HP 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

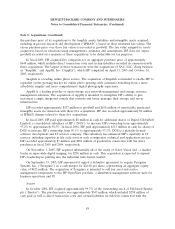

Note 5: Acquisitions (Continued)

the purchase price of its acquisitions to the tangible assets, liabilities and intangible assets acquired,

including in-process research and development (‘‘IPR&D’’), based on their estimated fair values. The

excess purchase price over those fair values is recorded as goodwill. The fair value assigned to assets

acquired is based on valuations using management’s estimates and assumptions. HP does not expect

goodwill recorded on a majority of these acquisitions to be deductible for tax purposes.

In fiscal 2005, HP acquired five companies for an aggregate purchase price of approximately

$648 million, which includes direct transaction costs and certain liabilities recorded in connection with

these acquisitions. The largest of these transactions were the acquisitions of SAC, LLC, doing business

as ‘‘Snapfish,’’ and AppIQ, Inc. (‘‘AppIQ’’), which HP completed on April 15, 2005 and October 24,

2005, respectively.

Snapfish is a leading online photo service. The acquisition of Snapfish is intended to enable HP to

capitalize on the growing market for online photo printing, with customers benefiting from a more

affordable, simpler and more comprehensive digital photography experience.

AppIQ is a leading provider of open storage area network management and storage resource

management solutions. The acquisition of AppIQ is intended to strengthen HP’s ability to give

customers a single integrated console that controls and better manages their storage and server

infrastructure.

HP recorded approximately $537 million of goodwill and $108 million of amortizable purchased

intangible assets in connection with these five acquisitions. HP also recorded approximately $2 million

of IPR&D charges related to these five acquisitions.

In fiscal 2005, HP paid approximately $8 million in cash for additional shares of Digital GlobalSoft

Limited, a consolidated subsidiary of HP (‘‘DGS’’), to increase HP’s ownership from approximately

97.2% to approximately 98.5%. In fiscal 2004, HP paid approximately $315 million in cash for shares of

DGS to increase HP’s ownership from 50.1% to approximately 97.2%. DGS is a globally-focused

software development and IT services company. This subsidiary has enhanced HP’s capability in IT

services, including expertise in life cycle services such as migration, technical and application services.

HP recorded approximately $7 million and $281 million of goodwill in connection with the share

purchases in fiscal 2005 and 2004, respectively.

On November 1, 2005, HP acquired substantially all of the assets of Scitex Vision Ltd., a market

leader in super-wide digital imaging, for $230 million in cash. This acquisition is expected to expand

HP’s leadership in printing into the industrial wide-format market.

On September 19, 2005, HP announced it signed a definitive agreement to acquire Peregrine

Systems, Inc. (‘‘Peregrine’’) in a cash merger for $26.08 per share, representing an aggregate equity

value of $425 million. The acquisition of Peregrine is intended to add key asset and service

management components to the HP OpenView portfolio, a distributed management software suite for

business operations and IT.

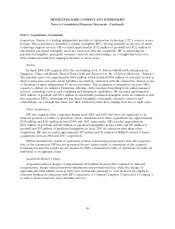

Synstar

In October 2004, HP acquired approximately 99.7% of the outstanding stock of UK-based Synstar

plc (‘‘Synstar’’). The purchase price was approximately $343 million, which included $298 million of

cash paid as well as direct transaction costs and certain liabilities recorded in connection with the

88