HP 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

HP’s credit risk is evaluated by three independent rating agencies based upon publicly available

information as well as information obtained in our ongoing discussions with them. Standard & Poor’s

Rating Services, Moody’s Investor Service and Fitch Ratings currently rate our senior unsecured long

term debt A-, A3 and A and our short-term debt A-1, Prime-1, and F1, respectively. We do not have

any rating downgrade triggers that would accelerate the maturity of a material amount of our debt.

However, a downgrade in our credit rating would increase the cost of borrowings under our credit

facilities. Also, a downgrade in our credit rating could limit or, in the case of a significant downgrade,

preclude our ability to issue commercial paper under our current programs. If we were so limited or

precluded from borrowing, we would seek alternative sources of funding, including the issuance of

notes under our existing shelf registration statement and our Euro Medium-Term Note Programme or

our credit facilities.

We have revolving trade receivables-based facilities permitting us to sell certain trade receivables

to third parties on a non-recourse basis. The aggregate maximum capacity under these programs was

approximately $1.2 billion as of October 31, 2005. The facility with the largest volume is one that is

subject to a maximum amount of 525 million euros, or approximately $630 million (the ‘‘Euro

Program’’). Trade receivables of approximately $7.9 billion were sold during fiscal 2005, including

approximately $5.4 billion under the Euro Program. Fees associated with these facilities do not

generally differ materially from the cash discounts offered to customers under other alternative prompt

payment programs. As of October 31, 2005, there was approximately $571 million available under these

programs, of which $357 million relates to the Euro Program.

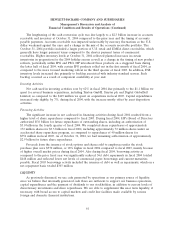

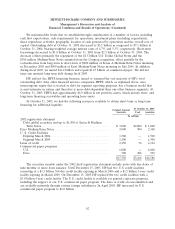

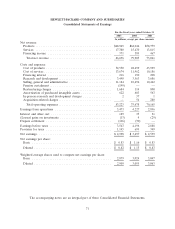

Contractual Obligations

The impact that our contractual obligations as of October 31, 2005 are expected to have on our

liquidity and cash flow in future periods is as follows:

Payments Due by Period

Less than More than

Total 1 Year 1-3 Years 3-5 Years 5 Years

In millions

Long-term debt, including capital lease obligations(1) . . $4,817 $1,167 $2,569 $ 19 $1,062

Operating lease obligations ................... 2,028 541 749 460 278

Purchase obligations(2) ...................... 2,092 1,417 430 212 33

Total ................................... $8,937 $3,125 $3,748 $691 $1,373

(1) Amounts represent the expected cash payments of our long-term debt and do not include any fair

value adjustments or discounts. Included in our long-term debt are approximately $39 million of

capital lease obligations that are secured by certain equipment.

(2) Purchase obligations include agreements to purchase goods or services that are enforceable and

legally binding on HP and that specify all significant terms, including fixed or minimum quantities

to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. Purchase obligations exclude agreements that are cancelable without penalty. These

purchase obligations are related principally to cost of sales, inventory and other items. Our

purchase obligation includes the settlement agreement with EMC Corporation (‘‘EMC’’) pursuant

to which HP agreed to pay $325 million (the net amount of the valuation of EMC’s claims against

HP less the valuation of HP’s claims against EMC) to EMC, which HP can satisfy through the

purchase for resale or internal use of complementary EMC products in equal installments of

$65 million over the next five years, of which the first installment was paid on August 29, 2005. As

63