HP 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

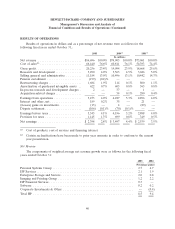

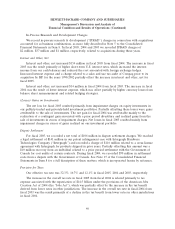

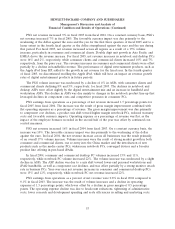

The following table summarizes the major restructuring activities in aggregate and during each of

fiscal years 2005, 2004 and 2003.

For the fiscal years ended October 31

Aggregate

Total 2005 2004 2003

In millions, except employee data

Restructuring headcount reductions:

2005 plans—estimate ................................. 16,750 16,750

2005 plans—exits ................................... (6,150) (6,150)

Remaining to exit ................................. 10,600 10,600

2003 plans—estimate and estimate revisions .................. 8,400 (200) (400) 9,000

2003 plans—exits ................................... (8,400) (100) (1,300) (7,000)

Remaining to exit ................................. —

Restructuring program charges:

2005 restructuring charges:

Severance and other benefits .......................... $1,674 $ 1,674

Asset impairments ................................. — —

Other infrastructure costs ............................ — —

Sub-total ..................................... 1,674 1,674

2003 cost structure realignment charges:

Severance and other benefits .......................... $ 636 $ (9) $ 6 $ 639

Asset impairments ................................. 74 (3) 6 71

Other infrastructure costs ............................ 69 2 25 42

Sub-total ..................................... 779 (10) 37 752

2002 and 2001 restructuring charges ....................... $ 145 $ 20 $ 77 $ 48

Total restructuring charges .......................... $2,598 $ 1,684 $ 114 $ 800

Goodwill adjustments relating to restructuring plans ............. $ (237) $ (44) $ (73) $ (120)

Fiscal 2005 Workforce Rebalancing

In addition to the restructuring activities described above, in fiscal 2005 we incurred approximately

$236 million in workforce rebalancing charges resulting from actions taken by certain business segments

for severance and related costs. Workforce rebalancing costs are included in the segment results. We

recorded these costs during the six months ended April 30, 2005. As a result of these workforce

rebalancing actions, approximately 3,000 employees left HP as of October 31, 2005. Of the workforce

rebalancing charges, we had paid $209 million as of October 31, 2005, and we expect to pay the

remainder by the end of fiscal 2006.

Amortization of Purchased Intangible Assets

The increase in amortization expense for fiscal 2005 as compared to fiscal 2004 was due primarily

to the amortization of intangible assets related to the acquisitions of Triaton in April 2004, Synstar PLC

(‘‘Synstar’’) in October 2004 and SAC, LLC (‘‘Snapfish’’) in April 2005, as well as accelerated

amortization related to the early termination of certain acquired customer contracts. The increase in

amortization expense in fiscal 2004 as compared to fiscal 2003 was due primarily to the amortization of

intangible assets related to the acquisition of Triaton in April 2004.

45