HP 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

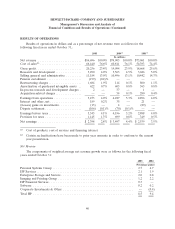

RESULTS OF OPERATIONS

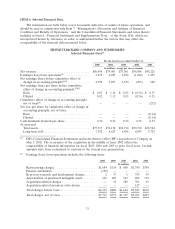

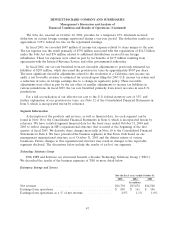

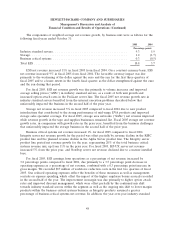

Results of operations in dollars and as a percentage of net revenue were as follows for the

following fiscal years ended October 31,:

2005 2004(2) 2003(2)

In millions

Net revenue ......................... $86,696 100.0% $79,905 100.0% $73,061 100.0%

Cost of sales(1) ........................ 66,440 76.6% 60,811 76.1% 54,393 74.4%

Gross profit .......................... 20,256 23.4% 19,094 23.9% 18,668 25.6%

Research and development ............... 3,490 4.0% 3,563 4.5% 3,686 5.0%

Selling, general and administrative ......... 11,184 13.0% 10,496 13.1% 10,442 14.3%

Pension curtailment .................... (199) (0.2)% — — — —

Restructuring charges ................... 1,684 1.9% 114 0.1% 800 1.1%

Amortization of purchased intangible assets . . 622 0.7% 603 0.8% 563 0.8%

In-process research and development charges . 2 — 37 — 1 —

Acquisition-related charges ............... — — 54 0.1% 280 0.4%

Earnings from operations ................ 3,473 4.0% 4,227 5.3% 2,896 4.0%

Interest and other, net .................. 189 0.2% 35 — 21 —

(Losses) gains on investments ............. (13) — 4 — (29) —

Dispute settlement ..................... (106) (0.1)% (70) (0.1)% — —

Earnings before taxes ................... 3,543 4.1% 4,196 5.2% 2,888 4.0%

Provision for taxes ..................... 1,145 1.3% 699 0.8% 349 0.5%

Net earnings ......................... $ 2,398 2.8% $ 3,497 4.4% $ 2,539 3.5%

(1) Cost of products, cost of services and financing interest.

(2) Certain reclassifications have been made to prior year amounts in order to conform to the current

year presentation.

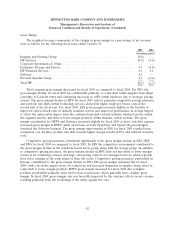

Net Revenue

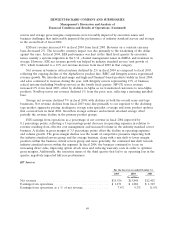

The components of weighted average net revenue growth were as follows for the following fiscal

years ended October 31:

2005 2004

Percentage points

Personal Systems Group .............................................. 2.7 4.7

HP Services ....................................................... 2.1 1.9

Enterprise Storage and Servers ......................................... 2.0 0.8

Imaging and Printing Group ........................................... 1.2 2.2

HP Financial Services ................................................ 0.3 —

Software ......................................................... 0.2 0.2

Corporate Investments & Other ........................................ — (0.4)

Total HP ......................................................... 8.5 9.4

40