HP 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

FINANCIAL CONDITION (Sources and Uses of Cash)

Our total cash and cash equivalents increased approximately 10% to $13.9 billion at October 31,

2005 from $12.7 billion at the end of fiscal 2004. Net earnings in fiscal 2005 helped generate

$8.0 billion in cash from operating activities. The cash generated by operations in fiscal 2005 funded all

of the $6.8 billion in investing and financing activities. Year-over-year borrowings declined 27% to

$5.2 billion at October 31, 2005. The net $6.8 billion used for investing and financing activities during

fiscal 2005 included $3.5 billion for share repurchases, $2.0 billion for gross investments in property

plant and equipment and $1.8 billion for payments of debt. Cash flows from financing activities

benefited from $1.2 billion of proceeds relating to employee stock plans. Our cash position remains

strong and our cash balances are sufficient to cover significant cash outlays expected in fiscal 2006

associated with our restructuring actions and company bonus payments.

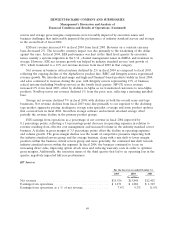

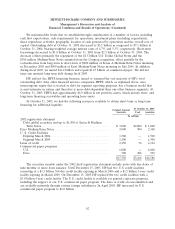

For the fiscal years ended October 31

2005 2004 2003

In millions

Net cash provided by operating activities .................... $8,028 $ 5,088 $ 6,057

Net cash used in investing activities ........................ (1,757) (2,454) (1,512)

Net cash used in financing activities ........................ (5,023) (4,159) (1,549)

Net increase (decrease) in cash and cash equivalents ............ $1,248 $(1,525) $ 2,996

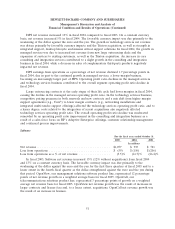

Key Performance Metrics

October 31

2005 2004 2003

Days of sales outstanding in accounts receivable ........................... 39 43 40

Days of supply in inventory .......................................... 35 39 37

Days of purchases outstanding in accounts payable ......................... (52) (51) (56)

Cash conversion cycle .............................................. 22 31 21

Days of sales outstanding in accounts receivable (‘‘DSO’’) measures the average number of days

our receivables are outstanding. DSO is calculated by dividing accounts receivable, net of allowance for

doubtful accounts, by a 90-day average net revenue.

Days of supply in inventory (‘‘DOS’’) measures the average number of days from procurement to

sale of our product. DOS is calculated by dividing inventory by a 90-day average cost of goods sold.

Days of purchases outstanding in accounts payable (‘‘DPO’’) measures the average number of days

our accounts payable balances are outstanding. DPO is calculated by dividing accounts payable by a

90-day average cost of goods sold.

Our working capital requirements depend upon our effective management of the cash conversion

cycle, which represents effectively the number of days that elapse from the day we pay for the purchase

of raw materials to the collection of cash from our customers. The cash conversion cycle is the sum of

DSO and DOS less DPO.

59