HP 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

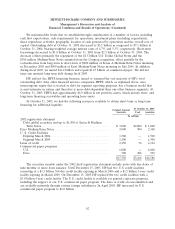

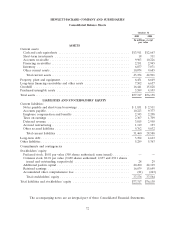

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Consolidated Balance Sheets

October 31

2005 2004

In millions, except

par value

ASSETS

Current assets:

Cash and cash equivalents ........................................ $13,911 $12,663

Short-term investments .......................................... 18 311

Accounts receivable ............................................. 9,903 10,226

Financing receivables ............................................ 2,551 2,945

Inventory .................................................... 6,877 7,071

Other current assets ............................................. 10,074 9,685

Total current assets ............................................ 43,334 42,901

Property, plant and equipment ....................................... 6,451 6,649

Long-term financing receivables and other assets ......................... 7,502 6,657

Goodwill ...................................................... 16,441 15,828

Purchased intangible assets ......................................... 3,589 4,103

Total assets ..................................................... $77,317 $76,138

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Notes payable and short-term borrowings ............................. $ 1,831 $ 2,511

Accounts payable ............................................... 10,223 9,377

Employee compensation and benefits ................................ 2,343 2,208

Taxes on earnings .............................................. 2,367 1,709

Deferred revenue .............................................. 3,815 2,958

Accrued restructuring ............................................ 1,119 193

Other accrued liabilities .......................................... 9,762 9,632

Total current liabilities ......................................... 31,460 28,588

Long-term debt .................................................. 3,392 4,623

Other liabilities .................................................. 5,289 5,363

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.01 par value (300 shares authorized; none issued) ......... — —

Common stock, $0.01 par value (9,600 shares authorized; 2,837 and 2,911 shares

issued and outstanding, respectively) ............................... 28 29

Additional paid-in capital ......................................... 20,490 22,129

Retained earnings .............................................. 16,679 15,649

Accumulated other comprehensive loss ............................... (21) (243)

Total stockholders’ equity ....................................... 37,176 37,564

Total liabilities and stockholders’ equity ................................ $77,317 $76,138

The accompanying notes are an integral part of these Consolidated Financial Statements.

72