GameStop 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Common Stock payable on March 25, 2014 to stockholders of record at the close of business on March 17, 2014. Future dividends

will be subject to approval by our Board of Directors.

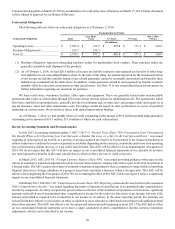

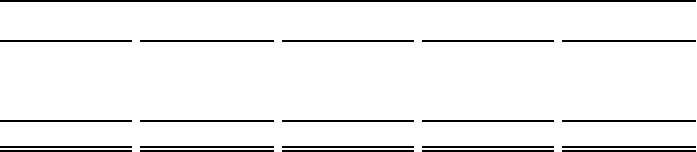

Contractual Obligations

The following table sets forth our contractual obligations as of February 1, 2014:

Payments Due by Period

Contractual Obligations Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

(In millions)

Operating Leases ................................. $ 1,039.4 $ 332.5 $ 405.8 $ 171.1 $ 130.0

Purchase Obligations(1) ...................... 538.7 538.7 — — —

Total (2) ............................................... $ 1,578.1 $ 871.2 $ 405.8 $ 171.1 $ 130.0

(1) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase orders are

generally cancelable until shipment of the products.

(2) As of February 1, 2014, we had $20.6 million of income tax liability related to unrecognized tax benefits in other long-

term liabilities in our consolidated balance sheet. At the time of this filing, the settlement period for the noncurrent portion

of our income tax liability (and the timing of any related payments) cannot be reasonably determined and therefore these

liabilities are excluded from the table above. In addition, certain payments related to unrecognized tax benefits would be

partially offset by reductions in payments in other jurisdictions. See Note 13 to our consolidated financial statements for

further information regarding our uncertain tax positions.

We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable

agreements that expire at various dates through 2034 with various renewal options for additional periods. The agreements, which

have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to

pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified

minimums at various stores. We do not have leases with capital improvement funding.

As of February 1, 2014, we had standby letters of credit outstanding in the amount of $9.0 million and had bank guarantees

outstanding in the amount of $18.7 million, $13.0 million of which are cash collateralized.

Recent Accounting Standards and Pronouncements

In July 2013, accounting standards update (“ASU”) 2013-11 “Income Taxes (Topic 740): Presentation of an Unrecognized

Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists” was issued

requiring an unrecognized tax benefit, or a portion of an unrecognized tax benefit, to be presented in the financial statements as

either a reduction to a deferred tax asset or separately as a liability depending on the existence, availability and/or use of an operating

loss carryforward, a similar tax loss, or a tax credit carryforward. This ASU will be effective for us beginning the first quarter of

2014. We do not expect that this ASU will have an impact on our consolidated financial statements as we currently do not have

any unrecognized tax benefits in the same jurisdictions in which we have tax loss or credit carryovers.

In March 2013, ASU 2013-05 “Foreign Currency Matters (Topic 830)” was issued providing guidance with respect to the

release of cumulative translation adjustments into net income when a parent company sells either a part or all of an investment in

a foreign entity. The ASU requires the release of cumulative translation adjustments when a company no longer holds a controlling

financial interest in a foreign subsidiary or a group of assets that constitutes a business within a foreign entity. This ASU will be

effective for us beginning the first quarter of 2014. We are evaluating the effect of this ASU, but do not expect it to have a significant

impact on our consolidated financial statements.

In February 2013, ASU 2013-02 “Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated

Other Comprehensive Income” was issued regarding disclosure of amounts reclassified out of accumulated other comprehensive

income by component. An entity is required to present either on the face of the statement of operations or in the notes, significant

amounts reclassified out of accumulated other comprehensive income by the respective line items of net income, but only if the

amount reclassified is required to be reclassified to net income in its entirety in the same reporting period. For amounts not

reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures that provide additional detail

about those amounts. This ASU was effective for our annual and interim periods beginning in fiscal 2013. The ASU had no effect

on our consolidated financial statements as we have a single component of other comprehensive income, currency translation

adjustments, which is not reclassified to net income.