GameStop 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-26

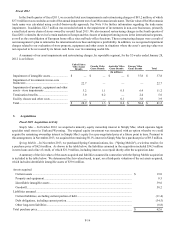

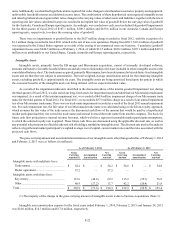

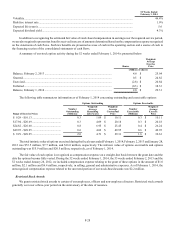

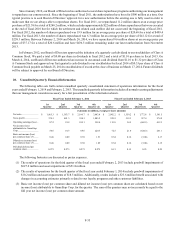

Differences between financial accounting principles and tax laws cause differences between the bases of certain assets and

liabilities for financial reporting purposes and tax purposes. The tax effects of these differences, to the extent they are temporary,

are recorded as deferred tax assets and liabilities and consisted of the following components (in millions):

February 1, 2014 February 2, 2013

Deferred tax asset:

Inventory obsolescence reserve.............................................................................. $ 18.8 $ 23.6

Deferred rents......................................................................................................... 12.4 13.6

Stock-based compensation ..................................................................................... 26.4 25.3

Net operating losses ............................................................................................... 16.8 15.0

Customer liabilities ................................................................................................ 31.9 38.1

Property and equipment ......................................................................................... 21.9 9.3

Foreign tax credit carryover ................................................................................... 1.4 —

Other....................................................................................................................... 9.4 11.1

Total deferred tax assets .................................................................................... 139.0 136.0

Valuation allowance........................................................................................... (13.3)(13.5)

Total deferred tax assets, net.............................................................................. 125.7 122.5

Deferred tax liabilities: .............................................................................................

Goodwill................................................................................................................. (80.3)(55.0)

Prepaid expenses .................................................................................................... (4.9)(6.6)

Acquired intangible assets...................................................................................... (20.6)(24.6)

Other....................................................................................................................... (5.6)(6.1)

Total deferred tax liabilities............................................................................... (111.4)(92.3)

Net ..................................................................................................................... $ 14.3 $ 30.2

Consolidated financial statements:

Deferred income tax assets — current...................................................................... $ 51.7 $ 61.7

Deferred income tax liabilities — noncurrent .......................................................... $ (37.4)$ (31.5)

In addition, the valuation allowance for deferred tax assets as of the fiscal year ended January 28, 2012 was $3.4 million.

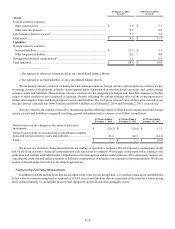

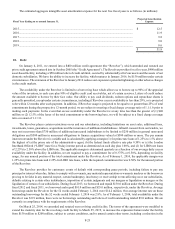

We file income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. The Internal Revenue

Service (“IRS”) is currently examining our U.S. income tax returns for the fiscal years ended February 2, 2013, January 28, 2012,

January 29, 2011, January 30, 2010 and January 31, 2009. We do not anticipate any adjustments that would result in a material

impact on our consolidated financial statements as a result of these audits. We are no longer subject to U.S. federal income tax

examination for years before and including the fiscal year ended February 2, 2008.

With respect to state and local jurisdictions and countries outside of the United States, we and our subsidiaries are typically

subject to examination for three to six years after the income tax returns have been filed. Although the outcome of tax audits is

always uncertain, we believe that adequate amounts of tax, interest and penalties have been provided for in the accompanying

consolidated financial statements for any adjustments that might be incurred due to state, local or foreign audits.

As of February 1, 2014, the gross amount of unrecognized tax benefits was approximately $20.6 million. If we were to

prevail on all uncertain tax positions, the net effect would be a benefit to our effective tax rate of approximately $18.5 million,

exclusive of any benefits related to interest and penalties.

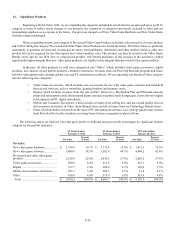

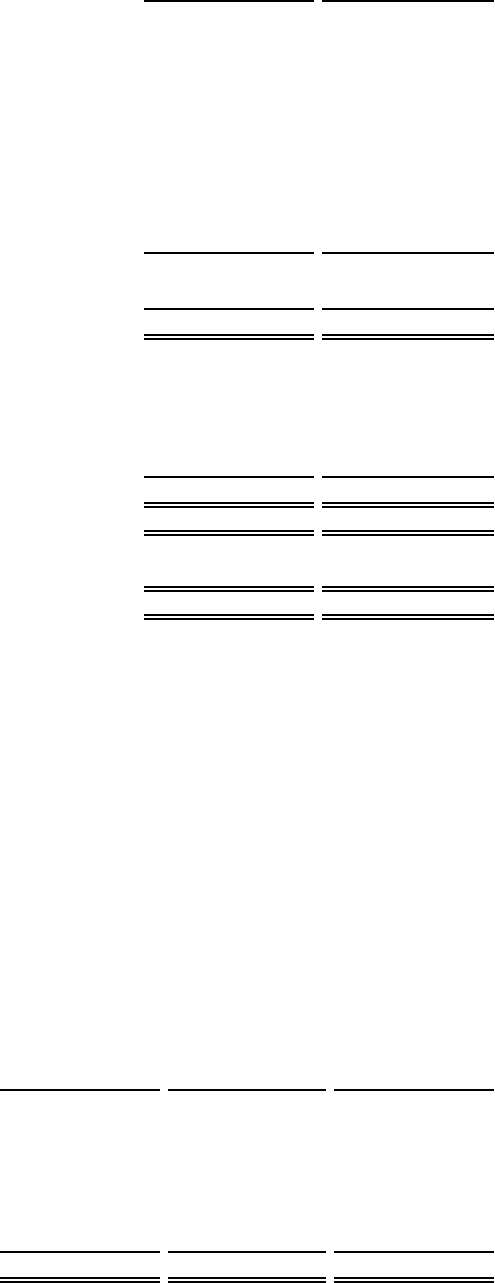

A reconciliation of the changes in the gross balances of unrecognized tax benefits follows (in millions):

February 1, 2014 February 2, 2013 January 28, 2012

Beginning balance of unrecognized tax benefits ......................... $ 28.7 $ 25.4 $ 24.9

Increases related to current period tax positions ....................... 0.5 0.5 —

Increases related to prior period tax positions........................... 16.6 6.3 9.9

Reductions as a result of a lapse of the applicable statute of

limitations .................................................................................. (1.9)(3.2)(2.0)

Reductions as a result of settlements with taxing authorities.... (23.3)(0.3)(7.4)

Ending balance of unrecognized tax benefits .............................. $ 20.6 $ 28.7 $ 25.4