HP 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

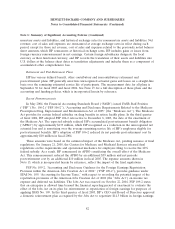

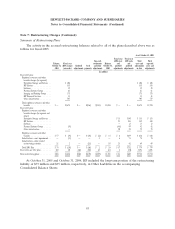

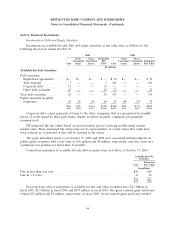

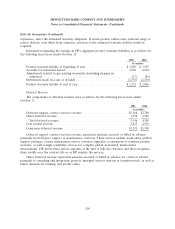

Note 7: Restructuring Charges (Continued)

Fiscal 2005 Workforce Rebalancing

In addition to the restructuring activities described above, HP incurred approximately $236 million

in workforce rebalancing charges resulting from actions taken by certain business segments for

severance and related costs. Workforce rebalancing costs are included in the segment results. HP

recorded these costs during the six months ended April 30, 2005. As a result of these workforce

rebalancing actions, approximately 3,000 employees left HP as of October 31, 2005. Of the workforce

rebalancing charges, HP had paid $209 million as of October 31, 2005, and expects to pay the

remainder by the end of fiscal 2006.

Fiscal 2003 Restructuring Plans

During fiscal 2003, HP’s management approved and implemented plans to restructure certain of its

operations with the intent of better managing HP’s cost structure and aligning certain of its operations

more effectively with then current business conditions. The initial charge for these actions totaled

$752 million and included $639 million related to severance and other employee benefits for workforce

reductions, $42 million for vacating duplicative facilities (leased or owned) and contract termination

costs, and asset impairments of $71 million associated with the identification of duplicative assets and

facilities (leased or owned) related to the acquisition of Compaq.

HP included original estimates of 9,000 employees across many regions and job classes in the fiscal

2003 workforce reduction plans. Subsequent to the initial estimate, HP reduced the number of

employees to be terminated under the fiscal 2003 restructuring plans by 600 employees. As of

October 31, 2005, substantially all of the 8,400 employees had been terminated, had been placed in

workforce reduction programs or had retired. HP expects to pay out the majority of the remaining

severance and other employee benefits during fiscal 2006. HP anticipates the remaining costs of

vacating duplicative facilities to be substantially settled by the end of fiscal 2006.

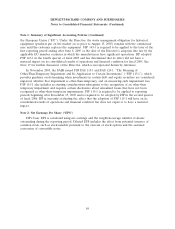

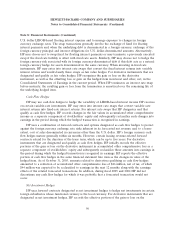

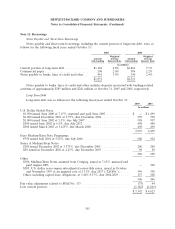

Fiscal 2002 and 2001 Restructuring Plans

On May 3, 2002, HP acquired Compaq. At that time, both HP and Compaq had restructuring

liabilities for 2001 restructuring plans, of which $3 million and $52 million, respectively, remained at

October 31, 2005. Restructuring plans established in 2002 in connection with the Compaq acquisition

resulted in additional restructuring liabilities aggregating $2.8 billion. Of this amount, HP recorded an

aggregate $1.9 billion as restructuring charges during fiscal 2002, 2003 and 2004, while HP recorded

$960 million as of the acquisition date as part of the Compaq purchase price allocation. At October 31,

2005, the remaining restructuring liabilities for the HP and Compaq-related 2002 restructuring plans

were $8 million and $61 million, respectively. The 2001 and 2002 restructuring plans are substantially

complete, although HP records minor revisions to previous estimates as necessary. During fiscal 2005,

HP recorded adjustments of $20 million. These adjustments pertained to severance and other related

restructuring true-ups to the fiscal 2002 restructuring plans. In addition, an adjustment for fiscal 2005

includes a $44 million reduction of goodwill for the 2001 and 2002 Compaq-related restructuring plans,

of which $25 million is related to asset true-ups of previously estimated fair value adjustments on asset

disposal. The aggregate $124 million restructuring liability on these plans as of October 31, 2005 related

primarily to facility lease obligations. HP expects to pay out these obligations over the life of the

related obligations, which extend to the end of fiscal 2010.

92