HP 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 13: Stockholders’ Equity (Continued)

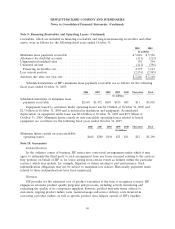

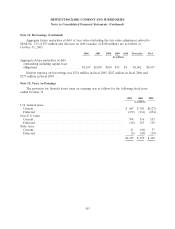

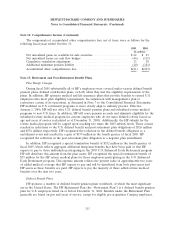

Option activity was as follows for the following fiscal years ended October 31:

2005 2004 2003

Weighted- Weighted- Weighted-

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

Shares in thousands

Outstanding at beginning of year ............ 549,868 $30 499,858 $31 459,334 $32

Granted .............................. 63,635 22 71,894 22 71,426 16

Assumed through acquisitions ............... 558 1 2,507 14 — —

Exercised ............................. (46,628) 17 (12,869) 13 (14,873) 10

Forfeited or cancelled .................... (36,200) 35 (11,522) 30 (16,029) 33

Outstanding at end of year ................. 531,233 30 549,868 30 499,858 31

Exercisable at end of year ................. 386,303 $33 377,438 $33 326,829 $34

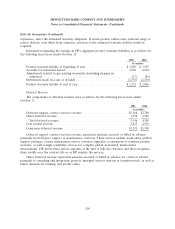

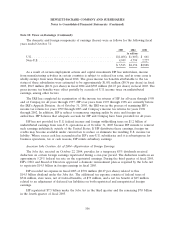

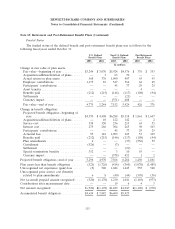

Information about options outstanding was as follows at October 31, 2005:

Options Outstanding Options Exercisable

Weighted-

Average

Remaining Weighted- Weighted-

Contractual Average Average

Shares Life in Exercise Shares Exercise

Range of Exercise Prices Outstanding Years Price Exercisable Price

Shares in thousands

$0-$9.99 ............................ 1,159 6.6 $ 4 557 $ 7

$10-$19.99 .......................... 98,531 5.1 $16 66,995 $16

$20-$29.99 .......................... 246,791 5.4 $23 133,999 $25

$30-$39.99 .......................... 76,046 3.7 $35 76,046 $35

$40-$49.99 .......................... 61,656 3.5 $46 61,656 $46

$50-$59.99 .......................... 30,695 3.5 $57 30,695 $57

$60 and over ........................ 16,355 3.2 $71 16,355 $71

531,233 4.7 $30 386,303 $33

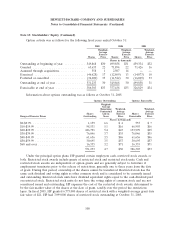

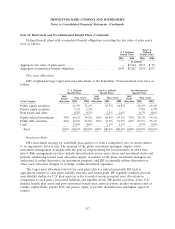

Under the principal option plans, HP granted certain employees cash, restricted stock awards, or

both. Restricted stock awards include grants of restricted stock and restricted stock units. Cash and

restricted stock awards are independent of option grants and are generally subject to forfeiture if

employment terminates prior to the release of restrictions, generally one to three years from the date

of grant. During that period, ownership of the shares cannot be transferred. Restricted stock has the

same cash dividend and voting rights as other common stock and is considered to be currently issued

and outstanding. Restricted stock units have dividend equivalent rights equal to the cash dividend paid

on restricted stock. Restricted stock units do not have the voting rights of common stock and are not

considered issued and outstanding. HP expenses the cost of the restricted stock awards, determined to

be the fair market value of the shares at the date of grant, ratably over the period the restrictions

lapse. In fiscal 2005, HP granted 6,773,000 shares of restricted stock with a weighted-average grant date

fair value of $21. HP had 7,099,000 shares of restricted stock outstanding at October 31, 2005,

108