HP 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

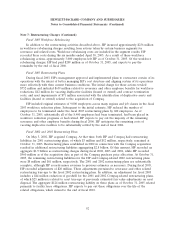

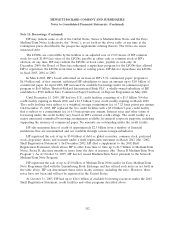

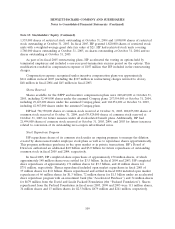

Note 11: Borrowings

Notes Payable and Short-Term Borrowings

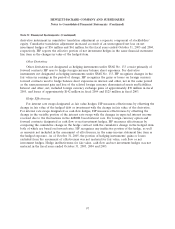

Notes payable and short-term borrowings, including the current portion of long-term debt, were as

follows for the following fiscal years ended October 31:

2005 2004

Weighted Weighted

Amount Average Amount Average

Outstanding Interest Rate Outstanding Interest Rate

In millions

Current portion of long-term debt ............. $1,182 4.8% $1,861 7.1%

Commercial paper ......................... 208 2.6% 306 2.2%

Notes payable to banks, lines of credit and other . . 441 3.9% 344 2.4%

$1,831 $2,511

Notes payable to banks, lines of credit and other includes deposits associated with banking-related

activities of approximately $385 million and $241 million at October 31, 2005 and 2004, respectively.

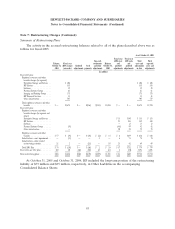

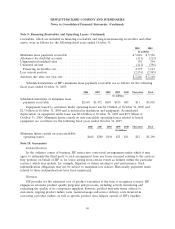

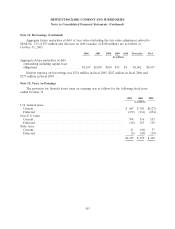

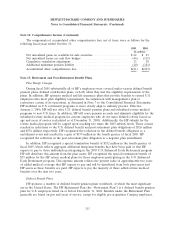

Long-Term Debt

Long-term debt was as follows for the following fiscal years ended October 31:

2005 2004

In millions

U.S. Dollar Global Notes

$1,500 issued June 2000 at 7.15%, matured and paid June 2005 ............. $ — $1,499

$1,000 issued December 2001 at 5.75%, due December 2006 ................ 999 998

$1,000 issued June 2002 at 5.5%, due July 2007 ......................... 998 997

$500 issued June 2002 at 6.5%, due July 2012 .......................... 498 498

$500 issued March 2003 at 3.625%, due March 2008 ...................... 498 498

2,993 4,490

Euro Medium-Term Note Programme

A750 issued July 2001 at 5.25%, due July 2006 .......................... 900 954

Series A Medium-Term Notes

$200 issued December 2002 at 3.375%, due December 2005 ................ 200 200

$50 issued in December 2002 at 4.25%, due December 2007 ................ 50 50

250 250

Other

$300, Medium-Term Notes assumed from Compaq, issued at 7.65%, matured and

paid August 2005 ............................................. — 300

$505, U.S. dollar zero-coupon subordinated convertible notes, issued in October

and November 1997 at an imputed rate of 3.13%, due 2017 (‘‘LYONs’’) ...... 349 338

Other, including capital lease obligations, at 3.46%-9.17%, due 2004-2029 ...... 157 108

506 446

Fair value adjustment related to SFAS No. 133 ........................... (75) 44

Less current portion ............................................... (1,182) (1,861)

$ 3,392 $ 4,623

101