HP 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

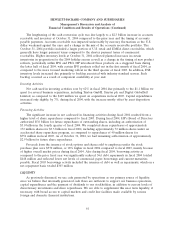

We maintain debt levels that we establish through consideration of a number of factors, including

cash flow expectations, cash requirements for operations, investment plans (including acquisitions),

share repurchase activities, geographic location of cash generated by operations and the overall cost of

capital. Outstanding debt at October 31, 2005 decreased to $5.2 billion as compared to $7.1 billion at

October 31, 2004, bearing weighted average interest rates of 4.7% and 5.3%, respectively. Short-term

borrowings decreased to $1.8 billion at October 31, 2005 from $2.5 billion at October 31, 2004. The

decrease reflects primarily the repayment of the $1.5 billion U.S. Dollar Global Notes and the

$300 million Medium-Term Notes assumed from the Compaq acquisition, offset partially by the

reclassification from long-term to short-term of $200 million of Series A Medium-Term Notes maturing

in December 2005 and $900 million of Euro Medium-Term Notes maturing in July 2006. In addition,

during fiscal 2005, we issued $11.4 billion and repaid $11.5 billion of commercial paper. We did not

issue any material long-term debt during fiscal 2005.

HP, and not the HPFS financing business, issued or assumed the vast majority of HP’s total

outstanding debt. Like other financial services companies, HPFS, which, as explained above, uses

intercompany equity that is treated as debt for segment reporting purposes, has a business model that

is asset-intensive in nature and therefore is more debt-dependent than our other business segments. At

October 31, 2005, HPFS had approximately $6.9 billion in net portfolio assets, which include short- and

long-term financing receivables and operating lease assets.

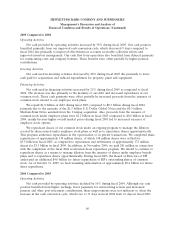

At October 31, 2005, we had the following resources available to obtain short-term or long-term

financing for additional liquidity:

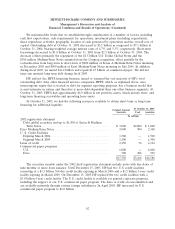

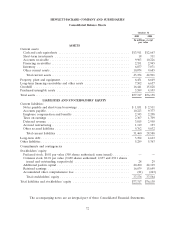

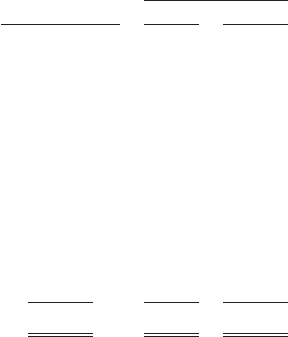

At October 31, 2005

Original Amount

Available Used Available

In millions

2002 registration statement

Debt, global securities and up to $1,500 of Series B Medium

Term Notes ...................................... $ 3,000 $2,000 $ 1,000

Euro Medium-Term Notes ............................... 3,000 900 2,100

U. S. Credit Facilities

Expiring March 2006 ................................. 1,500 — 1,500

Expiring March 2009 ................................. 1,500 — 1,500

Lines of credit ....................................... 2,250 56 2,194

Commercial paper programs

U.S. ............................................. 6,000 — 6,000

Euro ............................................. 500 208 292

$17,750 $3,164 $14,586

The securities issuable under the 2002 shelf registration statement include notes with due dates of

nine months or more from issuance. Until December 15, 2005, HP had two U.S. credit facilities

consisting of a $1.5 billion 364-day credit facility expiring in March 2006 and a $1.5 billion 5-year credit

facility expiring in March 2009. On December 15, 2005 HP replaced the two credit facilities with a

$3.0 billion 5-year credit facility. The U.S. credit facility is available for general corporate purposes,

including the support of our U.S. commercial paper program. The lines of credit are uncommitted and

are available primarily through various foreign subsidiaries. In April 2005, HP increased its U.S.

commercial paper program to $6.0 billion.

62