GameStop 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

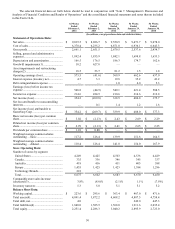

31

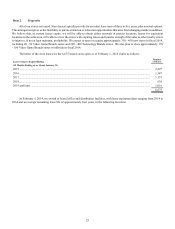

(1) Results for fiscal 2013 include a goodwill impairment charge of $10.2 million related to our decision to abandon our

investment in Spawn Labs. Results for fiscal 2012 include charges related to goodwill impairments of $627.0 million

resulting from our interim goodwill impairment tests performed during the third quarter of fiscal 2012. See Note 9 to our

consolidated financial statements for further information regarding our goodwill impairment charges.

(2) Results for fiscal 2013 include impairments of $18.5 million, of which $7.4 million and $2.1 million were related to certain

technology assets and other intangible assets, respectively, as a result of our decision to abandon our investment in Spawn

Labs and the remaining $9.0 million was related to property and equipment impairments resulting from our evaluation of

store property, equipment and other assets. Results for fiscal 2012 include charges related to asset impairments of

$53.7 million, of which $44.9 million relates to the impairment of the Micromania trade name and $8.8 million relates to

other impairment charges from the evaluations of store property, equipment and other assets. Results for fiscal 2011 include

charges related to asset impairments and restructuring charges of $81.2 million, of which $37.8 million relates to the

impairment of the Micromania trade name, $22.7 million relates to the impairment of investments in non-core businesses

and $20.7 million relates to other impairments, termination benefits and facility closure costs. For fiscal years 2009 and

2010, results include impairment charges resulting from our evaluation of store property, equipment and other assets.

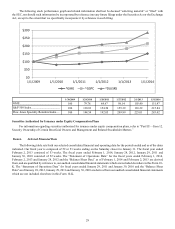

(3) Comparable store sales is a measure commonly used in the retail industry and indicates store performance by measuring

the growth in sales for certain stores for a particular period over the corresponding period in the prior year. Our comparable

store sales are comprised of sales from stores operating for at least 12 full months as well as sales related to our Web sites

and sales we earn from sales of pre-owned merchandise to wholesalers or dealers. Comparable store sales for our

international operating segments exclude the effect of changes in foreign currency exchange rates. The calculation of

comparable store sales for the 52 weeks ended February 1, 2014 compares the 52 weeks for the period ended February 1,

2014 to the most closely comparable weeks for the prior year period. The method of calculating comparable store sales

varies across the retail industry. As a result, our method of calculating comparable store sales may not be the same as other

retailers’ methods. We believe our calculation of comparable store sales best represents our strategy as a multi-channel

retailer who provides its consumers several ways to access its products.

(4) We have revised the presentation of outstanding checks in our prior period financial statements. Previously, we reduced

cash and liabilities when the checks were presented for payment and cleared our bank accounts. As of February 1, 2014,

we reduce cash and liabilities when the checks are released for payment. See Note 1 to our consolidated financial statements.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in our consolidated financial

statements, including the notes thereto. Statements regarding future economic performance, management’s plans and objectives,

and any statements concerning assumptions related to the foregoing contained in Management’s Discussion and Analysis of

Financial Condition and Results of Operations constitute forward-looking statements. Certain factors, which may cause actual

results to vary materially from these forward-looking statements, accompany such statements or appear elsewhere in this Form 10-

K, including the factors disclosed under “Part I — Item 1A. Risk Factors.”

General

GameStop Corp. (“GameStop,” “we,” “us,” “our,” or the “Company”) is a global, multichannel video game, consumer

electronics and wireless services retailer and is the world’s largest multichannel video game retailer. We sell new and pre-owned

video game hardware, physical and digital video game software, video game accessories, as well as new and pre-owned mobile

and consumer electronics products and other merchandise primarily through our GameStop, EB Games and Micromania stores.

As of February 1, 2014, we operated 6,675 stores, in the United States, Australia, Canada and Europe, which are primarily located

in major shopping malls and strip centers. We also operate electronic commerce Web sites www.gamestop.com,

www.ebgames.com.au, www.ebgames.co.nz, www.gamestop.ca, www.gamestop.it, www.gamestop.es, www.gamestop.ie,

www.gamestop.de, www.gamestop.co.uk and www.micromania.fr. The network also includes: www.kongregate.com, a leading

browser-based game site; Game Informer magazine, the leading multi-platform video game publication; a digital PC distribution

platform available at www.gamestop.com/pcgames; iOS and Android mobile applications; and an online consumer electronics

marketplace available at www.buymytronics.com. We also operate a certified Apple reseller with stores selling Apple products

in the United States under the name Simply Mac; Spring Mobile, an authorized AT&T reseller operating AT&T branded wireless

retail stores in the United States; and pre-paid wireless stores under the name Aio Wireless (an AT&T brand) as part of our expanding

relationship with AT&T.

Our fiscal year is composed of 52 or 53 weeks ending on the Saturday closest to January 31. The fiscal year ended February 1,

2014 (“fiscal 2013”) consisted of 52 weeks. The fiscal year ended February 2, 2013 (“fiscal 2012”) consisted of 53 weeks. The

fiscal year ended January 28, 2012 (“fiscal 2011”) consisted of 52 weeks.