HP 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

who do not receive credit for years of service prior to January 1, 2003. Effective December 31, 2005,

participants whose combination of age plus years of service is less than 62 will cease accruing benefits

under the Retirement Plan. For U.S employees hired or rehired on or after January 1, 2003, HP

sponsors the Hewlett-Packard Company Cash Account Pension Plan (the ‘‘Cash Account Pension

Plan’’), under which benefits accrue pursuant to a cash accumulation account formula based upon a

percentage of pay plus interest. Effective December 31, 2005, the Cash Account Pension Plan will be

closed to new participants, and participants whose combination of age plus years of service is less than

62 will cease accruing benefits.

Effective November 30, 2005, HP merged the Cash Account Pension Plan into the Retirement

Plan; the merged plan is treated as one plan for certain legal and financial purposes, including funding

requirements. The merger has no impact on the separate benefit structures of the plans.

HP reduces the benefit payable to a U.S. employee under the Retirement Plan for service before

1993, if any, by any amounts due to the employee under HP’s frozen defined contribution Deferred

Profit-Sharing Plan (‘‘the DPSP’’). HP closed the DPSP to new participants in 1993. The DPSP plan

obligations are equal to the plan assets and are recognized as an offset to the Retirement Plan when

HP calculates its defined benefit pension cost and obligations. The fair value of plan assets and

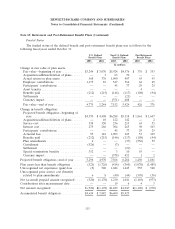

projected benefit obligations for the U.S. defined benefit plans combined with the DPSP as of the

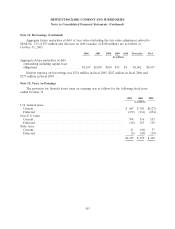

September 30 measurement date is as follows for the following fiscal years ended October 31:

2005 2004

Projected Projected

Plan Benefit Plan Benefit

Assets Obligation Assets Obligation

In millions

U.S. defined benefit plans ........................... $4,775 $5,296 $3,244 $4,970

DPSP .......................................... 1,295 1,295 1,197 1,197

Total ......................................... $6,070 $6,591 $4,441 $6,167

Post-Retirement Benefit Plans

Through fiscal 2005, substantially all of HP’s U.S. employees at December 31, 2002 could become

eligible for partially subsidized retiree medical benefits and retiree life insurance benefits under the

Pre-2003 HP Retiree Medical Program (the ‘‘Pre-2003 Program’’) and certain other retiree medical

programs. Plan participants in the Pre-2003 Program make contributions based on their choice of

medical option and length of service. U.S. employees hired or rehired on or after January 1, 2003 may

be eligible to participate in a post-retirement medical plan, the HP Retiree Medical Program but must

bear the full cost of their participation. Effective January 1, 2006, employees whose combination of age

and years of service is less than 62 no longer will be eligible for the subsidized Pre-2003 Program, but

instead will be eligible for the HP Retiree Medical Program. Employees no longer eligible for the

Pre-2003 Program, as well as employees hired on or after January 1, 2003, are eligible for certain

credits under the HP Retirement Medical Savings Account Plan (‘‘RMSA Plan’’) upon attaining age 45.

Upon retirement, former employees may use credits under the RMSA Plan for the reimbursement of

certain eligible medical expenses, including premiums required for participation in the HP Retiree

Medical Program.

112