HP 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 8: Financial Instruments (Continued)

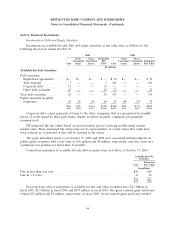

$27 million and $4 million, respectively, in fiscal 2004. Gross realized gains and losses totaled

$36 million and $8 million, respectively, in fiscal 2003. The specific identification method is used to

account for gains and losses on available-for-sale securities.

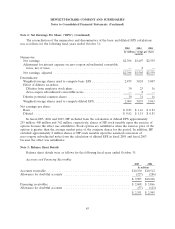

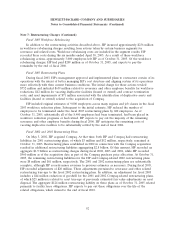

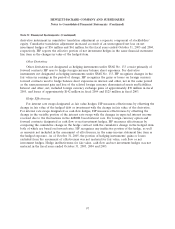

A summary of the carrying values and balance sheet classification of all investments in debt and

equity securities was as follows for the following fiscal years ended October 31:

2005 2004

In millions

Available-for-sale debt securities ......................................... $ 18 $311

Short-term investments ............................................... 18 311

Available-for-sale debt securities ......................................... 18 22

Available-for-sale equity securities ........................................ 64 70

Equity securities in privately-held companies and other investments ................ 353 388

Included in long-term financing receivables and other assets .................... 435 480

Total investments ..................................................... $453 $791

Other investments consist primarily of marketable securities held to generate returns that HP

expects to offset changes in certain liabilities related to deferred compensation arrangements. HP

includes gains or losses from changes in fair value of these securities, offset by losses or gains on the

related liabilities, in interest and other, net, in HP’s Consolidated Statements of Earnings.

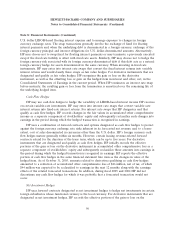

Derivative Financial Instruments

HP is a global company that is exposed to foreign currency exchange rate fluctuations and interest

rate changes in the normal course of its business. As part of its risk management strategy, HP uses

derivative instruments, primarily forward contracts, swaps and options, to hedge certain foreign

currency and interest rate exposures. HP’s objective is to offset gains and losses resulting from these

exposures with losses and gains on the derivative contracts used to hedge them, thereby reducing

volatility of earnings or protecting fair values of assets and liabilities. HP does not use derivative

contracts for speculative purposes. HP applies hedge accounting based upon the criteria established by

SFAS No. 133, ‘‘Accounting for Derivative Instruments and Hedging Activities,’’ whereby HP designates

its derivatives as fair value hedges, cash flow hedges or hedges of the foreign currency exposure of a

net investment in a foreign operation (‘‘net investment hedges’’). HP recognizes all derivatives in the

Consolidated Balance Sheets at fair value and reports them in other current assets, long-term financing

receivables and other assets, other accrued liabilities, and other liabilities. HP classifies cash flows from

the derivative programs as cash flows from operating activities in the Consolidated Statement of Cash

Flows.

Fair Value Hedges

HP enters into fair value hedges to reduce the exposure of its debt portfolio to both interest rate

risk and foreign currency exchange rate risk. HP issues long-term debt in either U.S. dollars or foreign

currencies based on market conditions at the time of financing. HP may then use interest rate or cross

currency swaps to modify the market risk exposures in connection with the debt to achieve primarily

95