HP 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 18: Segment Information (Continued)

•HP Financial Services supports and enhances HP’s global product and services solutions,

providing a broad range of value-added financial life cycle management services. HPFS enables

HP’s worldwide customers to acquire complete IT solutions, including hardware, software and

services. HPFS offers leasing, financing, utility programs, and asset recovery services, as well as

financial asset management services, for large global and enterprise customers. HPFS also

provides an array of specialized financial services to SMBs and educational and governmental

entities. HPFS offers innovative, customized and flexible alternatives to balance unique customer

cash flow, technology obsolescence and capacity needs.

•Corporate Investments is managed by the Office of Strategy and Technology and includes HP

Labs and certain business incubation projects. Revenue in this segment is attributable to the sale

of certain network infrastructure products that enhance computing and enterprise solutions, as

well as the licensing of specific HP technology to third parties.

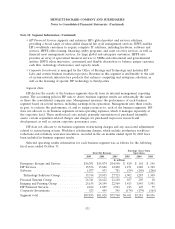

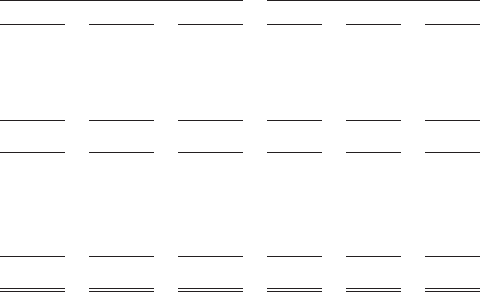

Segment Data

HP derives the results of the business segments directly from its internal management reporting

system. The accounting policies HP uses to derive business segment results are substantially the same

as those the consolidated company uses. Management measures the performance of each business

segment based on several metrics, including earnings from operations. Management uses these results,

in part, to evaluate the performance of, and to assign resources to, each of the business segments. HP

does not allocate to its business segments certain operating expenses, which it manages separately at

the corporate level. These unallocated costs include primarily amortization of purchased intangible

assets, certain acquisition-related charges and charges for purchased in-process research and

development, as well as certain corporate governance costs.

HP does not allocate to its business segments restructuring charges and any associated adjustments

related to restructuring actions. Workforce rebalancing charges, which include involuntary workforce

reductions and voluntary severance incentives, recorded in the six months ended April 30, 2005 have

been included in business segment results.

Selected operating results information for each business segment was as follows for the following

fiscal years ended October 31:

Earnings (Loss) from

Total Net Revenue Operations

2005 2004 2003 2005 2004 2003

In millions

Enterprise Storage and Servers ........... $16,701 $15,074 $14,540 $ 810 $ 161 $ 146

HP Services ......................... 15,536 13,848 12,402 1,151 1,282 1,369

Software ........................... 1,077 933 781 (59) (156) (206)

Technology Solutions Group ............ 33,314 29,855 27,723 1,902 1,287 1,309

Personal Systems Group ................ 26,741 24,622 21,210 657 205 18

Imaging and Printing Group ............. 25,155 24,199 22,569 3,413 3,843 3,591

HP Financial Services .................. 2,102 1,895 1,921 213 125 79

Corporate Investments ................. 523 449 345 (174) (179) (161)

Segment total ........................ $87,835 $81,020 $73,768 $6,011 $5,281 $4,836

131