GameStop 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

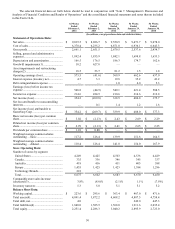

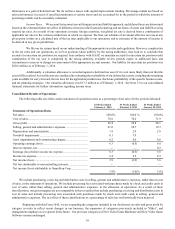

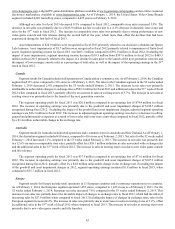

The following table sets forth gross profit (in millions) and gross profit percentages by significant product category for the

periods indicated:

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

52 Weeks Ended

January 28, 2012

Gross

Profit

Gross

Profit

Percent

Gross

Profit

Gross

Profit

Percent

Gross

Profit

Gross

Profit

Percent

Gross Profit:

New video game hardware............... $ 176.5 10.2% $ 101.7 7.6% $ 113.6 7.0%

New video game software................ 805.3 23.1% 786.3 21.9% 839.0 20.7%

Pre-owned and value video game

products............................................ 1,093.9 47.0% 1,170.1 48.1% 1,221.2 46.6%

Video game accessories ................... 220.5 39.3% 237.9 38.9% 251.9 38.1%

Digital .............................................. 149.2 68.5% 120.9 58.0% 66.5 46.5%

Mobile and consumer electronics .... 65.1 21.4% 41.3 20.6% 3.5 27.3%

Other ................................................ 150.6 36.1% 193.3 37.2% 183.8 40.5%

Total ................................................. $ 2,661.1 29.4% $ 2,651.5 29.8% $ 2,679.5 28.1%

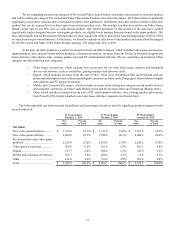

Fiscal 2013 Compared to Fiscal 2012

Net sales increased $152.8 million, or 1.7%, to $9,039.5 million in the 52 weeks of fiscal 2013 from $8,886.7 million in the

53 weeks of fiscal 2012. Sales for the 53rd week included in fiscal 2012 were $112.2 million. The increase in net sales during fiscal

2013 was primarily attributable to an increase in comparable store sales of 3.8% compared to fiscal 2012. Additionally, sales

included $62.8 million from the new Technology Brands segment. These increases were partially offset by a decline in domestic

sales of $185.9 million due to a 4.1% decline in domestic store count, changes in foreign exchange rates, which had the effect of

decreasing sales by $23.3 million when compared to the 53 weeks of fiscal 2012, and sales from the 53rd week in fiscal 2012. The

increase in comparable store sales was primarily due to strong sales performance during the second half of fiscal 2013. Refer to

the note to the Selected Financial Data table in "Item 6 — Selected Financial Data" for a discussion of the calculation of comparable

store sales.

New video game hardware sales increased $396.6 million, or 29.7%, from fiscal 2012 to fiscal 2013, primarily attributable

to an increase in hardware unit sell-through due to the launches of the Microsoft Xbox One and the Sony PlayStation 4 in November

2013. These increases were partially offset by declines in sales of previous generation hardware. New video game software sales

decreased $101.5 million, or 2.8%, from fiscal 2012 to fiscal 2013, primarily due to fewer new titles that were released during

fiscal 2013 when compared to fiscal 2012 and by the additional sales for the 53rd week in fiscal 2012. Pre-owned and value video

game product sales decreased $100.7 million, or 4.1%, from fiscal 2012 to fiscal 2013, primarily due to less store traffic during

the majority of fiscal 2013 because of lower video game demand due to the late stages of the previous console cycle, and also due

to sales for the 53rd week in fiscal 2012. Sales of video game accessories declined $51.2 million, or 8.4% from fiscal 2012 to fiscal

2013 due to the decline in demand for video game products in the late stages of the last console cycle, offset slightly by sales of

accessories for use with the recently launched consoles. Digital revenues increased $9.3 million, or 4.5%, from fiscal 2012 to

fiscal 2013 with growth limited due to the conversion of certain types of digital currency cards from a full retail price revenue

arrangement to a commission revenue model. Mobile and consumer electronics sales increased $103.4 million, or 51.6%, from

fiscal 2012 to fiscal 2013, due to increased growth of the mobile business within the Video Game Brand stores and due to the

Technology Brands stores acquired or started in the fourth quarter of fiscal 2013. Sales of other product categories decreased

$103.1 million, or 19.8%, from fiscal 2012 to fiscal 2013, primarily due to a decrease in sales of PC entertainment software due

to strong launches of PC titles during fiscal 2012.

As a percentage of net sales, new video game hardware sales increased and sales of new video game software, pre-owned

and value video game products and video game accessories decreased in fiscal 2013 compared to fiscal 2012. The change in the

mix of net sales was primarily due to the launch of the new hardware consoles in the fourth quarter of fiscal 2013.

Cost of sales increased by $143.2 million, or 2.3%, from $6,235.2 million in fiscal 2012 to $6,378.4 million in fiscal 2013

primarily as a result of the increase in net sales discussed above and the changes in gross profit discussed below, partially offset

by the cost of sales associated with the 53rd week in fiscal 2012.

Gross profit increased by $9.6 million, or 0.4%, from $2,651.5 million in fiscal 2012 to $2,661.1 million in fiscal 2013.

Gross profit as a percentage of net sales was 29.8% in fiscal 2012 and 29.4% in fiscal 2013. The gross profit percentage decreased

primarily due to an increase in sales of new video game hardware as a percentage of total net sales and the decrease in gross profit

as a percentage of sales on pre-owned and value video game products. This decrease was partially offset by a $33.6 million benefit