HP 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

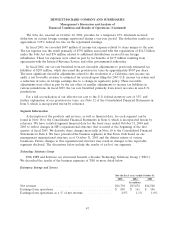

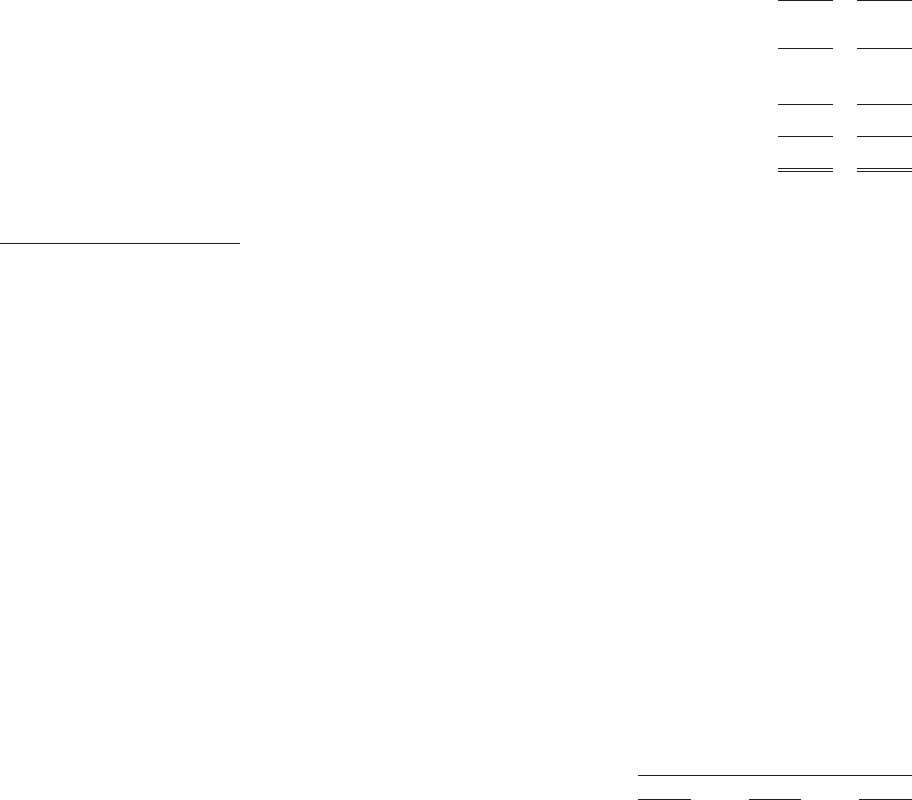

The portfolio assets and ratios derived from the segment balance sheet for HPFS were as follows

for the following fiscal years ended October 31:

2005 2004

In millions

Portfolio assets(1) .................................................. $7,085 $7,380

Allowance for doubtful accounts ....................................... 111 213

Operating lease equipment reserve ..................................... 45 51

Total reserves ..................................................... 156 264

Net portfolio assets ................................................ $6,929 $7,116

Reserve coverage .................................................. 2.2% 3.6%

Debt to equity ratio(2) ............................................... 5.5x 5.1x

(1) Portfolio assets include financing receivables of $5.0 billion at October 31, 2005 and $5.3 billion at

October 31, 2004 and net equipment under operating leases of $1.3 billion at October 31, 2005 and

$1.4 billion at October 31, 2004, as disclosed in Note 9 of the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference. Portfolio assets also include capitalized profit on

intercompany equipment transactions of approximately $400 million at both October 31, 2005 and

October 31, 2004 and intercompany leases of approximately $400 million at October 31, 2005 and

$300 million at October 31, 2004, both of which are eliminated in consolidation.

(2) HPFS debt consists of intercompany equity that is treated as debt for segment reporting purposes,

intercompany debt and debt issued directly by HPFS.

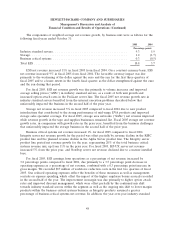

Portfolio assets at October 31, 2005 decreased 4% from October 31, 2004. The decrease resulted

primarily from collections of billed receivables, a decline in the exchange rate between the euro and the

dollar and the write-off of assets covered by specific reserves. The overall percentage of portfolio assets

reserved decreased due primarily to the write-off of assets covered by specific reserves, the release of

$40 million of reserves for aged receivables in EMEA that have since been collected and lower reserves

resulting from a stronger portfolio risk profile.

HPFS funds its operations mainly through a combination of intercompany debt and equity. The

increase in the debt to equity ratio reflects a planned increase in portfolio leverage.

Corporate Investments

For the fiscal years ended October 31

2005 2004 2003

In millions

Net revenue .......................................... $ 523 $ 449 $ 345

Loss from operations ................................... $(174) $ (179) $ (161)

Loss from operations as a % of net revenue ................... (33.3)% (39.9)% (46.7)%

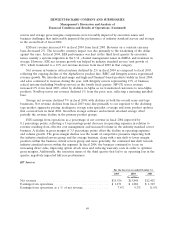

In fiscal 2005, the majority of the net revenue in Corporate Investments related to network

infrastructure products, which increased 20% from fiscal 2004 as a result of continued product

enhancements, particularly in gigabit Ethernet switch products.

Expenses related to corporate development, global alliances and HP Labs increased 5% in fiscal

2005 from fiscal 2004. The increase was due to higher spending on strategic initiatives and incubation

57