HP 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 12: Taxes on Earnings (Continued)

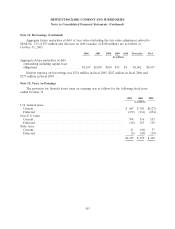

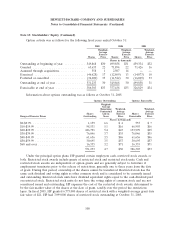

The domestic and foreign components of earnings (losses) were as follows for the following fiscal

years ended October 31:

2005 2004 2003

In millions

U.S. .............................................. $(1,406) $ (603) $ 661

Non-U.S. .......................................... 4,949 4,799 2,227

$ 3,543 $4,196 $2,888

As a result of certain employment actions and capital investments HP has undertaken, income

from manufacturing activities in certain countries is subject to reduced tax rates, and in some cases is

wholly exempt from taxes through fiscal 2018. The gross income tax benefits attributable to the tax

status of these subsidiaries were estimated to be approximately $1,051 million ($0.36 per share) in fiscal

2005, $947 million ($0.31 per share) in fiscal 2004 and $705 million ($0.23 per share) in fiscal 2003. The

gross income tax benefits were offset partially by accruals of U.S. income taxes on undistributed

earnings, among other factors.

The IRS has completed its examination of the income tax returns of HP for all years through 1998

and of Compaq for all years through 1997. HP’s tax years from 1993 through 1998 are currently before

the IRS’s Appeals Division. As of October 31, 2005, the IRS was in the process of examining HP’s

income tax returns for years 1999 through 2003 and Compaq’s income tax returns for years 1998

through 2002. In addition, HP is subject to numerous ongoing audits by state and foreign tax

authorities. HP believes that adequate accruals for HP and Compaq have been provided for all years.

HP has not provided for U.S. federal income and foreign withholding taxes on $1.2 billion of

undistributed earnings from non-U.S. operations as of October 31, 2005 because HP intends to reinvest

such earnings indefinitely outside of the United States. If HP distributes these earnings, foreign tax

credits may become available under current law to reduce or eliminate the resulting U.S. income tax

liability. Where excess cash has accumulated in HP’s non-U.S. subsidiaries and it is advantageous for

business operations, tax or cash reasons, HP remits subsidiary earnings.

American Jobs Creation Act of 2004—Repatriation of Foreign Earnings

The Jobs Act, enacted on October 22, 2004, provides for a temporary 85% dividends received

deduction on certain foreign earnings repatriated during a one-year period. The deduction results in an

approximate 5.25% federal tax rate on the repatriated earnings. During the third quarter of fiscal 2005,

HP’s CEO and Board of Directors approved a domestic reinvestment plan as required by the Jobs Act

to repatriate $14.5 billion in foreign earnings in fiscal 2005.

HP recorded tax expense in fiscal 2005 of $792 million ($0.27 per share) related to this

$14.5 billion dividend under the Jobs Act. The additional tax expense consists of federal taxes of

$744 million, state taxes, net of federal benefits, of $73 million, and a net tax benefit of $25 million

related to an adjustment of deferred tax liabilities on both repatriated and unrepatriated foreign

earnings.

HP repatriated $7.5 billion under the Jobs Act in the third quarter and the remaining $7.0 billion

in the fourth quarter of fiscal 2005.

106