HP 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 12: Taxes on Earnings (Continued)

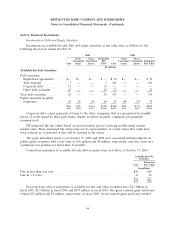

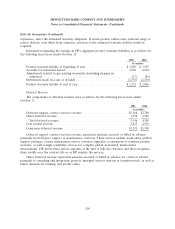

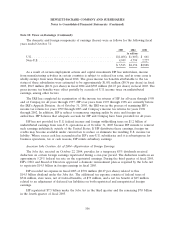

The significant components of deferred tax assets and deferred tax liabilities were as follows for

the following fiscal years ended October 31:

2005 2004

Deferred Deferred Deferred Deferred

Tax Tax Tax Tax

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards ................................ $ 565 $ — $ 403 $ —

Credit carryforwards ............................... 2,922 — 678 —

Unremitted earnings of foreign subsidiaries .............. — 4,015 — 2,347

Inventory valuation ................................ 179 58 151 81

Intercompany transactions—profit in inventory ............ 749 — 587 —

Intercompany transactions—excluding inventory ........... 777 — 1,814 —

Fixed assets ..................................... 386 13 196 13

Warranty ....................................... 602 — 595 —

Employee and retiree benefits ........................ 1,055 472 1,067 205

Accounts receivable allowance ........................ 166 — 186 —

Capitalized research and development .................. 2,235 — 2,582 —

Purchased intangible assets .......................... 120 619 219 832

Restructuring .................................... 333 — 90 —

Equity investments ................................ 177 — 289 —

Deferred revenue ................................. 443 — 346 —

Other ......................................... 909 41 319 47

Gross deferred tax assets and liabilities ................. 11,618 5,218 9,522 3,525

Valuation allowance ............................... (894) — (447) —

Total deferred tax assets and liabilities .................. $10,724 $5,218 $9,075 $3,525

At October 31, 2005, HP had a deferred tax asset of $565 million related to loss carryforwards, of

which $337 million relates to foreign net operating losses. HP has provided a valuation allowance of

$310 million on those foreign net operating loss carryforwards, which HP does not expect to utilize. HP

has recorded a deferred tax asset of $118 million as a result of the current year U.S. net operating loss,

which will expire in fiscal 2026. The remaining $110 million deferred tax asset relates to various state

net operating losses and losses from acquired companies. HP has provided $97 million in valuation

allowance for such losses.

Of the total tax credit carryforwards of $2.9 billion, HP had foreign tax credit carryforwards of

$1.93 billion, which will expire in fiscal 2016. HP had alternative minimum tax credit carryforwards of

$107 million, which do not expire, and research and development credit carryforwards of $334 million,

of which $19 million will expire in fiscal 2013 and the remainder will expire after fiscal 2018. HP also

had tax credit carryforwards of $551 million in various states and foreign countries, on which HP has

provided a valuation allowance of $401 million.

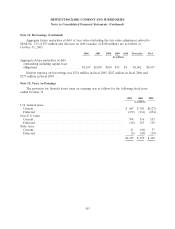

Gross deferred tax assets at October 31, 2005 and 2004 were reduced by valuation allowances of

$894 million and $447 million, respectively. The total valuation allowance increased by $447 million, of

which $262 million was attributable to the net operating losses and tax credits in various states,

104