HP 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

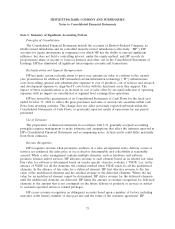

Note 1: Summary of Significant Accounting Policies (Continued)

the pro forma net earnings presented below would have been immaterial for all periods presented. See

the further discussion of SFAS 123R in the Recent Pronouncements section of Note 1.

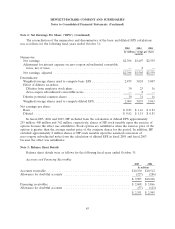

The weighted average fair values and the assumptions used in calculating such values were as

follows during each of the following fiscal years:

Stock Options Stock Purchase Rights

2005 2004 2003 2005 2004 2003

Weighted average fair value of grants .............. $5.63 $6.72 $5.15 $6.01 $4.95 $5.92

Risk-free interest rate ......................... 3.93% 2.77% 3.23% 2.66% 1.11% 1.21%

Dividend yield ............................... 1.5% 1.4% 1.8% 1.6% 1.5% 1.9%

Expected volatility ............................ 28% 35% 35% 30% 28% 47%

Expected life in months ........................ 54 60 72666

In light of new accounting guidance under SFAS 123R, beginning in the second quarter of fiscal

2005 HP reevaluated its assumptions used in estimating the fair value of employee options granted.

Based on this assessment, management determined that implied volatility is a better indicator of

expected volatility than historical volatility. This change from historical to implied volatility resulted in a

reduction of the pro forma expense by an aggregate of $68 million over the average four-year vesting

period for the options granted during the second through fourth quarters of fiscal 2005.

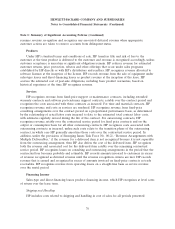

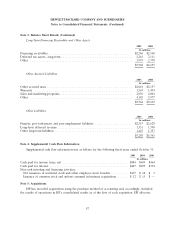

The pro forma effect on net earnings as if the fair value of stock-based compensation had been

recognized as compensation expense on a straight-line basis over the vesting period of the stock option

or purchase right was as follows for the following fiscal years ended October 31:

2005 2004 2003

In millions, except per share

amounts

Net earnings, as reported ...................................... $2,398 $3,497 $2,539

Add: Stock-based compensation included in reported net earnings, net of

related tax effects ......................................... 144 33 30

Less: Stock-based compensation expense determined under the fair-value

based method for all awards, net of related tax effects ............... (621) (692) (839)

Pro forma net earnings ....................................... $1,921 $2,838 $1,730

Basic net earnings per share:

As reported .............................................. $ 0.83 $ 1.16 $ 0.83

Pro forma ............................................... $ 0.67 $ 0.94 $ 0.57

Diluted net earnings per share:

As reported .............................................. $ 0.82 $ 1.15 $ 0.83

Pro forma ............................................... $ 0.66 $ 0.93 $ 0.57

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities

denominated in non-U.S. dollars are remeasured into U.S. dollars at current exchange rates for

81