HP 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

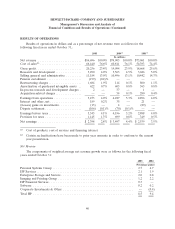

Operating Expenses

Research and Development

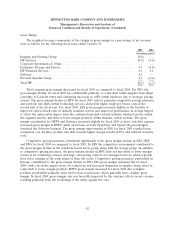

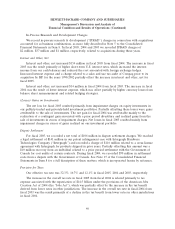

For fiscal 2005, total research and development expense as a percentage of net revenue declined

from the same period in the prior year due primarily to savings resulting from workforce reductions

and tight expense controls. These savings were partially offset by increased costs for the company bonus

and costs associated with the workforce rebalancing actions taken in the first half of the fiscal year. As

a percentage of net revenue, each of our segments experienced a decrease in research and development

expense for the current year as we work to focus our investments and manage realignment, while also

continuing to drive new technologies and business opportunities. Such decreases resulted in part from

cost control measures, including the benefit from workforce reduction actions in ESS, the consolidation

and realignment of certain IPG research and development infrastructure and lower program spending.

For fiscal 2004, total research and development spending decreased as a percentage of net revenue

in each of our major segments. The decrease was a result of our focus on investing in categories of the

business that yield stronger long-term returns in the marketplace and on curtailing spending in the

more mature categories of our business, particularly within ESS. In addition, during fiscal 2004 we

continued to realize synergies from the Compaq acquisition, and we shifted our business towards more

standards-based products, leveraging research and development from our technology partners. These

decreases as a percentage of net revenue were moderated by increased research and development

spending in IPG related to strategic initiatives and unfavorable currency impacts resulting primarily

from the weakening of the dollar against the euro. IPG’s increase in research and development

spending was due primarily to our investment in inkjet technology.

Selling, General and Administrative

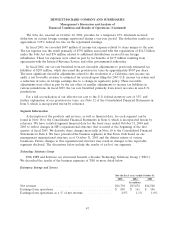

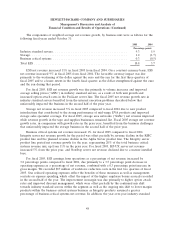

Selling, general and administrative (‘‘SG&A’’) expense decreased slightly as a percentage of net

revenue during fiscal 2005, as net revenue growth was higher than the growth of SG&A due in part to

tight company-wide expense controls. On an absolute basis, SG&A spending increased 6.6% for the

current fiscal year due primarily to higher employee bonuses earned in the second half of fiscal 2005

and unfavorable currency impacts.

The decline in SG&A expense as a percentage of net revenue in fiscal 2004 as compared to fiscal

2003 was due primarily to the increase in net revenue outpacing expense growth. This was in part a

result of effective expense controls and workforce reduction measures. Unfavorable currency impacts

moderated the decline due to the weakening of the dollar against the euro.

Pension Curtailment

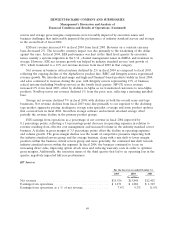

In conjunction with management’s plan to restructure certain of its operations, as discussed in

Note 7 to the Consolidated Financial Statements in Item 8, HP modified its U.S. retirement programs

to more closely align to industry practice. Effective January 1, 2006, HP will cease pension accruals and

eliminate eligibility for the subsidized retiree medical program for current employees who do not meet

defined criteria based on age and years of service. As a result, we recognized a curtailment gain of

$199 million in the fourth quarter of fiscal 2005 stemming from the elimination of future benefit

accruals for the affected employee group.

For more information on our plan design changes, see Note 15 of the Consolidated Financial

Statements in Item 8, which is incorporated herein by reference.

43