HP 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

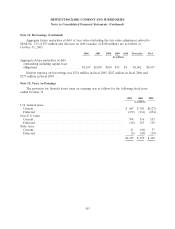

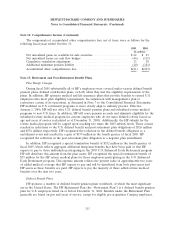

Note 14: Comprehensive Income (Continued)

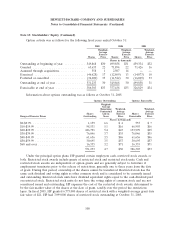

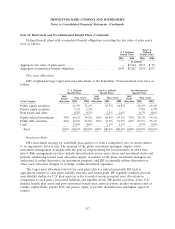

The components of accumulated other comprehensive loss, net of taxes, were as follows for the

following fiscal years ended October 31:

2005 2004

In millions

Net unrealized gains on available-for-sale securities .................... $22 $ 23

Net unrealized losses on cash flow hedges .......................... (46) (115)

Cumulative translation adjustment ................................ 13 30

Additional minimum pension liability .............................. (10) (181)

Accumulated other comprehensive loss ............................. $(21) $(243)

Note 15: Retirement and Post-Retirement Benefit Plans

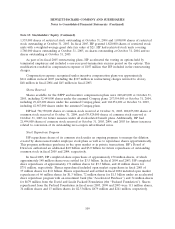

Plan Design Changes

During fiscal 2005 substantially all of HP’s employees were covered under various defined benefit

pension plans, defined contribution plans, or both, when they met the eligibility requirements of the

plans. In addition, HP sponsors medical and life insurance plans that provide benefits to retired U.S.

employees who meet plan eligibility requirements. In conjunction with management’s plan to

restructure certain of its operations, as discussed in Note 7 to the Consolidated Financial Statements,

HP modified its U.S. retirement programs to more closely align to industry practice. Effective

January 1, 2006, HP will not offer U.S. defined benefit pension plans and subsidized retiree medical

programs to new U.S. hires. In addition, HP will cease pension accruals and eliminate eligibility for the

subsidized retiree medical program for current employees who do not meet defined criteria based on

age and years of service (calculated as of December 31, 2005). Additionally, the HP subsidy for the

retiree medical program will be capped upon reaching two times the 2003 subsidy levels. These actions

resulted in reductions to the U.S. defined benefit and post-retirement plan obligations of $526 million

and $556 million respectively. HP recognized the reduction in the defined benefit obligation as a

curtailment event and resulted in a gain of $199 million in the fourth quarter of fiscal 2005. HP

recognized the reduction in the post-retirement plan obligation as a negative plan amendment.

In addition, HP recognized a special termination benefit of $352 million in the fourth quarter of

fiscal 2005, which reflects aggregate additional lump-sum benefits that have been paid or that HP

expects to pay to those individuals participating in the 2005 U.S. Enhanced Early Retirement program.

HP will distribute this amount from the plan assets. HP recognized the special termination benefit of

$55 million for the HP retiree medical plans for those employees participating in the U.S. Enhanced

Early Retirement program. This expense amount reflects the present value of approximately two years

of added medical coverage that HP expects to pay and will be distributed from both plan assets and

HP assets as these benefits are paid. HP expects to pay the majority of these added retiree medical

benefits over the next two years.

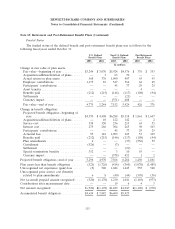

Defined Benefit Plans

HP sponsors a number of defined benefit pension plans worldwide, of which the most significant

are in the United States. The HP Retirement Plan (the ‘‘Retirement Plan’’) is a defined benefit pension

plan for U.S. employees hired on or before December 31, 2002. Benefits under the Retirement Plan

generally are based on pay and years of service, except for eligible pre-acquisition Compaq employees,

111