GameStop 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

www.kongregate.com, a digital PC game distribution platform available at www.gamestop.com/pcgames and an online consumer

electronics marketplace available at www.buymytronics.com. As of February 1, 2014, the United States Video Game Brands

segment included 4,249 GameStop stores, compared to 4,425 stores on February 2, 2013.

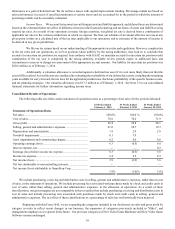

Although net sales for fiscal 2013 decreased 0.5% compared to fiscal 2012, comparable store sales increased 3.0%. The

decrease in net sales was primarily due to a $185.9 million decline in sales due to a 4.1% decrease in domestic store count and

sales for the 53rd week in fiscal 2012. The increase in comparable store sales was primarily due to strong performance of new

video game console and title releases during the second half of the year, which more than offset the declines that had been

experienced during the first half of fiscal 2013.

Asset impairments of $24.0 million were recognized in fiscal 2013 primarily related to our decision to abandon our Spawn

Labs business. Asset impairments of $5.7 million were recognized in fiscal 2012 primarily related to impairment of finite-lived

assets. Segment operating income for fiscal 2013 was $465.3 million compared to $501.9 million in fiscal 2012. Excluding the

impact of asset impairments, segment operating income decreased $18.3 million from $507.6 million in fiscal 2012 to $489.3

million in fiscal 2013 primarily related to the impact of a decline in sales prior to the launch of the next generation consoles and

the impact of lower margin console sales as a percentage of total sales, as well as the impact of the operating earnings in the 53rd

week in fiscal 2012.

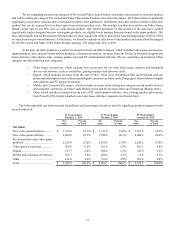

Canada

Segment results for Canada include retail operations in Canada and an e-commerce site. As of February 1, 2014, the Canadian

segment had 335 stores compared to 336 stores as of February 2, 2013. Net sales in the Canadian segment in the 52 weeks ended

February 1, 2014 decreased 2.0% compared to the 53 weeks ended February 2, 2013. The decrease in net sales was primarily

attributable to unfavorable changes in exchange rates of $22.3 million for fiscal 2013 and additional sales in the 53rd week of fiscal

2012 when compared to fiscal 2013, partially offset by an increase in sales at existing stores of 5.7%. The increase in net sales at

existing stores was primarily due to the launch of the next generation consoles.

The segment operating profit for fiscal 2013 was $26.6 million compared to an operating loss of $74.4 million for fiscal

2012. The increase in operating earnings was primarily due to the goodwill and asset impairment charges of $100.7 million

recognized during fiscal 2012. Excluding the impact of the goodwill and asset impairment charges, adjusted segment operating

earnings were $26.3 million in fiscal 2012. The increase in adjusted segment operating earnings was due to a decrease in selling,

general and administrative expenses as a result of lower sales and lower store count when compared to fiscal 2012, partially offset

by a $1.4 million unfavorable change in the exchange rate.

Australia

Segment results for Australia include retail operations and e-commerce sites in Australia and New Zealand. As of February 1,

2014, the Australian segment included 418 stores, compared to 416 stores as of February 2, 2013. Net sales for the 52 weeks ended

February 1, 2014 increased 1.1% compared to the 53 weeks ended February 2, 2013. The increase in net sales was primarily due

to a 12.6% increase in comparable store sales, partially offset by a $58.1 million reduction in sales associated with exchange rates

and the additional sales in the 53rd week of fiscal 2012. The increase in sales at existing stores was due to new video game console

and title releases.

The segment operating profit for fiscal 2013 was $37.5 million compared to an operating loss of $71.6 million for fiscal

2012. The increase in operating earnings was primarily due to the goodwill and asset impairment charges of $107.3 million

recognized during fiscal 2012, partially offset by a $4.8 million unfavorable change in the exchange rate. Excluding the impact

of the goodwill and asset impairment charges in 2012, segment operating earnings increased $1.8 million in fiscal 2013, when

compared to $35.7 million in fiscal 2012.

Europe

Segment results for Europe include retail operations in 11 European countries and e-commerce operations in six countries.

As of February 1, 2014, the European segment operated 1,455 stores, compared to 1,425 stores as of February 2, 2013. For the

52 weeks ended February 1, 2014, European net sales increased 7.8% compared to the 53 weeks ended February 2, 2013. This

increase in net sales was partially due to the favorable impact of changes in exchange rates in fiscal 2013, which had the effect of

increasing sales by $57.0 million when compared to fiscal 2012. Excluding the impact of changes in exchange rates, sales in the

European segment increased 4.2%. The increase in sales was primarily due to an increase in sales at existing stores of 3.2%, offset

by additional sales in the 53rd week of fiscal 2012 when compared to fiscal 2013. The increase in net sales at existing stores was

primarily due to new video game console and title launches.