HP 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

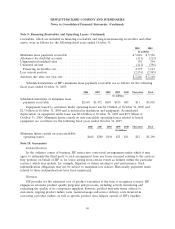

Note 5: Acquisitions (Continued)

transaction. Synstar is a leading independent provider of information technology (‘‘IT’’) services across

Europe. This acquisition is intended to further strengthen HP’s offering primarily in the area of multi-

technology support services. HP recorded approximately $172 million of goodwill and $122 million of

amortizable purchased intangible assets in connection with this acquisition. HP is amortizing the

purchased intangibles, principally customer contracts and relationships, on a straight-line basis over

their estimated useful lives ranging from three to seven years.

Triaton

In April 2004, HP acquired all of the outstanding stock of Triaton GmbH (with subsidiaries in

Singapore, China and Brazil), Triaton France SAS and Triaton N.A, Inc. (USA) (collectively, ‘‘Triaton’’).

The purchase price was approximately $464 million, which included $306 million of cash paid as well as

direct transaction costs and certain liabilities recorded in connection with the transaction. Triaton is one

of Germany’s largest independent IT service providers. This acquisition is intended to increase HP’s

capacity to deliver its Adaptive Enterprise offerings, with customers benefiting from added managed

services, technology services and consulting and integration capabilities. HP recorded approximately

$285 million of goodwill and $179 million of amortizable purchased intangible assets in connection with

this acquisition. HP is amortizing the purchased intangibles, principally customer contracts and

relationships, on a straight-line basis over their estimated useful lives ranging from two to eight years.

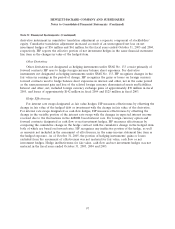

Other Acquisitions

HP also acquired other companies during fiscal 2004 and 2003 that were not significant to its

financial position or results of operations. Total consideration for these acquisitions was approximately

$250 million and $185 million in fiscal 2004 and 2003, respectively. HP recorded approximately

$181 million of goodwill and $49 million of purchased intangibles in fiscal 2004 and $91 million of

goodwill and $53 million of purchased intangibles in fiscal 2003 in connection with these other

acquisitions. HP also recorded approximately $37 million and $1 million of IPR&D related to these

acquisitions in fiscal 2004 and 2003, respectively.

HP has included the results of operations of these transactions prospectively from the respective

date of the transaction. HP has not presented the pro forma results of operations of the acquired

businesses because the results are not material to HP’s consolidated results of operations on either an

individual or an aggregate basis.

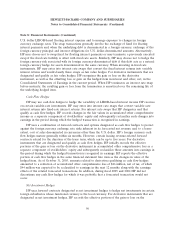

Acquisition-Related Charges

Acquisition-related charges of approximately $54 million in fiscal 2004 consisted of deferred

compensation, merger-related inventory adjustments and professional fees, while the charges of

approximately $280 million in fiscal 2003 were attributable primarily to costs incurred for employee

retention bonuses in connection with HP’s acquisition of Compaq Computer Corporation (‘‘Compaq’’)

as well as professional fees and consulting services.

89