HP 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 6: Goodwill and Purchased Intangible Assets

Goodwill

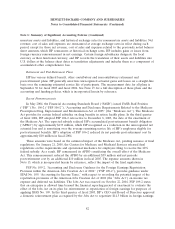

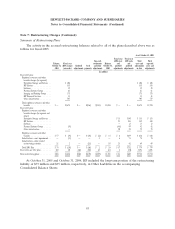

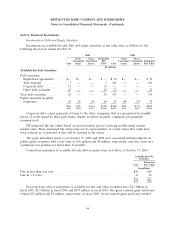

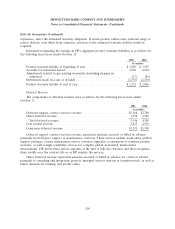

Goodwill allocated to HP’s business segments as of October 31, 2004 and 2005 and changes in the

carrying amount of goodwill during the fiscal year ended October 31, 2005 are as follows:

Enterprise Imaging

Storage Personal and HP

HP and Systems Printing Financial

Services Servers Software Group Group Services Total

In millions

Balance at October 31, 2004 ............ $6,270 $4,810 $759 $2,327 $1,510 $152 $15,828

Goodwill acquired during the period ...... 39 251 — — 254 — 544

Goodwill adjustments ................. 51 16 (11) 8 5 — 69

Balance at October 31, 2005 ............ $6,360 $5,077 $748 $2,335 $1,769 $152 $16,441

The goodwill adjustments for acquisitions made prior to fiscal 2005, as shown above, relate

primarily to revisions of acquisition-related tax estimates that resulted in net additions to goodwill,

which were offset partially by the reduction of a restructuring liability and asset impairments associated

with fiscal 2002 and 2001 restructuring plans of Compaq prior to its acquisition by HP. These

reductions resulted from adjusting original estimates to actual costs incurred at various locations

throughout the world.

Based on the results of its annual impairment tests, HP determined that no impairment of

goodwill existed as of August 1, 2005 or August 1, 2004. However, future goodwill impairment tests

could result in a charge to earnings. HP will continue to evaluate goodwill on an annual basis as of the

beginning of its fourth fiscal quarter and whenever events and changes in circumstances indicate that

there may be a potential impairment.

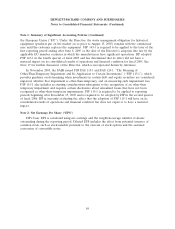

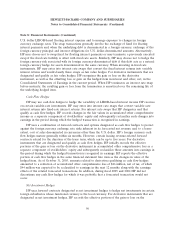

Purchased Intangible Assets

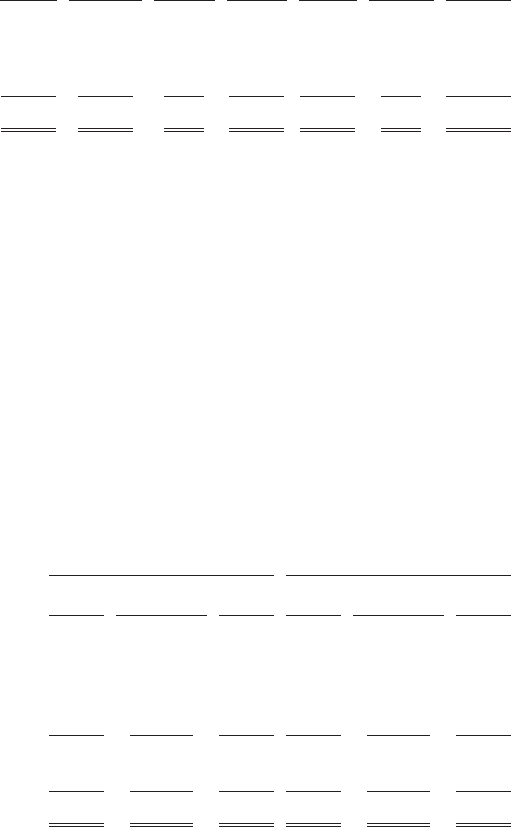

HP’s purchased intangible assets associated with completed acquisitions for each of the following

fiscal years ended October 31 are composed of:

2005 2004

Accumulated Accumulated

Gross Amortization Net Gross Amortization Net

In millions

Customer contracts, customer lists and

distribution agreements .................. $2,401 $ (972) $1,429 $2,340 $ (637) $1,703

Developed and core technology and patents .... 1,750 (1,040) 710 1,704 (775) 929

Product trademarks ...................... 94 (66) 28 93 (44) 49

Total amortizable purchased intangible assets . . . 4,245 (2,078) 2,167 4,137 (1,456) 2,681

Compaq trade name ..................... 1,422 — 1,422 1,422 — 1,422

Total purchased intangible assets ............ $5,667 $(2,078) $3,589 $5,559 $(1,456) $4,103

Amortization expense related to finite-lived purchased intangible assets was approximately

$622 million in fiscal 2005, $603 million in fiscal 2004 and $563 million in fiscal 2003.

90