HP 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

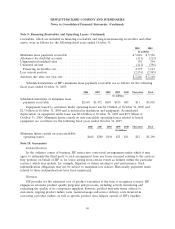

Note 8: Financial Instruments (Continued)

U.S. dollar LIBOR-based floating interest expense and to manage exposure to changes in foreign

currency exchange rates. The swap transactions generally involve the exchange of fixed for floating

interest payments and, when the underlying debt is denominated in a foreign currency, exchange of the

foreign currency principal and interest obligations for U.S. dollar-denominated amounts. Alternatively,

HP may choose not to swap fixed for floating interest payments or may terminate a previously executed

swap if the fixed rate liability is offset with fixed rate assets. Similarly, HP may choose not to hedge the

foreign currency risk associated with its foreign currency-denominated debt if this debt acts as a natural

foreign currency hedge for assets denominated in the same currency. When investing in fixed rate

instruments, HP may enter into interest rate swaps that convert the fixed interest returns into variable

interest returns and would classify these swaps as fair value hedges. For derivative instruments that are

designated and qualify as fair value hedges, HP recognizes the gain or loss on the derivative

instrument, as well as the offsetting loss or gain on the hedged item in interest and other, net, in the

Consolidated Statements of Earnings in the current period. When HP terminates an interest rate swap

before maturity, the resulting gain or loss from the termination is amortized over the remaining life of

the underlying hedged item.

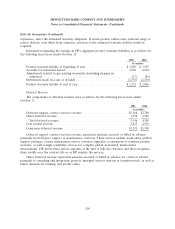

Cash Flow Hedges

HP may use cash flow hedges to hedge the variability of LIBOR-based interest income HP receives

on certain variable-rate investments. HP may enter into interest rate swaps that convert variable rate

interest returns into fixed-rate interest returns. For interest rate swaps that HP designates and that

qualify as cash flow hedges, HP records changes in the fair values in accumulated other comprehensive

income as a separate component of stockholders’ equity and subsequently reclassifies such changes into

earnings in the period during which the hedged transaction is recognized in earnings.

HP uses a combination of forward contracts and options designated as cash flow hedges to protect

against the foreign currency exchange rate risks inherent in its forecasted net revenue and, to a lesser

extent, cost of sales denominated in currencies other than the U.S. dollar. HP’s foreign currency cash

flow hedges mature generally within six months. However, certain leasing revenue-related forward

contracts extend for the duration of the lease term, which can be up to five years. For derivative

instruments that are designated and qualify as cash flow hedges, HP initially records the effective

portions of the gain or loss on the derivative instrument in accumulated other comprehensive loss as a

separate component of stockholders’ equity and subsequently reclassifies these amounts into earnings in

the period during which the hedged transaction is recognized in earnings. HP reports the effective

portion of cash flow hedges in the same financial statement line item as the changes in value of the

hedged item. As of October 31, 2005, amounts related to derivatives qualifying as cash flow hedges

amounted to a reduction of accumulated other comprehensive loss of $46 million, net of tax, of which

$44 million was expected to be reclassified to earnings in the next 12 months along with the earnings

effects of the related forecasted transactions. In addition, during fiscal 2005 and 2004 HP did not

discontinue any cash flow hedges for which it was probable that a forecasted transaction would not

occur.

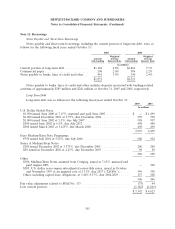

Net Investment Hedges

HP uses forward contracts designated as net investment hedges to hedge net investments in certain

foreign subsidiaries whose functional currency is the local currency. For derivative instruments that are

designated as net investment hedges, HP records the effective portion of the gain or loss on the

96