GameStop 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-15

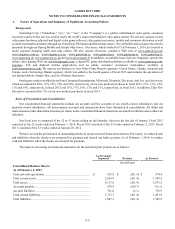

2. Asset Impairments and Restructuring Charges

Fiscal 2013

We recognized impairment charges of $9.0 million in fiscal 2013 related to our evaluation of store property, equipment and

other assets in situations where the asset’s carrying value was not expected to be recovered by its future cash flows over its

remaining useful life. We used a discounted cash flow method to estimate the present value of net cash flows that the fixed asset

or fixed asset group is expected to generate in determining its fair value. The key inputs to the discounted cash flow model generally

included our forecasts of net cash generated from revenue, expenses and other significant cash outflows, such as capital

expenditures, as well as an appropriate discount rate.

Additionally, we made a decision during the fourth quarter of fiscal 2013 to abandon our Spawn Labs business and related

technology assets. As a result of this decision, we recorded impairment charges of $2.1 million related to other intangible assets

and $7.4 million related to certain technology assets in connection with the exit of the Spawn Labs business, which are reflected

in the asset impairments and restructuring charges line item in our consolidated statements of operations. Additionally, because

we never integrated Spawn Labs into our United States Video Game Brands reporting unit, our decision to exit this business

triggered an interim impairment test that resulted in a goodwill impairment charge of $10.2 million, which is reflected in the

goodwill impairments line item in our consolidated statements of operations.

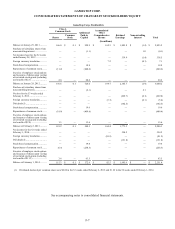

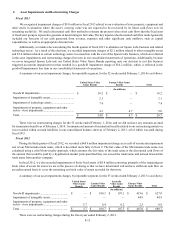

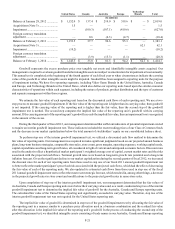

A summary of our asset impairment charges, by reportable segment, for the 52 weeks ended February 1, 2014 is as follows:

United States Video

Game Brands

Europe Video Game

Brands Total

(In millions)

Goodwill impairments .............................................. $ 10.2 $ — $ 10.2

Impairment of intangible assets ................................ 2.1 — 2.1

Impairment of technology assets .............................. 7.4 — 7.4

Impairments of property, equipment and other

assets - store impairments......................................... 4.3 4.7 9.0

Total.......................................................................... $ 24.0 $ 4.7 $ 28.7

There were no restructuring charges for the 52 weeks ended February 1, 2014, and we did not have any amounts accrued

for termination benefits as of February 1, 2014. An immaterial amount of termination benefits related to our restructuring initiatives

was recorded within accrued liabilities in our consolidated balance sheet as of February 2, 2013, all of which was paid during

fiscal 2013.

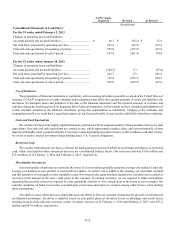

Fiscal 2012

During the third quarter of fiscal 2012, we recorded a $44.9 million impairment charge as a result of our interim impairment

test of our Micromania trade name, which is described more fully in Note 9. The fair value of the Micromania trade name was

calculated using a relief-from-royalty approach, which assumes the fair value of the trade name is the discounted cash flows of

the amount that would be paid by a hypothetical market participant had they not owned the trade name and instead licensed the

trade name from another company.

In fiscal 2012, we also recorded impairments of finite-lived assets of $8.8 million consisting primarily of the remaining net

book value of assets for stores we are in the process of closing or that we have determined will not have sufficient cash flow on

an undiscounted basis to cover the remaining net book value of assets recorded for that store.

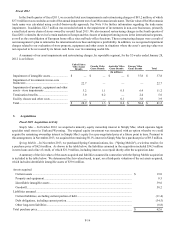

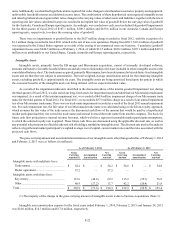

A summary of our asset impairment charges, by reportable segment, for the 53 weeks ended February 2, 2013 is as follows:

United States

Video Game

Brands

Canada Video

Game Brands

Australia

Video Game

Brands

Europe Video

Game Brands Total

(In millions)

Goodwill impairments ...................................... $ — $ 100.3 $ 107.1 $ 419.6 $ 627.0

Impairment of intangible assets ........................ — — — 44.9 44.9

Impairments of property, equipment and other

assets - store impairments................................. 5.7 0.4 0.2 2.5 8.8

Total.................................................................. $ 5.7 $ 100.7 $ 107.3 $ 467.0 $ 680.7

There were no restructuring charges during the fiscal year ended February 2, 2013.