance payments to suppliers or enter into non-cancelable commitments with vendors. In addition, we may purchase supplies strategically in advance of demand to take advantage of favorable pricing or to address... -

Page 37

... historically varied, which makes our future financial results less predictable. Our revenue, gross margin and profit vary among our products and services, customer groups and geographic markets and therefore will likely be different in future periods than our current results. Overall gross margins... -

Page 38

... value of deferred tax assets, which are predominantly in the United States, is dependent on our ability to generate future taxable income in the United States. Any of these changes could affect our profitability. Our sales cycle makes planning and inventory management difficult and future financial... -

Page 39

... using equipment before the end of their respective lease term or asset life, the savings associated with the benefit plan changes announced in February 2007, the costs associated with the replacement of employees who retired under the February 2007 early retirement program and the costs and timing... -

Page 40

... the number of employees who receive share-based payment awards. Due to this change in our stock-based compensation strategy, combined with the pension and other benefit plan changes undertaken to reduce costs and our increasing reliance on variable pay, we may find it difficult to attract, retain... -

Page 41

... in order to address customer uncertainty), minimizing sales force attrition and coordinating sales, marketing and distribution efforts; consolidating and rationalizing corporate IT infrastructure, which may include multiple legacy systems from various acquisitions and integrating software code... -

Page 42

... liabilities, legal, accounting and financial advisory fees, and required payments to executive officers and key employees under retention plans. Moreover, HP has incurred and will incur additional depreciation and amortization expense over the useful lives of certain assets acquired in connection... -

Page 43

... or current directors, officers or employees in accordance with the terms of our certificate of incorporation, bylaws, other applicable agreements, and Delaware law. Unforeseen environmental costs could impact our future net earnings. We are subject to various federal, state, local and foreign laws... -

Page 44

...could face significant costs and liabilities in connection with product take-back legislation. The EU has enacted the Waste Electrical and Electronic Equipment Directive (the "WEEE Legislation"), which makes producers of electrical goods, including computers and printers, financially responsible for... -

Page 45

..., Texas Europe, Middle East, Africa Geneva, Switzerland Asia Pacific, including Japan Singapore Product Development and Manufacturing The locations of our major product development and manufacturing facilities and HP Labs at October 31, 2007 were as follows: Americas Cupertino, Fremont, Palo Alto... -

Page 46

.... Issuer Purchases of Equity Securities Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Approximate Dollar Value of Shares that May Yet Be Purchased under the Plans or Programs Period Total Number of Shares Purchased Average Price Paid per Share Month #1 (August... -

Page 47

... cumulative total stockholder return assuming the investment of $100 on the date specified (and the reinvestment of dividends thereafter) in each of HP common stock, the S&P 500 Index, and the S&P Information Technology Index.(1) The comparisons in the graph below are based upon historical data and... -

Page 48

... Financial Data For the fiscal years ended October 31, 2006 2005 2004 In millions, except per share amounts 2007 2003 Net revenue...Earnings from operations(1) ...Net earnings...Net earnings per share Basic ...Diluted ...Cash dividends declared per share...At year-end: Total assets...Long-term... -

Page 49

... consulting and integration and outsourcing services. • We have seven business segments: Enterprise Storage and Servers ("ESS"), HP Services ("HPS"), HP Software, the Personal Systems Group ("PSG"), the Imaging and Printing Group ("IPG"), HP Financial Services ("HPFS"), and Corporate Investments... -

Page 50

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) • We are expanding our ethics and compliance programs and enhancing our corporate governance to ensure that all of our actions are consistent with HP' s values... -

Page 51

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) partially offset by $9.6 billion in cash provided from operations, $3.1 billion in proceeds from the issuance of our common stock under employee stock plans and ... -

Page 52

... compensation cost for only those shares expected to vest on a straight-line basis over the requisite service period of the award. Prior to SFAS 123R adoption, we accounted for share-based payment awards under Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees... -

Page 53

... based on projected cash flow needs as well as the working capital and long-term investment requirements of our foreign subsidiaries and our domestic operations. Based on these assumptions, we estimate the amount we will distribute to the United States and provide the U.S. federal taxes due on these... -

Page 54

... accounts for all customers based on a variety of factors, including the length of time receivables are past due, trends in overall weighted-average risk rating of the total portfolio, macroeconomic conditions, significant one-time events, historical experience and the use of third-party credit... -

Page 55

... rates, average cost per call, and current period product shipments. If actual product failure rates, repair rates, service delivery costs or postsales support costs differ from our estimates, we would be required to make revisions to the estimated warranty liability. Warranty terms generally range... -

Page 56

... 3.2% of annual net product revenue. Retirement Benefits Our pension and other post-retirement benefit costs and obligations are dependent on various assumptions. Our major assumptions relate primarily to discount rates, salary growth, long-term return on plan assets and medical cost trend rates... -

Page 57

... that otherwise would not be recognized at inception and non-cash warranty obligations where a warrantor is permitted to pay a third party to provide the warranty goods or services. If the use of fair value is elected, any upfront costs and fees related to the item must be recognized in earnings and... -

Page 58

... Misstatements when Quantifying Misstatements in Current Year Financial Statements"; EITF 05-5, "Accounting for Early Retirement or Postemployment Programs with Specific Features (Such as Terms Specified in Altersteilzeit Early Retirement Arrangements)"; and EITF 06-9, "Reporting a Change in (or the... -

Page 59

... 2005(2) Net revenue...Cost of sales(1) ...Gross profit ...Research and development ...Selling, general and administrative...Amortization of purchased intangible assets ...In-process research and development charges ...Restructuring charges ...Pension curtailments and pension settlements, net... -

Page 60

... points Personal Systems Group ...Imaging and Printing Group ...Enterprise Storage and Servers ...HP Software...HP Services...HP Financial Services...Corporate Investments/Other...Total HP... 7.9 1.8 1.6 1.1 1.1 0.3 - 13.8 2.8 1.9 0.7 0.3 0.1 (0.1) - 5.7 In fiscal 2007, HP net revenue increased... -

Page 61

... HP Software...HP Services...Enterprise Storage and Servers ...HP Financial Services...Personal Systems Group ...Imaging and Printing Group ...Corporate Investments/Other...Total HP... 0.6 0.1 (0.1) (0.1) (0.2) (0.2) - 0.1 0.2 0.2 0.4 (0.1) 0.1 0.2 (0.1) 0.9 Total company gross margin increased... -

Page 62

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) used equipment sales. During fiscal 2007, PSG contributed unfavorably to our total company' s weighted-average change in gross margin as a result of higher ... -

Page 63

... of purchased intangibles assets, see Note 7 to the Consolidated Financial Statements in Item 8, which is incorporated herein by reference. In-Process Research and Development Charges We record in-process research and development ("IPR&D") charges in connection with acquisitions accounted for... -

Page 64

... post-retirement benefit plan. This curtailment gain was offset partially by net settlement losses related to our other pension plan design changes. In conjunction with management' s plan to restructure certain of our operations, we modified our U.S. retirement programs to align them more closely to... -

Page 65

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) Gains (Losses) on Investments Net gains on investment in fiscal 2007 and fiscal 2006 resulted primarily from gains on the sale of equity investments, which were ... -

Page 66

... of strong growth in blade revenue and units, as well as increased option attach rates in the ProLiant server line. Storage net revenue increased 4% in fiscal 2007 compared to fiscal 2006, with the increase driven primarily by mid-range EVA products and commercial products within the storage area... -

Page 67

... points Technology services ...Outsourcing services '(1) ...Consulting and integration...Total HPS ... 2.1 2.8 1.7 6.6 (1.6) 1.8 0.3 0.5 '(1) Reflects the name change from managed services to outsourcing services effective in fiscal 2007. On a constant currency basis, HPS net revenue increased... -

Page 68

... to improved performance in Asia Pacific and Europe, Middle East and Africa. HPS earnings from operations as a percentage of net revenue in fiscal 2006 increased by 2.2 percentage points. The operating margin increase was the result of a combination of an increase in gross margin and a decrease in... -

Page 69

... costs associated with the acquisition of Peregrine as well as higher bonus accruals. The improvement in gross margin was driven by an increase in revenue, more effective management of the support and services costs for OpenView and OpenCall and from improved margins of our OpenCall product line... -

Page 70

... the Personal Digital Assistant ("PDA") product market, which were partially offset by our new converged device and travel companion products. In fiscal 2007, the positive revenue impact from the PSG unit volume increase compared to fiscal 2006 was also moderated by a 5% decline in commercial client... -

Page 71

... PDA product market coupled with our product transition to converged devices. The PSG volume increase in fiscal 2006 was moderated by a decline of 6% in consumer client ASPs and 7% in commercial client ASPs. The ASP declines were due to pricing decisions resulting from lower component costs as well... -

Page 72

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) revenue in fiscal 2007 was attributable mainly to unit volume growth in multifunction printers and revenue from our digital press and large format printing ... -

Page 73

...136 New financing originations, which represent the amounts of financing provided to customers for equipment and related software and services, and include intercompany activity, increased 11% in fiscal 2007 from fiscal 2006. The increase reflects higher financing associated with HP product sales... -

Page 74

... in Corporate Investments relates to network infrastructure products sold under the brand "ProCurve Networking." In fiscal 2007, revenue from network infrastructure products increased 33% compared to the same period in fiscal 2006 as new product introductions continued to drive increased sales of... -

Page 75

... borrowings, or both. We utilize a variety of tax planning and financing strategies in an effort to ensure that our worldwide cash or debt is available in the locations in which it is needed. FINANCIAL CONDITION (Sources and Uses of Cash) Our total cash and cash equivalents declined approximately 31... -

Page 76

... and Analysis of Financial Condition and Results of Operations (Continued) Key Performance Metrics October 31 2006 2005 2007 Days of sales outstanding in accounts receivable ...Days of supply in inventory...Days of purchases outstanding in accounts payable ...Cash conversion cycle ... 43... -

Page 77

... Purchase Price. Accordingly, we had the option to receive either additional shares of our common stock or a cash payment in the amount of the difference from the investment bank. In June 2007, we received approximately 2 million additional shares purchased by the investment bank in the open market... -

Page 78

... financing activities in the Consolidated Statement of Cash Flows. In connection with this program, the investment bank purchased shares of our common stock in the open market over time. The prepaid funds were expended ratably over the term of the program. During fiscal 2006, our Board of Directors... -

Page 79

... that we establish through consideration of a number of factors, including cash flow expectations, cash requirements for operations, investment plans (including acquisitions), share repurchase activities, and the overall cost of capital. Outstanding debt increased to $8.2 billion as of October 31... -

Page 80

... we put in place primarily to support our U.S. commercial paper program. Our ability to have a U.S. commercial paper outstanding balance that exceeds the $3.0 billion committed credit facility is subject to a number of factors, including liquidity conditions and business performance. Our credit risk... -

Page 81

... $58 million to cover benefit claims under postretirement benefit plans. In addition, we used $108 million of cash to fund the distribution and subsequent transfer of accrued pension benefits from the U.S. Excess Benefit Plan to the U.S. Executive Deferred Compensation Plan for the terminated vested... -

Page 82

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) We have implemented bonus programs that are designed to reward our employees upon achievement of annual performance objectives. We calculate bonuses based on a ... -

Page 83

... alone. We use a combination of forward contracts and options designated as cash flow hedges to protect against the foreign currency exchange rate risks inherent in our forecasted net revenue and, to a lesser extent, cost of sales denominated in currencies other than the U.S. dollar. In addition... -

Page 84

... positions from time to time. We do not purchase our equity securities with the intent to use them for speculative purposes. A hypothetical 30% adverse change in the stock prices of our publicly-traded equity securities would result in a loss in the fair values of our marketable equity securities of... -

Page 85

... Financial Statements...Note 1: Summary of Significant Accounting Policies ...Note 2: Stock-Based Compensation ...Note 3: Net Earnings Per Share ...Note 4: Balance Sheet Details...Note 5: Supplemental Cash Flow Information...Note 6: Acquisitions ...Note 7: Goodwill and Purchased Intangible Assets... -

Page 86

... in relation to the basic financial statements taken as a whole, presents fairly in all material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Hewlett-Packard... -

Page 87

... the standards of the Public Company Accounting Oversight Board (United States), the accompanying consolidated balance sheets of Hewlett-Packard Company and subsidiaries as of October 31, 2007 and 2006, and the related consolidated statements of earnings, stockholders' equity and cash flows for each... -

Page 88

... public accounting firm, as stated in their report which appears on page 73 of this Annual Report on Form 10-K. /s/ MARK V. HURD Mark V. Hurd Chairman, Chief Executive Officer and President December 14, 2007 /s/ CATHERINE A. LESJAK Catherine A. Lesjak Executive Vice President and Chief Financial... -

Page 89

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Consolidated Statements of Earnings For the fiscal years ended October 31 2006 2005 2007 In millions, except per share amounts Net revenue: Products ...Services...Financing income...Total net revenue...Costs and expenses: Cost of products ...Cost of services... -

Page 90

..., plant and equipment ...Long-term financing receivables and other assets ...Goodwill ...Purchased intangible assets...Total assets ...LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Notes payable and short-term borrowings ...Accounts payable...Employee compensation and benefits...Taxes on... -

Page 91

...) of commercial paper and notes payable, net...Issuance of debt ...Payment of debt ...Issuance of common stock under employee stock plans...Repurchase of common stock...Prepayment of common stock repurchase...Excess tax benefit from stock-based compensation...Dividends ...Net cash used in financing... -

Page 92

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Consolidated Statements of Stockholders' Equity Common Stock Number of Par Value Shares Balance October 31, 2004 ...Net earnings...Net unrealized loss on available-for-sale securities...Net unrealized gains on cash flow hedges ...Minimum pension liability ...... -

Page 93

... related to the sale. When a sales arrangement contains multiple elements, such as hardware and software products, licenses and/or services, HP allocates revenue to each element based on its relative fair value, or for software, based on vendor specific objective evidence ("VSOE") of fair value... -

Page 94

... customer returns, price protection, rebates and other programs offered under sales agreements established by HP with its distributors and resellers. HP records revenue from the sale of equipment under sales-type leases as product revenue at the inception of the lease. HP accrues the estimated cost... -

Page 95

... on fixed-price contracts as trade receivables. Financing Income Sales-type and direct-financing leases produce financing income, which HP recognizes at consistent rates of return over the lease term. Shipping and Handling HP includes costs related to shipping and handling in cost of sales for all... -

Page 96

... Consolidated Financial Statements (Continued) Note 1: Summary of Significant Accounting Policies (Continued) If circumstances related to customers change, HP would further adjust estimates of the recoverability of receivables. Inventory HP values inventory at the lower of cost or market, with cost... -

Page 97

... of HP' s derivative financial instrument activities and related accounting policies, which is incorporated herein by reference. Investments HP' s investments consist principally of time deposits, commercial paper, corporate debt, other debt securities, and equity securities of publicly-traded and... -

Page 98

... principally of cash and cash equivalents, investments, accounts receivable from trade customers and from contract manufacturers, financing receivables and derivatives. HP maintains cash and cash equivalents, short and long-term investments, derivatives and certain other financial instruments with... -

Page 99

... Statements of Cash Flows of the tax effects of employee stock-based compensation awards that are outstanding upon adoption of SFAS 123R. See Note 2 to the Consolidated Financial Statements for a further discussion on stock-based compensation. Foreign Currency Transactions HP uses the U.S. dollar... -

Page 100

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 1: Summary of Significant Accounting Policies (Continued) currency as their functional currency, and HP records the translation of their assets and liabilities into U.S. dollars at the balance sheet ... -

Page 101

... that otherwise would not be recognized at inception and non-cash warranty obligations where a warrantor is permitted to pay a third party to provide the warranty goods or services. If the use of fair value is elected, any upfront costs and fees related to the item must be recognized in earnings and... -

Page 102

...Entity or between the Reporting Period of an Investor and That of an Equity Method Investee." Note 2: Stock-Based Compensation At October 31, 2007, HP has the stock-based employee compensation plans described below. The total compensation expense before taxes related to these plans was $629 million... -

Page 103

..., net of related tax effects...Pro forma net earnings...Basic net earnings per share: As reported...Pro forma ...Diluted net earnings per share: As reported...Pro forma ...Employee Stock Purchase Plan $2,398 144 (621) $1,921 $0.83 $0.67 $0.82 $0.66 HP sponsors the Hewlett-Packard Company 2000... -

Page 104

... U.S. Internal Revenue Code. The exercise price of a stock option is equal to the fair market value of HP' s common stock on the option grant date (as determined by the average of the highest and lowest reported sale prices of HP' s common stock on that date). The contractual term of options granted... -

Page 105

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 2: Stock-Based Compensation (Continued) weighted-average grant date fair value of $45. In fiscal 2006, HP granted 33,000 shares of restricted stock units with a weighted-average grant date fair value... -

Page 106

... the table above represents the total pre-tax intrinsic value (the difference between HP' s closing stock price on the last trading day of fiscal 2007 and fiscal 2006 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all... -

Page 107

...million of total unrecognized compensation cost related to stock options was expected to be recognized over a weighted-average period of 2.30 years. Cash received from option exercises and purchases under the ESPP in fiscal 2007 was $3.1 billion. The actual tax benefit realized for the tax deduction... -

Page 108

... related to the ESPP and the principal option plans under SFAS 123R as follows for each of the fiscal years: 2006 2007 In millions Cost of sales...Research and development ...Selling, general and administrative...Stock-based compensation expense before income taxes ...Income tax benefit ...Total... -

Page 109

... EPS options to purchase an additional 33 million shares and 48 million shares in fiscal 2007 and fiscal 2006, respectively, whose combined exercise price, unamortized fair value and excess tax benefits were greater in each of those periods than the average market price for HP' s common stock, as... -

Page 110

... programs. Inventory 2006 2007 In millions Finished goods ...Purchased parts and fabricated assemblies ... $5,404 2,629 $8,033 $5,424 2,326 $7,750 Other Current Assets 2006 2007 In millions Deferred tax assets-short-term ...Tax, supplier and other receivables ...Prepaid and other current assets... -

Page 111

...-Term Financing Receivables and Other Assets 2006 2007 In millions Financing receivables ...Deferred tax assets-long-term ...Other ... $2,778 961 3,908 $7,647 $2,340 1,475 2,834 $6,649 Other Accrued Liabilities 2006 2007 In millions Other accrued taxes...Warranty ...Sales and marketing programs... -

Page 112

...Deferred revenue represents amounts received or billed in advance for fixed-price support or maintenance contracts, software customer support contracts, outsourcing services start-up or transition work, consulting and integration projects, product sales and leasing income. The fixed-price support or... -

Page 113

... of cash paid for outstanding stock, vested in-themoney stock options and direct transaction costs. In addition, the purchase price also included the estimated fair value of earned unvested stock options and out-of-the-money vested stock options assumed by HP. In connection with this acquisition, HP... -

Page 114

....08 per share. The purchase price was approximately $538 million, consisting of $442 million of cash paid, which includes direct transaction costs, as well as the assumption of certain liabilities in connection with the transaction. The acquisition of Peregrine added key asset and service management... -

Page 115

... October 31, 2007 are as follows: Enterprise Storage and Servers Personal Systems Group In millions Imaging and Printing Group HP Financial Services HP Services HP Software Total Balance at October 31, 2006...Goodwill acquired during the period .. Goodwill adjustments ...Balance at October 31... -

Page 116

... Amortization Gross Net Gross In millions Net Customer contracts, customer lists and distribution agreements...Developed and core technology and patents...Product trademarks ...Total amortizable purchased intangible assets. Compaq trade name ...Total purchased intangible assets... $3,239... -

Page 117

...of 2007. HP funded the cash expenditures associated with the 2007 EER primarily by using available U.S. pension plan assets. For more information, see Note 15, which is incorporated herein by reference. Fiscal 2007 Mercury Plan In connection with the acquisition of Mercury, HP' s management approved... -

Page 118

... costs related to severance and other employee benefits as of October 31, 2007 and expects to pay out the remaining costs associated primarily with tax payments for early retirees through fiscal 2018. In the third quarter of fiscal 2005, HP' s management approved a restructuring plan and HP recorded... -

Page 119

...Cost Gross Unrealized Gains Estimated Fair Value Cost In millions Gross Unrealized Gains Estimated Fair Value Available-for-Sale Securities Debt securities: Time deposits...$141 Commercial paper...104 Corporate debt...11 Other debt securities ...27 Total debt securities ...283 Equity securities... -

Page 120

... of fixed-interest securities invested for early retirement purposes. Equity securities in public companies are primarily common stock. HP estimated the fair values based on quoted market prices or pricing models using current market rates. These estimated fair values may not be representative... -

Page 121

... cost basis and equity method investments. Other investments consist primarily of marketable trading securities held to generate returns that HP expects to offset changes in certain liabilities related to deferred compensation arrangements. HP includes gains or losses from changes in fair value... -

Page 122

.... HP uses a combination of forward contracts and options designated as cash flow hedges to protect against the foreign currency exchange rate risks inherent in its forecasted net revenue and, to a lesser extent, cost of sales denominated in currencies other than the U.S. dollar. HP' s foreign... -

Page 123

... value, cash flow or net investment hedges. Hedge ineffectiveness for fair value, cash flow and net investment hedges was not material in the fiscal years ended October 31, 2007, 2006 and 2005. HP estimates the fair values of derivatives based on quoted market prices or pricing models using current... -

Page 124

... $(560) Gross Notional Other Current Assets 2006 Long-term Financing Other Receivables Accrued and Liabilities Other Assets In millions Other Liabilities Total Fair value hedges ...Cash flow hedges...Net investment hedges ...Other derivatives...Total...Fair Value of Other Financial Instruments... -

Page 125

...maximum loss clauses. Historically, payments made related to these indemnifications have been immaterial. Warranty HP provides for the estimated cost of product warranties at the time it recognizes revenue. HP engages in extensive product quality programs and processes, including actively monitoring... -

Page 126

... evaluating the quality of its component suppliers; however, product warranty terms offered to customers, ongoing product failure rates, material usage and service delivery costs incurred in correcting a product failure, as well as specific product class failures outside of HP' s baseline experience... -

Page 127

..."), as set forth in the above table, at any time at the redemption prices described in the prospectus supplements relating thereto. The Notes are senior unsecured debt. In May 2006, HP filed a shelf registration statement (the "2006 Shelf Registration Statement") with the Securities and Exchange... -

Page 128

....09 shares of HP common stock for each $1,000 face value of the LYONs, payable in either cash or common stock at HP' s election. In December 2000, the HP Board of Directors authorized a repurchase program for the LYONs that allowed HP to repurchase the LYONs from time to time at varying prices. The... -

Page 129

...Registration Statement and other programs. HP also may issue additional debt securities, common stock, preferred stock, depositary shares and warrants under the 2006 Shelf Registration Statement. Aggregate future maturities of long-term debt at face value (excluding the fair value adjustment related... -

Page 130

...-excluding inventory ...Fixed assets...Warranty ...Employee and retiree benefits...Accounts receivable allowance...Capitalized research and development...Purchased intangible assets...Restructuring ...Equity investments...Deferred revenue ...Other ...Gross deferred tax assets and liabilities... -

Page 131

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 13: Taxes on Earnings (Continued) The breakdown between current and long-term deferred tax assets and deferred tax liabilities was as follows for the following fiscal years ended October 31: 2006 ... -

Page 132

... a result of certain employment actions and capital investments HP has undertaken, income from manufacturing activities of subsidiaries in certain countries is subject to reduced tax rates, and in some cases is wholly exempt from taxes through 2019. The gross income tax benefits attributable to the... -

Page 133

... of the United States. If HP were to distribute these earnings, foreign tax credits may become available under current law to reduce the resulting U.S. income tax liability. Determination of the amount of unrecognized deferred tax liability related to these earnings is not practicable. HP will remit... -

Page 134

...Purchase Price. Accordingly, HP had the option to either receive additional shares of HP' s common stock or a cash payment in the amount of the difference from the investment bank. In June 2007, HP received approximately 2 million additional shares purchased by the investment bank in the open market... -

Page 135

... Financial Statements (Continued) Note 14: Stockholders' Equity (Continued) maximum price that was determined in advance of any repurchases being completed under the program, thereby effectively hedging HP' s repurchase price. The minimum and maximum number of shares HP could receive under... -

Page 136

...restructuring charge of fiscal 2007. HP will fund the cash expenditures associated with the 2007 EER primarily by using available U.S. pension plan assets. Eligible employees whose pension accruals will cease effective December 31, 2007 will benefit from an increased company 401(k) match opportunity... -

Page 137

..., the remaining number of U.S. employees still accruing benefits under the program will cease accruing pension benefits. For U.S employees hired or rehired on or after January 1, 2003, HP sponsors the Hewlett-Packard Company Cash Account Pension Plan (the "Cash Account Pension Plan"), under which... -

Page 138

... Deferred Profit-Sharing Plan ("the DPSP"). HP closed the DPSP to new participants in 1993. The DPSP plan obligations are equal to the plan assets and are recognized as an offset to the Retirement Plan when HP calculates its defined benefit pension cost and obligations. The fair value of plan assets... -

Page 139

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 15: Retirement and Post-Retirement Benefit Plans (Continued) Effective January 31, 2004, HP designated the HP Stock Fund, an investment option under the HP 401(k) Plan, as an Employee Stock Ownership... -

Page 140

... cost were as follows for the following fiscal years ended October 31: U.S. Defined Benefit Plans 2006 2005 2007 Non-U.S. Defined Benefit Plans 2007 2006 2005 Post-Retirement Benefit Plans 2007 2006 2005 Discount rate...Average increase in compensation levels ...Expected long-term return on assets... -

Page 141

... Financial Statements (Continued) Note 15: Retirement and Post-Retirement Benefit Plans (Continued) above are those rates used by HP in conducting each of the respective plan re-measurements and reflect the weighted-average rate across all measurement periods. The medical cost and related... -

Page 142

......Actual return on plan assets ...Employer contributions...Participants' contributions ...Benefits paid ...Settlements...Currency impact...Fair value-end of year ...Change in benefit obligation: Projected benefit obligation-beginning of year ...Acquisition/addition/deletion of plans ...Service cost... -

Page 143

...(1): U.S. Defined Benefit Plans Non-U.S. Defined Benefit Plans In millions Post-Retirement Benefit Plans Prepaid benefit costs ...Pension, post-retirement and post-employment liabilities ...Intangible asset...Accumulated other comprehensive loss ...Contribution after measurement date ...Net amount... -

Page 144

... Allocation Plan Assets 2007 2006 Post-Retirement Benefit Plans 2007 Target Allocation Plan Assets 2007 2006 Asset Category Public equity securities ...Private equity securities ...Real estate and other...Equity-related investments ...Public debt securities ...Cash ...Total...Investment Policy 70... -

Page 145

...needs. HP invests a portion of the U.S. defined benefit plan assets and post-retirement benefit plan assets in private market securities such as venture capital funds, private debt and private equity to provide diversification and higher expected returns. Outside the United States, local regulations... -

Page 146

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 15: Retirement and Post-Retirement Benefit Plans (Continued) Estimated Future Benefits Payable HP estimates that the future benefits payable for the retirement and post-retirement plans in place were... -

Page 147

... of intellectual property, commercial, securities, employment, employee benefits and environmental matters, which arise in the ordinary course of business. In accordance with SFAS No. 5, "Accounting for Contingencies", HP records a provision for a liability when management believes that it is... -

Page 148

... of these matters and the associated financial impact on HP, including the number of units impacted, the amount of levies imposed and the ability of HP to recover such amounts through increased prices, remains uncertain. Alvis v. HP is a defective product consumer class action filed in the District... -

Page 149

... floppy disk controller errors. HP' s agreement with the Department of Justice to extend the statute of limitations on its investigation expired on December 6, 2006. HP is cooperating fully with this investigation. Barbara' s Sales, et al. v. Intel Corporation, Hewlett-Packard Company, et al. and... -

Page 150

... in violation of California' s Unfair Competition Law. Among other things, plaintiffs alleged that HP employed a "smart chip" in certain inkjet printing products in order to register ink depletion prematurely and to render the cartridge unusable through a built-in expiration date that is hidden... -

Page 151

... date has been set. Digwamaje et al. v. Bank of America et al. is a purported class action lawsuit that names HP and numerous other multinational corporations as defendants. It was filed on September 27, 2002 in United States District Court for the Southern District of New York on behalf of current... -

Page 152

... and counterclaims adding the allegation that all HP products which employ the draft IEEE 802.11n wireless protocol infringe the CSIRO patent. Trial is scheduled for April 2009. Polaroid Corp. v. HP is a lawsuit filed against HP by Polaroid Corporation on December 2006 in the United States District... -

Page 153

...an industry-wide practice of using partnership and alliance programs to make improper payments and cause the submission of false claims in connection with contracts to provide products and services to the federal government. On April 12, 2007, the U.S. Department of Justice intervened in the qui tam... -

Page 154

... California cases under the caption In re Hewlett-Packard Company Derivative Litigation. The consolidated complaint filed on November 19, 2006 also seeks to recover damages in connection with sales of HP stock alleged to have been made by certain current and former HP officers and directors while... -

Page 155

... of the acquisition, and beginning on or about August 19, 2005, four securities class action lawsuits were filed against Mercury and certain of its officers and directors on behalf of purchasers of Mercury' s stock from October 2003 to November 2005: Archdiocese of Milwaukee Supporting Fund, Inc... -

Page 156

...: Enterprise Storage and Servers ("ESS"), HP Services ("HPS"), HP Software, the Personal Systems Group ("PSG"), the Imaging and Printing Group ("IPG"), HP Financial Services ("HPFS"), and Corporate Investments. HP' s organizational structure is based on a number of factors that management 142 -

Page 157

... the public sector, including government services. HPS collaborates with the Enterprise Storage and Servers and HP Software, as well as with third-party system integrators and software and networking companies to bring solutions to HP customers. HPS also works with HP' s Imaging and Printing Group... -

Page 158

...other related accessories, software and services for the commercial and consumer markets. Commercial PCs are optimized for commercial uses, including enterprise and SMB customers, and for connectivity and manageability in networked environments. Commercial PCs include the HP Compaq business desktops... -

Page 159

... primarily amortization of purchased intangible assets, stock-based compensation expense related to HP-granted employee stock options and the employee stock purchase plan, certain acquisition-related charges and charges for purchased IPR&D, as well as certain corporate governance costs. HP does not... -

Page 160

...: Total Net Revenue 2007 2006 Earnings (Loss) from Operations 2007 2006 2005 2005 In millions Enterprise Storage and Servers ...HP Services...HP Software...Technology Solutions Group ...Personal Systems Group ...Imaging and Printing Group ...HP Financial Services...Corporate Investments ...Segment... -

Page 161

.... HP reports revenue net of sales taxes, use taxes and value-added taxes directly imposed by governmental authorities on HP' s revenue producing transactions with its customers. At October 31, 2007, no single country other than the United States had 10% or more of HP' s total consolidated net assets... -

Page 162

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 18: Segment Information (Continued) purchased intangible assets, which HP does not allocate to specific geographic locations as it is impracticable for HP to do so, are composed principally of net ... -

Page 163

......Desktops ...Workstations...Handhelds ...Other ...Personal Systems Group...Commercial hardware ...Consumer hardware...Supplies ...Other ...Imaging and Printing Group ...HP Financial Services...Corporate Investments ...Total segments...Eliminations of inter-segment net revenue and other...Total HP... -

Page 164

...) on investments...Earnings before taxes...Provision for taxes ...Net earnings ...Net earnings per share:(2) Basic ...Diluted ...Cash dividends paid per share ...Range of per share closing stock prices on the New York Stock Exchange Low ...High ...2006 Net revenue...Cost of sales(1) ...Research... -

Page 165

...our Securities and Exchange Commission ("SEC") reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) is accumulated and communicated to HP' s management, including our principal executive officer and principal financial officer... -

Page 166

... regarding security ownership of certain beneficial owners, directors and executive officers is set forth under "Common Stock Ownership of Certain Beneficial Owners and Management." Information regarding HP' s equity compensation plans, including both stockholder approved plans and nonstockholder... -

Page 167

... with related persons is set forth under "Related Person Transaction Policy and Procedures." Information regarding director independence is set forth under "Corporate Governance Principles and Board Matters-Board Independence." ITEM 14. Principal Accountant Fees and Services. Information... -

Page 168

... page 158 of this report. HP will furnish copies of exhibits for a reasonable fee (covering the expense of furnishing copies) upon request. Stockholders may request exhibits copies by contacting: Hewlett-Packard Company Attn: Investor Relations 3000 Hanover Street Palo Alto, CA 94304 (866) GET-HPQ1... -

Page 169

Schedule II HEWLETT-PACKARD COMPANY AND SUBSIDIARIES Valuation and Qualifying Accounts For the fiscal years ended October 31 2007 2006 2005 In millions Allowance for doubtful accounts-accounts receivable: Balance, beginning of period ...Amount acquired through acquisition...Addition of bad debt ... -

Page 170

... the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Signature Title(s) Date /s/ MARK V. HURD Mark V. Hurd Chairman, Chief Executive Officer and President (Principal Executive... -

Page 171

... Date /s/ JOEL Z. HYATT Joel Z. Hyatt /s/ JOHN R. JOYCE John R. Joyce /s/ ROBERT L. RYAN Robert L. Ryan Director December 18, 2007 Director December 18, 2007 Director December 18, 2007 /s/ LUCILLE S. SALHANY Lucille S. Salhany /s/ G. KENNEDY THOMPSON G. Kennedy Thompson Director December... -

Page 172

... dated as of October 14, 1997 among Registrant and J.P. Morgan Trust Company (as successor to Chase Trust Company of California) regarding Liquid Yield Option Notes due 2017. 4(d) Form of Senior Indenture. 4(e) Form of Registrant' s Fixed Rate Note and Floating Rate Note and related Officers... -

Page 173

... Corporation 1989 Equity Incentive Plan, amended and restated effective November 21, 2002.* 10(j) Compaq Computer Corporation 1985 Nonqualified Stock Option Plan for Non-Employee Directors.* 10(k) Amendment of Compaq Computer Corporation Non-Qualified Stock Option Plan for Non-Employee Directors... -

Page 174

... Filing Date 10(m) Registrant' s Excess Benefit Retirement Plan, amended and restated as of January 1, 2006.* 10(n) Hewlett-Packard Company Cash Account Restoration Plan, amended and restated as of January 1, 2005.* 10(o) Registrant' s 2005 Pay-for-Results Plan.* 10(p) Registrant' s 2005 Executive... -

Page 175

... Grant Notice for the Compaq Computer Corporation 1989 Equity Incentive Plan.* 10(g)(g) Forms of Stock Option Notice for the Compaq Computer Corporation Non-Qualified Stock Option Plan for Non-Employee Directors, as amended.* 10(h)(h) Form of Long-Term Performance Cash Award Agreement for Registrant... -

Page 176

... Registered Public Accounting Firm.‡ 24 Power of Attorney (included on the signature page). 31.1 Certification of Chief Executive Officer pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended.‡ 31.2 Certification of Chief Financial Officer pursuant... -

Page 177

... V. Hurd, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of Hewlett-Packard Company; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances... -

Page 178

... material, that involves management or other employees who have a significant role in the registrant' s internal control over financial reporting. Date: December 14, 2007 /s/ CATHERINE A. LESJAK Catherine A. Lesjak, Executive Vice President and Chief Financial Officer (Principal Financial Officer) -

Page 179

... in such Annual Report on Form 10-K fairly presents, in all material respects, the financial condition and results of operations of Hewlett-Packard Company. December 14, 2007 By: /s/ CATHERINE A. LESJAK Catherine A. Lesjak Executive Vice President and Chief Financial Officer A signed original... -

Page 180

...go/report. Printed on recycled paper. © 2008 Hewlett Packard Development Company, LP. The information contained herein is subject to change without notice. The only warranties for HP products and services are set forth in the express warranty statements accompanying such products and services...