GameStop 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-27

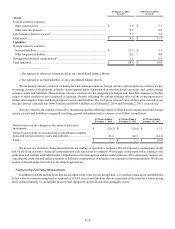

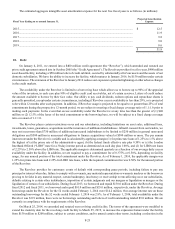

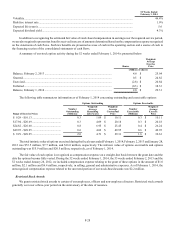

We recognize accrued interest and penalties related to unrecognized tax benefits in income tax expense. As of February 1,

2014, February 2, 2013 and January 28, 2012, we had approximately $6.1 million, $5.4 million and $3.2 million, respectively, in

interest and penalties related to unrecognized tax benefits accrued, of which approximately $1.6 million of expense, $2.3 million

of benefit and $2.7 million of benefit were recognized through income tax expense in the fiscal years ended February 1, 2014,

February 2, 2013 and January 28, 2012, respectively. If we were to prevail on all uncertain tax positions, the reversal of these

accruals would also be a benefit to our effective tax rate.

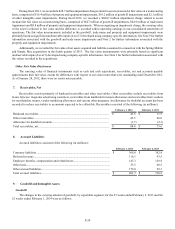

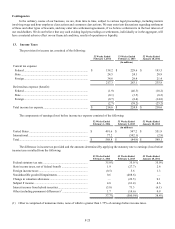

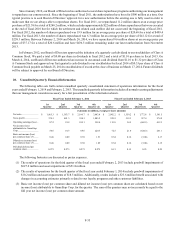

It is reasonably possible that the amount of the unrecognized benefit with respect to certain of our unrecognized tax positions

could significantly increase or decrease within the next 12 months as a result of settling ongoing audits. However, as audit outcomes

and the timing of audit resolutions are subject to significant uncertainty, and given the nature and complexity of the issues involved,

we are unable to reasonably estimate the possible amount of change in the unrecognized tax benefits, if any, that may occur within

the next 12 months as a result of ongoing examinations. Nevertheless, we believe we are adequately reserved for our uncertain

tax positions as of February 1, 2014.

Deferred income taxes have not been provided for on the approximately $542.1 million of undistributed earnings generated

by certain foreign subsidiaries as of February 1, 2014 because we intend to permanently reinvest such earnings outside the United

States. We do not currently require, nor do we have plans for, the repatriation of retained earnings from these subsidiaries. However,

in the future, if we determine it is necessary to repatriate these funds, or we sell or liquidate any of these subsidiaries, we may be

required to provide for income taxes on the repatriation. We may also be required to withhold foreign taxes depending on the

foreign jurisdiction from which the funds are repatriated. The effective rate of tax on such repatriations may materially differ from

the federal statutory tax rate, thereby having a material impact on tax expense in the year of repatriation; however, we cannot

reasonably estimate the amount of such a tax event.

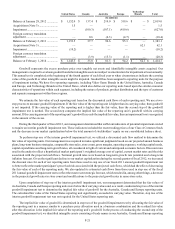

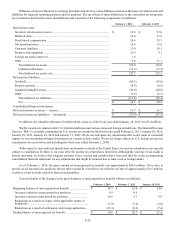

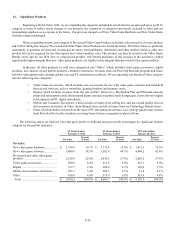

14. Stock Incentive Plan

Effective June 2013, our stockholders voted to adopt the Amended and Restated 2011 Incentive Plan (the “Amended 2011

Incentive Plan”) to provide for issuance under the 2011 Incentive Plan of our Class A Common Stock. The Amended 2011 Incentive

Plan provides a maximum aggregate amount of 9.25 million shares of Class A Common Stock with respect to which options may

be granted and provides for a grant of cash, granting of incentive stock options, non-qualified stock options, stock appreciation

rights, performance awards, restricted stock and other share-based awards, which may include, without limitation, restrictions on

the right to vote such shares and restrictions on the right to receive dividends on such shares. The options to purchase Class A

common shares are issued at fair market value of the underlying shares on the date of grant. In general, the options vest and become

exercisable in equal annual installments over a three-year period, commencing one year after the grant date, and expire ten years

from the grant date. Shares issued upon exercise of options are newly issued shares. Options and restricted shares granted after

June 21, 2011 are issued under the 2011 Incentive Plan.

Effective June 2009, our stockholders voted to amend the Third Amended and Restated 2001 Incentive Plan (the “2001

Incentive Plan”) to provide for issuance under the 2001 Incentive Plan of our Class A Common Stock. The 2001 Incentive Plan

provided a maximum aggregate amount of 46.5 million shares of Class A Common Stock with respect to which options may have

been granted and provided for the granting of incentive stock options, non-qualified stock options, and restricted stock, which

may have included, without limitation, restrictions on the right to vote such shares and restrictions on the right to receive dividends

on such shares. The options to purchase Class A common shares were issued at fair market value of the underlying shares on the

date of grant. In general, the options vested and became exercisable in equal annual installments over a three-year period,

commencing one year after the grant date, and expired ten years from the grant date. Shares issued upon exercise of options are

newly issued shares. Options and restricted shares granted on or before June 21, 2011 were issued under the 2001 Incentive Plan.

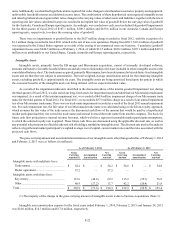

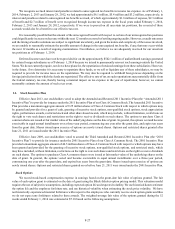

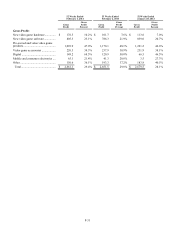

Stock Options

We record stock-based compensation expense in earnings based on the grant-date fair value of options granted. The fair

value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model. This valuation model

requires the use of subjective assumptions, including expected option life and expected volatility. We use historical data to estimate

the option life and the employee forfeiture rate, and use historical volatility when estimating the stock price volatility. We have

not historically experienced material forfeitures with respect to the employees who currently receive stock option grants and thus

we do not expect any forfeitures related to these awards. The weighted-average fair value of the options granted during the 52

weeks ended February 1, 2014 was estimated at $7.10 based on the following assumptions: