HP 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

servers and storage gross margins comparisons were favorably impacted by execution issues and

business challenges that unfavorably impacted the performance of industry standard servers and storage

in the second half of fiscal 2004.

ESS net revenue increased 4% in fiscal 2004 from fiscal 2003. Revenue on a constant currency

basis decreased 2%. The favorable currency impact was due primarily to the weakening of the dollar

against the euro. In fiscal 2004, ESS performance was hurt in the third fiscal quarter by execution

issues, namely a systems migration in the U.S., channel management issues in EMEA and weakness in

storage. However, ESS net revenue growth was helped by industry standard servers’ unit growth of

22%, which translated to a 12% net revenue increase from fiscal 2003 in that category.

Net revenue in business critical systems declined by 2% in fiscal 2004 as compared to fiscal 2003,

reflecting the ongoing decline of the AlphaServer product line. RISC and Integrity servers experienced

revenue growth. We introduced mid-range and high-end Itanium-based products widely in fiscal 2004,

and sales continued to increase during the year, with Integrity servers representing 13% of business

critical systems (including NonStop servers) in the fourth fiscal quarter. HP-UX server revenue

increased 2% from fiscal 2003, offset by declines in Alpha as we transitioned customers to non-Alpha

products. NonStop server net revenue declined 1% from the prior year, reflecting a maturing installed

base.

Storage net revenue declined 7% in fiscal 2004, with declines in both the overall array and tape

businesses. Net revenue declines from fiscal 2003 were due primarily to our exposure to the declining

tape market, aggressive pricing, inadequate storage sales specialist coverage and some product updates

that occurred late in fiscal 2004. Growth in storage software and network attached storage offset

partially the revenue decline in the primary product groups.

ESS earnings from operations as a percentage of net revenue in fiscal 2004 improved by

0.1 percentage points, reflecting a 3.6 percentage point decrease in operating expenses in relation to

revenue resulting from effective cost management and increased volume in the industry standard server

business. A decline in gross margin of 3.5 percentage points offset the decline in operating expenses

and volume growth. The gross margin decline was the result of competitive pressures impacting both

the industry standard servers group and the storage business, along with a mix shift to lower margin

products within the business critical servers group and more generally, the continued mix shift towards

industry standard servers within the segment. In fiscal 2004, the business continued to focus on

increasing direct sales, improving option attach rates and reducing warranty costs in order to optimize

gross margins. Additionally, the execution issues of the third quarter that led to an operating loss in the

quarter negatively impacted full year performance.

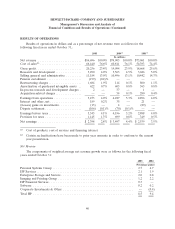

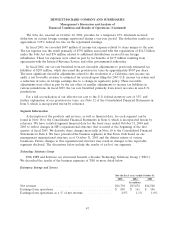

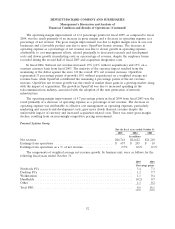

HP Services

For the fiscal years ended October 31

2005 2004 2003

In millions

Net revenue ......................................... $15,536 $13,848 $12,402

Earnings from operations ............................... $ 1,151 $ 1,282 $ 1,369

Earnings from operations as a % of net revenue .............. 7.4% 9.3% 11.0%

49