HP 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

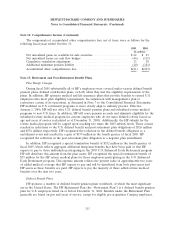

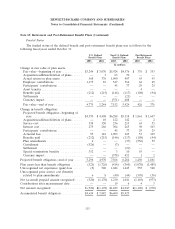

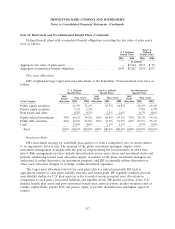

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

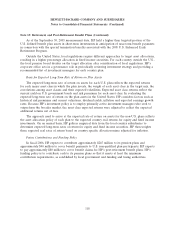

The Medicare Act reduced HP’s post-retirement medical plan obligations and expense during fiscal

2005 and 2004. See Note 1 for a full description of the impact of the Medicare Act as adopted by HP,

which is incorporated herein by reference.

Defined Contribution Plans

HP offers various defined contribution plans for U.S. and non-U.S. employees. Total defined

contribution expense was $422 million in fiscal 2005, $405 million in fiscal 2004 and $377 million in

fiscal 2003. U.S. employees are automatically enrolled in the Hewlett-Packard Company 401(k) Plan

(the ‘‘HP 401(k) Plan’’) when they meet eligibility requirements, unless they decline participation. On

May 3, 2002, HP assumed sponsorship of the Compaq Computer Corporation 401(k) Investment Plan

(the ‘‘Compaq 401(k) Plan’’). Effective January 1, 2004, HP merged the Compaq 401(k) Plan into the

HP 401(k) Plan.

During fiscal 2005, HP matched employee contributions to the HP 401(k) Plan with cash

contributions up to a maximum of 4% of eligible compensation. During the last eight months of

calendar 2002, for the Compaq 401(k) Plan only, HP matched up to a maximum of 6% of eligible

compensation. Effective January 1, 2006 newly-hired employees, rehired employees and employees

whose combination of age plus years of service is less than 62 will be eligible for a 6% HP matching

contribution.

Effective January 31, 2004, HP desginated the HP Stock Fund, an investment option under the HP

401(k) Plan, as an Employee Stock Ownership Plan and, as a result, participants in the HP Stock Fund

may receive dividends in cash or may reinvest such dividends into the HP Stock Fund. HP paid

approximately $12 million and $13 million in dividends for the HP common shares held by the HP

Stock Fund in fiscal 2005 and 2004, respectively. HP records the dividends as a reduction of retained

earnings in the Consolidated Statements of Stockholders’ Equity. The HP Stock Fund held

approximately 34 million shares of HP common stock at October 31, 2005.

113