HP 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

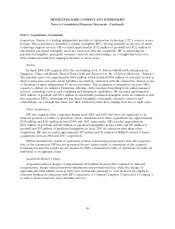

Note 3: Balance Sheet Details (Continued)

HP has revolving trade receivables-based facilities permitting us to sell certain trade receivables to

third parties on a non-recourse basis. The aggregate maximum capacity under these programs was

approximately $1.2 billion as of October 31, 2005. The facility with the largest volume is one that is

subject to a maximum amount of 525 million euros, approximately $630 million (the ‘‘Euro Program’’).

Trade receivables of approximately $7.9 billion were sold during fiscal 2005, including approximately

$5.4 billion under the Euro Program. Fees associated with these facilities do not generally differ

materially from the cash discounts previously offered to customers under other alternative prompt

payment programs. As of October 31, 2005, approximately $571 million was available under these

programs, of which $357 million relates to the Euro Program.

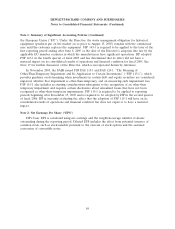

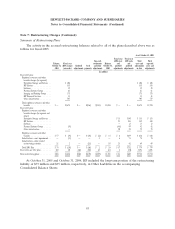

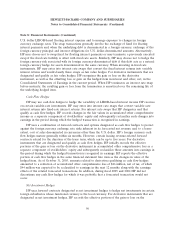

Inventory

2005 2004

In millions

Finished goods .................................................... $4,940 $5,322

Purchased parts and fabricated assemblies ................................ 1,937 1,749

$6,877 $7,071

Other Current Assets

2005 2004

In millions

Deferred tax assets—short term ....................................... $ 3,612 $3,744

Other receivables ................................................. 4,910 4,839

Prepaid and other current assets ...................................... 1,552 1,102

$10,074 $9,685

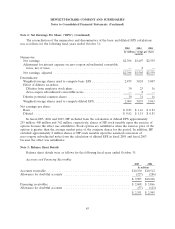

Property, Plant and Equipment

2005 2004

In millions

Land ......................................................... $ 629 $ 657

Buildings and leasehold improvements ................................. 5,630 5,752

Machinery and equipment .......................................... 7,621 7,427

13,880 13,836

Accumulated depreciation .......................................... (7,429) (7,187)

$ 6,451 $ 6,649

Depreciation expense was approximately $1.7 billion in fiscal 2005, $1.8 billion in fiscal 2004 and

$2.0 billion in fiscal 2003.

86