HP 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

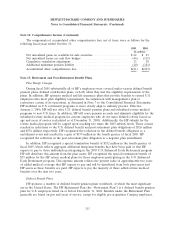

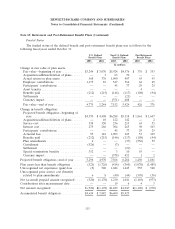

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

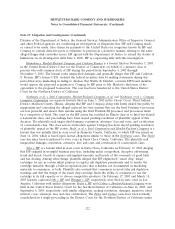

Funded Status

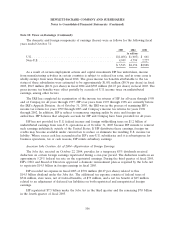

The funded status of the defined benefit and post-retirement benefit plans was as follows for the

following fiscal years ended October 31:

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2005 2004 2005 2004 2005 2004

In millions

Change in fair value of plan assets:

Fair value—beginning of year ........... $3,244 $ 3,070 $5,924 $4,576 $ 376 $ 353

Acquisition/addition/deletion of plans ...... — 3 63 70 — —

Actual return on plan assets ............ 568 376 1,090 407 63 43

Employer contributions ................ 1,175 10 547 564 62 49

Participants’ contributions .............. — — 45 37 29 25

Asset transfer ....................... — — — — 4 —

Benefits paid ....................... (212) (215) (146) (117) (108) (94)

Settlements ........................ — — — (21) — —

Currency impact ..................... — — (371) 408 — —

Fair value—end of year ................ 4,775 3,244 7,152 5,924 426 376

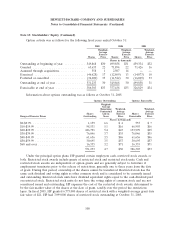

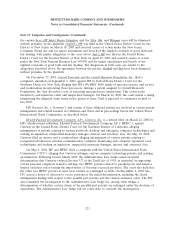

Change in benefit obligation:

Projected benefit obligation—beginning of

year ............................ $4,970 $ 4,408 $6,284 $5,118 $ 1,861 $ 1,607

Acquisition/addition/deletion of plans ...... — 10 122 142 — 2

Service cost ........................ 338 320 236 213 63 55

Interest cost ........................ 275 266 304 265 98 103

Participants’ contributions .............. — — 45 37 29 25

Actuarial loss ....................... 95 181 1,099 223 53 109

Benefits paid ....................... (212) (215) (146) (117) (108) (94)

Plan amendments .................... 4 — — (37) (556) 52

Curtailment ........................ (526) — (3) — — —

Settlement ......................... — — — (21) — —

Special termination benefits ............ 352 — 3 10 55 —

Currency impact ..................... — — (378) 451 1 2

Projected benefit obligation—end of year .... 5,296 4,970 7,566 6,284 1,496 1,861

Plan assets less than benefit obligation ...... (521) (1,726) (414) (360) (1,070) (1,485)

Unrecognized net experience (gain) loss ..... (5) 540 1,684 1,445 555 568

Unrecognized prior service cost (benefit)

related to plan amendments ............ 6 8 (40) (44) (595) (56)

Net (accrued) prepaid amount recognized .... (520) (1,178) 1,230 1,041 (1,110) (973)

Contributions after measurement date ....... — — 19 6 4 3

Net amount recognized ................. $(520) $(1,178) $1,249 $1,047 $(1,106) $ (970)

Accumulated benefit obligation ............ $4,634 $ 3,882 $6,600 $5,425

115