HP 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 12: Taxes on Earnings (Continued)

$175 million was provided on tax credits in foreign countries, $28 million was provided for losses from

acquired companies, and a net reduction of $18 million relates to other adjustments. The $447 million

valuation allowance increase was offset by corresponding increases to previously unrecognized deferred

tax assets of $325 million, and the remaining $122 million related to deferred tax assets generated in

the current year was recorded as an increase to the provision for taxes. At October 31, 2005, in

addition to $808 million of valuation allowances on foreign net operating losses and tax credits, HP had

valuation allowances of $86 million on unrealized capital losses. Of the $894 million in valuation

allowances at October 31, 2005, $151 million was related to deferred tax assets for Compaq and other

acquired companies that existed at the time of acquisition. In the future, if HP determines that the

realization of these deferred tax assets is more likely than not, the reversal of the related valuation

allowance will reduce goodwill instead of the provision for taxes.

Of the total tax benefits resulting from the exercise of employee stock options and other employee

stock programs, the amounts booked to stockholders’ equity were approximately $30 million in fiscal

2005, $35 million in fiscal 2004 and $24 million in fiscal 2003.

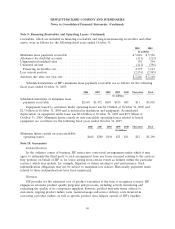

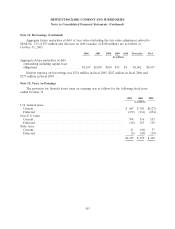

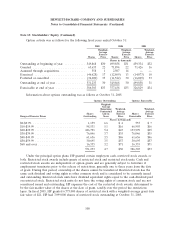

The differences between the U.S. federal statutory income tax rate and HP’s effective tax rate

were as follows for the following fiscal years ended October 31:

2005 2004 2003

U.S. federal statutory income tax rate ......................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit .................... (3.0) (2.3) 0.8

Lower rates in other jurisdictions, net ......................... (23.6) (15.3) (23.9)

Jobs Act Repatriation, including state taxes ..................... 22.4 — —

Research and development credit ............................ (0.2) (0.6) (1.9)

Valuation allowance ...................................... 3.4 1.1 1.2

Other, net ............................................. (1.7) (1.2) 0.9

32.3% 16.7% 12.1%

In fiscal 2005, HP recorded $697 million of net income tax expense related to items unique to the

year. The tax expense was the result primarily of $792 million associated with the repatriation of

$14.5 billion under the Jobs Act and $76 million related to additional distributions received from

foreign subsidiaries. These tax expenses were offset in part by tax benefits of $177 million resulting

from agreements with the U.S. Internal Revenue Service (‘‘IRS’’) and other governmental authorities,

which is reflected in lower rates in other jurisdictions, net and other, net.

In fiscal 2004, the tax rate benefited from net favorable adjustments to previously estimated tax

liabilities of $207 million, which decreased the provision for taxes by approximately $0.07 per share.

The most significant favorable adjustments related to the resolution of a California state income tax

audit, a net favorable revision to estimated tax accruals upon filing the 2003 U.S. income tax return and

a reduction in taxes on foreign earnings due to a change in regulatory policy. These favorable

adjustments were offset in part by the net effect of smaller adjustments to income tax liabilities in

various jurisdictions. In fiscal 2003, the tax rate benefited primarily from lower tax rates in non-U.S.

jurisdictions.

105