HP 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

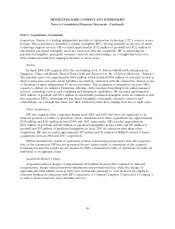

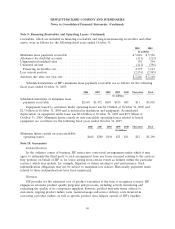

Note 9: Financing Receivables and Operating Leases (Continued)

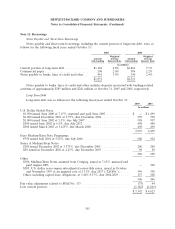

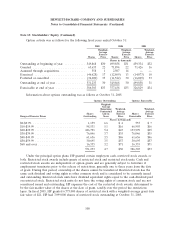

receivables, which are included in financing receivables and long-term financing receivables and other

assets, were as follows for the following fiscal years ended October 31:

2005 2004

In millions

Minimum lease payments receivable ................................... $5,018 $ 5,328

Allowance for doubtful accounts ...................................... (111) (213)

Unguaranteed residual value ........................................ 301 394

Unearned income ................................................ (411) (396)

Financing receivables, net ......................................... 4,797 5,113

Less current portion ............................................... (2,551) (2,945)

Amounts due after one year, net ..................................... $2,246 $ 2,168

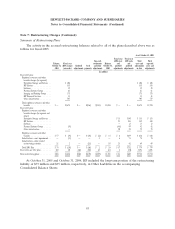

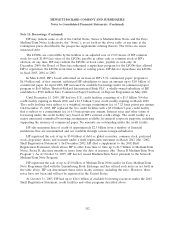

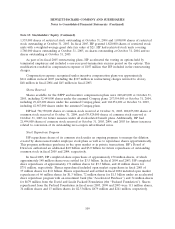

Scheduled maturities of HP’s minimum lease payments receivable are as follows for the following

fiscal years ended October 31, 2005:

2006 2007 2008 2009 2010 Thereafter Total

In millions

Scheduled maturities of minimum lease

payments receivable ................ $2,649 $1,472 $658 $183 $45 $11 $5,018

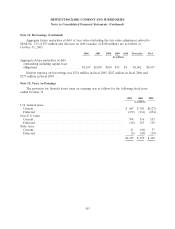

Equipment leased to customers under operating leases was $1.9 billion at October 31, 2005 and

$2.3 billion at October 31, 2004 and is included in machinery and equipment. Accumulated

depreciation on equipment under lease was $0.6 billion at October 31, 2005 and $0.9 billion at

October 31, 2004. Minimum future rentals on non-cancelable operating leases related to leased

equipment are as follows for the following fiscal years ended October 31, 2005:

2006 2007 2008 2009 2010 Thereafter Total

In millions

Minimum future rentals on non-cancelable

operating leases ..................... $668 $380 $196 $23 $11 $12 $1,290

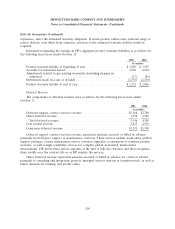

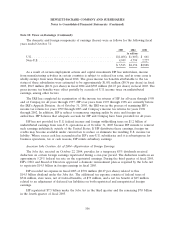

Note 10: Guarantees

Indemnifications

In the ordinary course of business, HP enters into contractual arrangements under which it may

agree to indemnify the third party to such arrangement from any losses incurred relating to the services

they perform on behalf of HP or for losses arising from certain events as defined within the particular

contract, which may include, for example, litigation or claims relating to past performance. Such

indemnification obligations may not be subject to maximum loss clauses. Historically, payments made

related to these indemnifications have been immaterial.

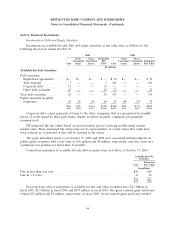

Warranty

HP provides for the estimated cost of product warranties at the time it recognizes revenue. HP

engages in extensive product quality programs and processes, including actively monitoring and

evaluating the quality of its component suppliers; however, product warranty terms offered to

customers, ongoing product failure rates, material usage and service delivery costs incurred in

correcting a product failure, as well as specific product class failures outside of HP’s baseline

99