HP 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

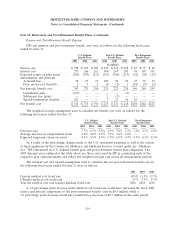

Note 15: Retirement and Post-Retirement Benefit Plans (Continued)

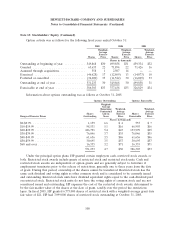

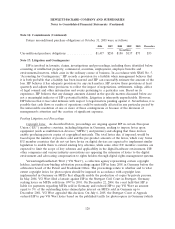

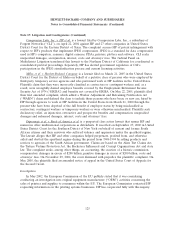

Defined benefit plans with accumulated benefit obligations exceeding the fair value of plan assets

were as follows:

Non-U.S.

U.S. Defined Defined

Benefit Plans Benefit Plans

2005 2004 2005 2004

In millions

Aggregate fair value of plan assets ............................ — $3,244 $311 $ 98

Aggregate accumulated benefit obligation ....................... $159 $3,882 $535 $271

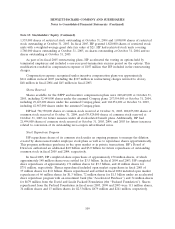

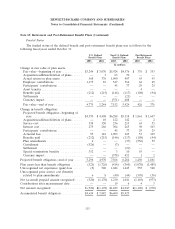

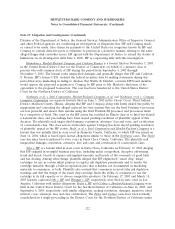

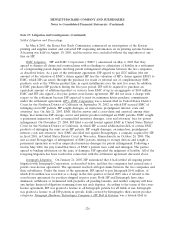

Plan Asset Allocations

HP’s weighted-average target and asset allocations at the September 30 measurement date were as

follows:

U. S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

2005 2005 2005

Plan Assets Plan Assets Plan Assets

Target Target Target

Asset Category Allocation 2005 2004 Allocation 2005 2004 Allocation 2005 2004

Public equity securities .... 61.3% 71.4% 63.5% 64.8% 68.4% 69.4%

Private equity securities .... 2.1% 2.5% — — 7.0% 6.7%

Real estate and other ..... 0.2% 0.3% 2.5% 2.6% 0.7% 0.8%

Equity-related investments . 74% 63.6% 74.2% 64% 66.0% 67.4% 76% 76.1% 76.9%

Public debt securities ...... 26% 22.6% 25.8% 36% 31.9% 31.5% 24% 23.6% 23.1%

Cash ................. 13.8% 0.0% 2.1% 1.1% 0.3% 0.0%

Total ............... 100% 100.0% 100.0% 100% 100.0% 100.0% 100% 100.0% 100.0%

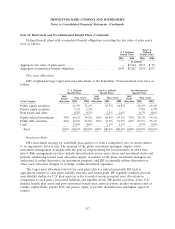

Investment Policy

HP’s investment strategy for worldwide plan assets is to seek a competitive rate of return relative

to an appropriate level of risk. The majority of the plans’ investment managers employ active

investment management strategies with the goal of outperforming the broad markets in which they

invest. Risk management practices include diversification across asset classes and investment styles and

periodic rebalancing toward asset allocation targets. A number of the plans’ investment managers are

authorized to utilize derivatives for investment purposes, and HP occasionally utilizes derivatives to

effect asset allocation changes or to hedge certain investment exposures.

The target asset allocation selected for each plan reflects a risk/return profile HP feels is

appropriate relative to each plan’s liability structure and return goals. HP regularly conducts periodic

asset-liability studies for U.S. plan assets in order to model various potential asset allocations in

comparison to each plan’s forecasted liabilities and liquidity needs. HP invests a portion of the U.S.

defined benefit plan assets and post-retirement benefit plan assets in private market securities such as

venture capital funds, private debt and private equity to provide diversification and higher expected

returns.

117