HP 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

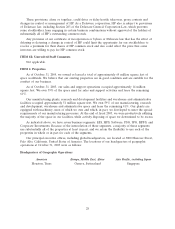

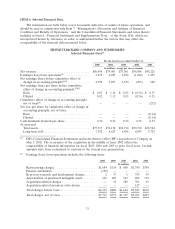

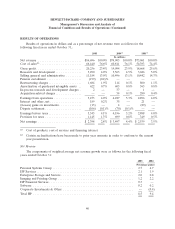

ITEM 6. Selected Financial Data.

The information set forth below is not necessarily indicative of results of future operations, and

should be read in conjunction with Item 7, ‘‘Management’s Discussion and Analysis of Financial

Condition and Results of Operations,’’ and the Consolidated Financial Statements and notes thereto

included in Item 8, ‘‘Financial Statements and Supplementary Data,’’ of this Form 10-K, which are

incorporated herein by reference, in order to understand further the factors that may affect the

comparability of the financial data presented below.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Selected Financial Data(1)

For the fiscal years ended October 31,

2005 2004 2003 2002 2001

In millions, except per share amounts

Net revenue .............................. $86,696 $79,905 $73,061 $56,588 $45,226

Earnings (loss) from operations(2) .............. 3,473 4,227 2,896 (1,012) 1,439

Net earnings (loss) before cumulative effect of

change in accounting principle(2)(3) ............ 2,398 3,497 2,539 (903) 680

Net earnings (loss) per share before cumulative

effect of change in accounting principle:(2)(3)

Basic ................................. $ 0.83 $ 1.16 $ 0.83 $ (0.36) $ 0.35

Diluted ................................ 0.82 1.15 0.83 (0.36) 0.35

Cumulative effect of change in accounting principle,

net of taxes(4) ...........................————(272)

Net loss per share for cumulative effect of change in

accounting principle, net of taxes:

Basic .................................————(0.14)

Diluted ................................————(0.14)

Cash dividends declared per share .............. 0.32 0.32 0.32 0.32 0.32

At year-end:

Total assets ............................. $77,317 $76,138 $74,716 $70,710 $32,584

Long-term debt .......................... 3,392 4,623 6,494 6,035 3,729

(1) HP’s Consolidated Financial Statements and notes thereto reflect HP’s acquisition of Compaq on

May 3, 2002. The occurrence of the acquisition in the middle of fiscal 2002 affects the

comparability of financial information for fiscal 2005, 2004 and 2003 to prior fiscal years. Certain

amounts have been reclassified to conform to the current year presentation.

(2) Earnings (loss) from operations includes the following items:

2005 2004 2003 2002 2001

In millions

Restructuring charges ....................... $1,684 $114 $ 800 $1,780 $384

Pension curtailment ........................ (199) — — — —

In-process research and development charges ...... 2 37 1 793 35

Amortization of purchased intangible assets ....... 622 603 563 402 174

Acquisition-related charges ................... — 54 280 701 25

Acquisition-related inventory write-downs ........ — — — 147 —

Total charges before taxes .................... $2,109 $808 $1,644 $3,823 $618

Total charges, net of taxes .................... $1,512 $571 $1,127 $3,031 $493

31