GameStop 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

policies and procedures intended to ensure compliance with these laws, our employees, contractors, representatives and agents

may take actions that violate our policies. Moreover, it may be more difficult to oversee the conduct of any such persons who are

not our employees, potentially exposing us to greater risk from their actions. Any violations of those laws by any of those persons

could have a negative impact on our business.

Unfavorable changes in our global tax rate could have a negative impact on our business, results of operations and cash

flows.

As a result of our operations in many foreign countries, our global tax rate is derived from a combination of applicable tax

rates in the various jurisdictions in which we operate. Depending upon the sources of our income, any agreements we may have

with taxing authorities in various jurisdictions and the tax filing positions we take in various jurisdictions, our overall tax rate may

be higher than other companies or higher than our tax rates have been in the past. We base our estimate of an annual effective tax

rate at any given point in time on a calculated mix of the tax rates applicable to our business and to estimates of the amount of

income to be derived in any given jurisdiction. A change in the mix of our business from year to year and from country to country,

changes in rules related to accounting for income taxes, changes in tax laws in any of the multiple jurisdictions in which we operate

or adverse outcomes from the tax audits that regularly are in process in any jurisdiction in which we operate could result in an

unfavorable change in our overall tax rate, which could have a material adverse effect on our business and results of our operations.

If we are unable to renew or enter into new leases on favorable terms, our revenue growth may decline.

All of our retail stores are located in leased premises. If the cost of leasing existing stores increases, we cannot assure you

that we will be able to maintain our existing store locations as leases expire. In addition, we may not be able to enter into new

leases on favorable terms or at all, or we may not be able to locate suitable alternative sites or additional sites for new store

expansion in a timely manner. Our revenues and earnings may decline if we fail to maintain existing store locations, enter into

new leases, locate alternative sites or find additional sites for new store expansion.

Restrictions on our ability to take trade-ins of and sell pre-owned video game products or pre-owned mobile devices could

negatively affect our financial condition and results of operations.

Our financial results depend on our ability to take trade-ins of, and sell, pre-owned video game products and pre-owned

mobile devices within our stores. Actions by manufacturers or publishers of video game products or mobile devices, wireless

carriers or governmental authorities to prohibit or limit our ability to take trade-ins or sell pre-owned video game products or

mobile devices, or to limit the ability of consumers to play pre-owned video games or use pre-owned mobile devices, could have

a negative impact on our sales and earnings.

Sales of video games containing graphic violence may decrease as a result of actual violent events or other reasons, and

our financial results may be adversely affected as a result.

Many popular video games contain material with graphic violence. These games receive an “M” or “T” rating from the

Entertainment Software Ratings Board. As actual violent events occur and are publicized, or for other reasons, public acceptance

of graphic violence in video games may decline. Consumer advocacy groups may increase their efforts to oppose sales of

graphically-violent video games and may seek legislation prohibiting their sales. As a result, our sales of those games may decrease,

which could adversely affect our financial results.

An adverse trend in sales during the holiday selling season could impact our financial results.

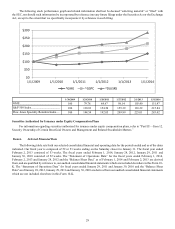

Our business, like that of many retailers, is seasonal, with the major portion of our sales and operating profit realized during

the fourth fiscal quarter, which includes the holiday selling season. During fiscal 2013, we generated approximately 41% of our

sales during the fourth quarter. Any adverse trend in sales during the holiday selling season could lower our results of operations

for the fourth quarter and the entire fiscal year.

Our results of operations may fluctuate from quarter to quarter.

Our results of operations may fluctuate from quarter to quarter depending upon several factors, some of which are beyond

our control. These factors include, but are not limited to:

• the timing and allocations of new product releases including new console launches;

• the timing of new store openings or closings;

• shifts in the timing or content of certain promotions or service offerings;

• the effect of changes in tax rates in the jurisdictions in which we operate;