GameStop 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

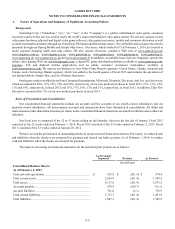

F-19

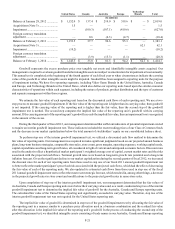

February 1, 2014

Level 2

February 2, 2013

Level 2

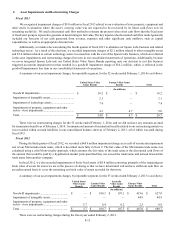

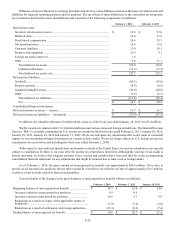

Assets

Foreign currency contracts

Other current assets........................................................................................... $ 0.9 $ 7.3

Other noncurrent assets..................................................................................... 0.5 0.9

Life insurance policies we own1......................................................................... 7.1 3.5

Total assets.......................................................................................................... $ 8.5 $ 11.7

Liabilities

Foreign currency contracts

Accrued liabilities............................................................................................. $ 21.3 $ 9.1

Other long-term liabilities................................................................................. 2.2 4.4

Nonqualified deferred compensation2................................................................. 1.1 0.9

Total liabilities..................................................................................................... $ 24.6 $ 14.4

____________________

1 Recognized in other non-current assets in our consolidated balance sheets.

2 Recognized in accrued liabilities in our consolidated balance sheets.

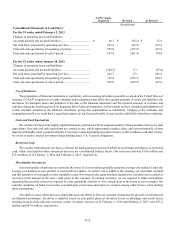

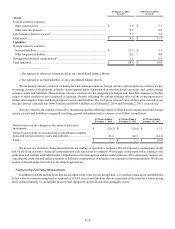

We use foreign currency contracts, including forward exchange contracts, foreign currency options and cross-currency swaps,

to manage currency risk primarily related to intercompany loans denominated in non-functional currencies and certain foreign

currency assets and liabilities. These foreign currency contracts are not designated as hedges and, therefore, changes in the fair

values of these derivatives are recognized in earnings, thereby offsetting the current earnings effect of the re-measurement of

related intercompany loans and foreign currency assets and liabilities. The total gross notional value of derivatives related to our

foreign currency contracts was $640.6 million and $669.9 million as of February 1, 2014 and February 2, 2013, respectively.

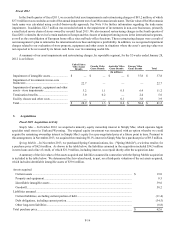

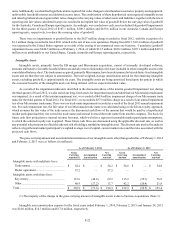

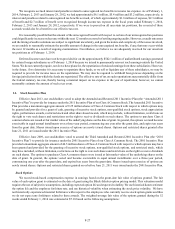

Activity related to the trading of derivative instruments and the offsetting impact of related intercompany loans and foreign

currency assets and liabilities recognized in selling, general and administrative expense is as follows (in millions):

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

52 Weeks Ended

January 28, 2012

Gains (losses) on the changes in fair value of derivative

instruments ..................................................................................... $(20.3)$ (19.8) $ 13.5

Gains (losses) on the re-measurement of related intercompany

loans and foreign currency assets and liabilities ............................ 23.6 22.3 (14.1)

Total................................................................................................ $ 3.3 $ 2.5 $ (0.6)

We do not use derivative financial instruments for trading or speculative purposes. We are exposed to counterparty credit

risk on all of our derivative financial instruments and cash equivalent investments. We manage counterparty risk according to the

guidelines and controls established under comprehensive risk management and investment policies. We continuously monitor our

counterparty credit risk and utilize a number of different counterparties to minimize our exposure to potential defaults. We do not

require collateral under derivative or investment agreements.

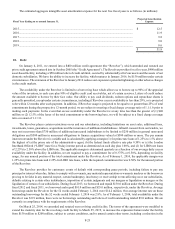

Nonrecurring Fair Value Measurements

In addition to assets and liabilities that are recorded at fair value on a recurring basis, we recorded certain assets and liabilities

at fair value on a nonrecurring basis as required by GAAP. Assets and liabilities that are measured at fair value on a nonrecurring

basis related primarily to our tangible property and equipment, goodwill and other intangible assets.