GameStop 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

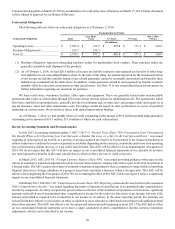

subsidiaries, defaults relating to certain other indebtedness, imposition of certain judgments and mergers or our liquidation or the

liquidation of certain of our subsidiaries.

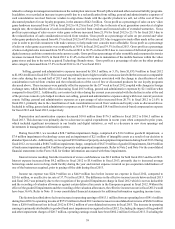

During fiscal 2013, we borrowed and repaid $130.0 million under the Revolver. During fiscal 2012 and fiscal 2011, we

borrowed and repaid $81.0 million and $35.0 million, respectively, under the Revolver. Average borrowings under the Revolver

for the 52 weeks ended February 1, 2014 were $14.2 million. Our average interest rate on those outstanding borrowings for the

52 weeks ended February 1, 2014 was 2.8%. As of February 1, 2014, total availability under the Revolver was $391.0 million,

there were no borrowings outstanding under the Revolver and letters of credit outstanding totaled $9.0 million.

On March 25, 2014, we further amended and restated our revolving credit facility. The terms of the agreement were modified

to extend the maturity date for the revolving credit facility to March 25, 2019, to increase the expansion feature under the facility

from $150 million to $200 million, subject to certain conditions, and to amend certain other terms, including a reduction in the

fee we are required to pay on the unused portion of the total commitment amount. The five-year, asset-based revolving credit

facility has a total commitment amount of $400 million, which is subject to a monthly borrowing base calculation, and is available

for the issuance of letters of credit of up to $50 million. The facility is secured by substantially all of our assets and the assets of

our domestic subsidiaries. We believe the extension of the maturity date of the revolving credit facility to March 2019 helps to

limit our exposure to potential tightening or other adverse changes in the credit markets.

In September 2007, our Luxembourg subsidiary entered into a discretionary $20.0 million Uncommitted Line of Credit (the

“Line of Credit”) with Bank of America. There is no term associated with the Line of Credit and Bank of America may withdraw

the facility at any time without notice. The Line of Credit is available to our foreign subsidiaries for use primarily as a bank

overdraft facility for short-term liquidity needs and for the issuance of bank guarantees and letters of credit to support operations.

As of February 1, 2014, there were no cash overdrafts outstanding under the Line of Credit and bank guarantees outstanding of

$4.3 million.

Uses of Capital

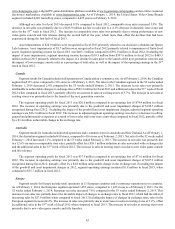

Our future capital requirements will depend on the number of new stores we open and the timing of those openings within

a given fiscal year, as well as the investments we will make in e-commerce, digital and other strategic initiatives. We opened or

acquired 327 stores in fiscal 2013, which includes the stores acquired in connection with the Spring Mobile and Simply Mac

acquisitions, and we expect to open or acquire approximately 350 to 450 stores in fiscal 2014, including investments in our

Technology Brands business. Capital expenditures for fiscal 2014 are projected to be approximately $160 million, to be used

primarily to fund continued digital initiatives, new store openings and store remodels and invest in distribution and information

systems in support of operations.

Between May 2006 and December 2011, we repurchased and redeemed $300 million of Senior Floating Rate Notes and

$650 million of Senior Notes under previously announced buybacks authorized by our Board of Directors. The associated loss on

the retirement of debt was $1.0 million for the 52 week period ended January 28, 2012, which consisted of the premium paid to

retire the Notes and the write-off of the deferred financing fees and the original issue discount on the Notes.

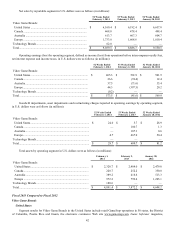

We used cash to expand our operations through acquisitions. During fiscal 2013, fiscal 2012 and fiscal 2011, we used $77.4

million, $1.5 million and $30.1 million, respectively, for acquisitions which in fiscal 2013 were primarily related to the growth of

our Technology Brands business.

Since January 2010, our Board of Directors has authorized several share repurchase programs authorizing management to

repurchase our common stock. Since the beginning of fiscal 2011, the authorizations have been for $500 million at a time. Our

typical practice is to seek Board of Directors’ approval for a new authorization before the existing one is fully used in order to

make sure that we are always able to repurchase shares. For fiscal 2011, we repurchased 11.2 million shares at an average price

per share of $21.38 for a total of $240.2 million, which excludes approximately $22 million of share repurchases that were executed

at the end of fiscal 2010 but for which the settlement and related cash outflow did not occur until the beginning of fiscal 2011.

For fiscal 2012, the number of shares repurchased was 19.9 million for an average price per share of $20.60 for a total of $409.4

million. For fiscal 2013, the number of shares repurchased was 6.3 million for an average price per share of $41.12 for a total of

$258.3 million. Between February 2, 2014 and March 20, 2014, we have repurchased 0.6 million shares at an average price per

share of $37.17 for a total of $20.6 million and we have $436.5 million remaining under our latest authorization from November

2013.

On February 8, 2012, our Board of Directors approved the initiation of a quarterly cash dividend to our stockholders of

Class A Common Stock. We paid a total of $0.80 per share in dividends in fiscal 2012 and a total of $1.10 per share in fiscal 2013.

On March 4, 2014, our Board of Directors authorized an increase in our annual cash dividend from $1.10 to $1.32 per share of

Class A Common Stock and on that date we declared our first quarterly cash dividend for fiscal 2014 of $0.33 per share of Class A