HP 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 13: Stockholders’ Equity (Continued)

The Accelerated Purchase began on September 2004 and was completed in November 2004. Upon

completion of the Accelerated Purchase HP paid a $51 million price adjustment based on the

difference between the $18.82 weighted average price of the open market stock purchases by the

investment bank and the initial purchase price of $18.11 per share. The price adjustment also included

certain amounts reflecting the investment bank’s carrying costs or benefits from purchasing shares at

prices other than the initial price and its benefits from receiving the $1.3 billion payment in advance of

its purchases. HP accounted for the Accelerated Purchase as an equity transaction on the cash

settlement dates.

HP repurchased shares from the Packard Foundation under a memorandum of understanding

dated September 9, 2002 and amended and restated September 17, 2004 that, among other things,

priced the repurchases by reference to the volume weighted-average price for composite New York

Stock Exchange transactions on trading days in which a repurchase occurred. Either HP or the Packard

Foundation may suspend or terminate sales under the amended and restated memorandum of

understanding at any time.

As of October 31, 2005, HP had authorization for remaining future repurchases of approximately

$3.4 billion.

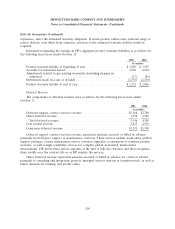

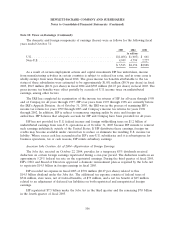

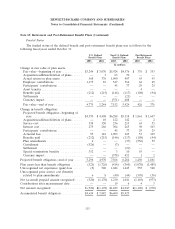

Note 14: Comprehensive Income

The changes in the components of other comprehensive income, net of taxes, were as follows for

the following fiscal years ended October 31:

2005 2004 2003

In millions

Net earnings ............................................... $2,398 $3,497 $2,539

Net unrealized (losses) gains on available-for-sale securities:

Change in net unrealized (losses) gains, net of tax of $6 in 2005, tax

benefit of $12 in 2004 and taxes of $20 in 2003 .................. 9 (12) 36

Net unrealized gains reclassified into earnings, net of taxes of $6 in 2005,

$5 in 2004 and $2 in 2003 .................................. (10) (8) (3)

(1) (20) 33

Net unrealized gains (losses) on cash flow hedges:

Change in net unrealized losses, net of tax benefits of $16 in 2005, $59 in

2004 and $45 in 2003 ..................................... (28) (100) (77)

Net unrealized losses reclassified into earnings, net of tax benefits of $56

in 2005, $42 in 2004 and taxes of $17 in 2003 .................... 97 72 29

69 (28) (48)

Net change in cumulative translation adjustment, net of tax benefit of $8 in

2005, and taxes of $4 and $0 in 2004 and 2003, respectively ........... (17) 21 2

Net change in additional minimum pension liability, net of taxes of $89 in

2005, tax benefit of $3 in 2004 and taxes of $97 in 2003 .............. 171 (13) 211

Comprehensive income ....................................... $2,620 $3,457 $2,737

110