HP 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

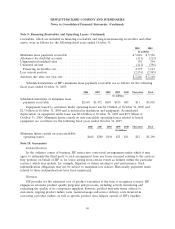

Note 13: Stockholders’ Equity (Continued)

1,533,000 shares of restricted stock outstanding at October 31, 2004 and 1,008,000 shares of restricted

stock outstanding at October 31, 2003. In fiscal 2005, HP granted 1,820,000 shares of restricted stock

units with a weighted-average grant date fair value of $21. HP had restricted stock units covering

1,780,000 shares outstanding at October 31, 2005, no shares outstanding at October 31, 2004 and no

shares outstanding at October 31, 2003.

As part of its fiscal 2005 restructuring plans, HP accelerated the vesting on options held by

terminated employees and included a one-year post-termination exercise period on the options. This

modification resulted in compensation expense of $107 million that HP included in the restructuring

charges.

Compensation expense recognized under incentive compensation plans was approximately

$211 million in fiscal 2005 (including the $107 million in restructuring charges referred to above),

$48 million in fiscal 2004 and $45 million in fiscal 2003.

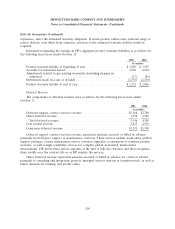

Shares Reserved

Shares available for the ESPP and incentive compensation plans were 260,669,000 at October 31,

2005, including 32,449,000 shares under the assumed Compaq plans; 257,554,000 at October 31, 2004,

including 29,123,000 shares under the assumed Compaq plans; and 168,951,000 at October 31, 2003,

including 42,967,000 shares under the assumed Compaq plans.

HP had 794,750,000 shares of common stock reserved at October 31, 2005, 808,855,000 shares of

common stock reserved at October 31, 2004, and 670,929,000 shares of common stock reserved at

October 31, 2003 for future issuance under all stock-related benefit plans. Additionally, HP had

21,494,000 shares of common stock reserved at October 31, 2005, 2004, and 2003 for future issuances

related to conversion of its outstanding zero-coupon subordinated notes.

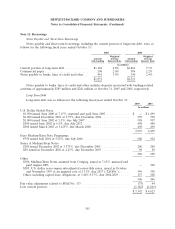

Stock Repurchase Program

HP repurchases shares of its common stock under an ongoing program to manage the dilution

created by shares issued under employee stock plans as well as to repurchase shares opportunistically.

This program authorizes purchases in the open market or in private transactions. HP’s Board of

Directors authorized an additional $4.0 billion and $5.0 billion for future repurchases of outstanding

common stock in fiscal 2005 and 2004, respectively.

In fiscal 2005, HP completed share repurchases of approximately 150 million shares, of which

approximately 148 million shares were settled for $3.5 billion. In fiscal 2004 and 2003, HP completed

share repurchases of approximately 172 million shares for $3.3 billion, and 40 million shares for

$751 million, respectively. Shares repurchased included open market repurchases in fiscal 2005 of

37 million shares for $1.0 billion. Shares repurchased and settled in fiscal 2004 included open market

repurchases of 66 million shares for $1.3 billion, 72 million shares for $1.3 billion under an accelerated

share repurchase program with an investment bank (the ‘‘Accelerated Purchase’’) and 34 million shares

for $679 million from the David and Lucile Packard Foundation (the ‘‘Packard Foundation’’). Shares

repurchased from the Packard Foundation in fiscal years 2005, 2004 and 2003 were 111 million shares,

34 million shares and 13 million shares for $2.5 billion, $679 million and $241 million, respectively.

109