HP 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

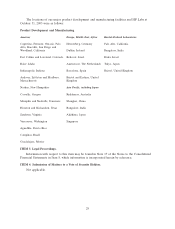

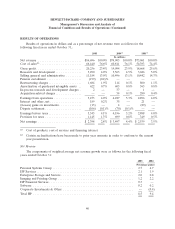

In terms of how our execution has translated into financial performance, our key fiscal 2005

financial metrics were as follows:

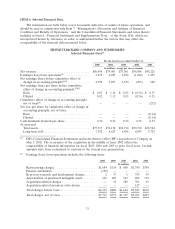

TSG

HP

Consolidated ESS HPS Software Total IPG PSG HPFS

in millions, except per share amounts

Net revenue ........... $86,696 $16,701 $15,536 $1,077 $33,314 $25,155 $26,741 $2,102

Year-over-year net revenue

% increase .......... 8% 11% 12% 15% 12% 4% 9% 11%

Earnings (loss) from

operations ........... $3,473 $ 810 $ 1,151 $ (59) $ 1,902 $ 3,413 $ 657 $ 213

Earnings (loss) from

operations as a % of net

revenue ............. 4.0% 4.9% 7.4% (5.5)% 5.7% 13.6% 2.5% 10.1%

Net earnings ........... $2,398

Net earnings per share

Basic .............. $ 0.83

Diluted ............. $ 0.82

Cash and cash equivalents for the fiscal year ended October 31, 2005 totaled $13.9 billion, an

increase of $1.2 billion from the October 31, 2004 balance of $12.7 billion. The increase for fiscal 2005

was due primarily to net cash provided by operating activities and proceeds received from shares issued

in connection with employee stock plans, partially reduced by the repayment of debt and repurchases of

common stock.

We intend the discussion of our financial condition and results of operations that follows to

provide information that will assist in understanding our Consolidated Financial Statements, the

changes in certain key items in those financial statements from year to year, and the primary factors

that accounted for those changes, as well as how certain accounting principles, policies and estimates

affect our Consolidated Financial Statements.

The discussion of results of operations at the consolidated level is followed by a more detailed

discussion of results of operations by segment.

For a further discussion of factors that could impact operating results, see the section entitled

‘‘Risk Factors’’ in Item 1A, which is incorporated herein by reference.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

General

The Consolidated Financial Statements of HP are prepared in accordance with U.S. generally

accepted accounting principles, which require management to make estimates, judgments and

assumptions that affect the reported amounts of assets, liabilities, net revenue and expenses, and the

disclosure of contingent assets and liabilities. Management bases its estimates on historical experience

and on various other assumptions that it believes to be reasonable under the circumstances, the results

of which form the basis for making judgments about the carrying values of assets and liabilities that are

not readily apparent from other sources. Senior management has discussed the development, selection

and disclosure of these estimates with the Audit Committee of HP’s Board of Directors. Management

believes that the accounting estimates employed and the resulting balances are reasonable; however,

actual results may differ from these estimates under different assumptions or conditions.

34