GameStop 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

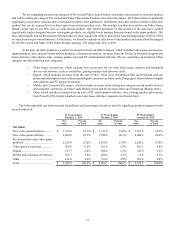

During fiscal 2012, cash provided by operations was $610.2 million, compared to cash provided by operations of

$641.8 million in fiscal 2011. The decrease in cash provided by operations of $31.6 million from fiscal 2011 to fiscal 2012 was

due primarily to lower net income in fiscal 2012. Cash provided by working capital increased modestly between years, due

primarily to a change in the timing of payments of prepaid expenses offset partially by higher inventory purchases in fiscal 2012

and the related effects on payments of accounts payable.

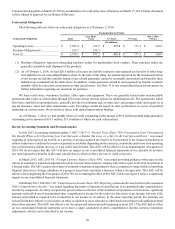

Cash used in investing activities was $207.5 million in fiscal 2013, $152.7 million in fiscal 2012 and $201.6 million in fiscal

2011. During fiscal 2013, we used $125.6 million for capital expenditures primarily to open 109 Video Game Brands stores in the

U.S. and internationally and to invest in information systems and digital initiatives. During fiscal 2013, we also used $77.4 million

of cash primarily for the acquisition of Spring Mobile and Simply Mac. During fiscal 2012, we used $139.6 million for capital

expenditures primarily to invest in information systems, distribution center capacity and e-commerce, digital and loyalty program

initiatives and to open 146 stores in the U.S. and internationally. During fiscal 2011, in addition to $165.1 million of cash used

for capital expenditures, we also used $30.1 million for acquisitions in support of our digital initiatives.

Cash used in financing activities was $350.6 million in fiscal 2013, $498.5 million in fiscal 2012 and $492.6 million in fiscal

2011. The cash flows used in financing activities in fiscal 2013 were primarily for the repurchase of $258.3 million of treasury

shares and the payment of dividends on our Class A Common Stock of $130.9 million. The cash flows used in financing activities

in fiscal 2012 were primarily for the repurchase of $409.4 million of treasury shares and the payment of dividends on our Class A

Common Stock of $102.0 million. The cash flows used in financing activities in fiscal 2011 were primarily for the repurchase of

$262.1 million of treasury shares and repayment of $250.0 million in principal of our senior notes. The cash used in financing

activities in fiscal 2013, fiscal 2012 and fiscal 2011 was also impacted by cash provided by the issuance of shares associated with

stock option exercises of $58.0 million, $11.6 million and $18.1 million, respectively.

Sources of Liquidity

We utilize cash generated from operations and have funds available to us under our revolving credit facility to cover seasonal

fluctuations in cash flows and to support our various growth initiatives. Our cash and cash equivalents are carried at cost, which

approximates market value, and consist primarily of time deposits with highly rated commercial banks.

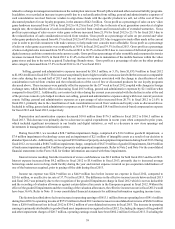

On January 4, 2011, we entered into a $400 million revolving credit facility (the “Revolver”), which amended and restated,

in its entirety, our prior credit agreement entered into in October 2005 (the “Credit Agreement”). The Revolver provides for a five-

year, $400 million asset-based facility, including a $50 million letter of credit sublimit, secured by substantially all of our and our

domestic subsidiaries’ assets. We have the ability to increase the facility, which matures in January 2016, by $150 million under

certain circumstances. The Revolver was further amended and restated on March 25, 2014 as described more fully below.

The availability under the Revolver is limited to a borrowing base which allows us to borrow up to 90% of the appraisal

value of the inventory, in each case plus 90% of eligible credit card receivables, net of certain reserves. Letters of credit reduce

the amount available to borrow by their face value. Our ability to pay cash dividends, redeem options and repurchase shares is

generally permitted, except under certain circumstances, including if Revolver excess availability is less than 20%, or is projected

to be so within 12 months after such payment. In addition, if Revolver usage is projected to be equal to or greater than 25% of

total commitments during the prospective 12-month period, we are subject to meeting a fixed charge coverage ratio of 1.1:1.0

prior to making such payments. In the event that excess availability under the Revolver is at any time less than the greater of

(1) $40 million or (2) 12.5% of the lesser of the total commitment or the borrowing base, we will be subject to a fixed charge

coverage ratio covenant of 1.1:1.0.

The Revolver places certain restrictions on us and our subsidiaries, including limitations on asset sales, additional liens,

investments, loans, guarantees, acquisitions and the incurrence of additional indebtedness. Absent consent from our lenders, we

may not incur more than $750 million of additional unsecured indebtedness to be limited to $250 million in general unsecured

obligations and $500 million in unsecured obligations to finance acquisitions valued at $500 million or more. The per annum

interest rate under the Revolver is variable and is calculated by applying a margin (1) for prime rate loans of 1.25% to 1.50%

above the highest of (a) the prime rate of the administrative agent, (b) the federal funds effective rate plus 0.50% or (c) the London

Interbank Offered (“LIBO”) rate for a 30-day interest period as determined on such day plus 1.00%, and (2) for LIBO rate loans

of 2.25% to 2.50% above the LIBO rate. The applicable margin is determined quarterly as a function of our average daily excess

availability under the facility. In addition, we are required to pay a commitment fee of 0.375% or 0.50%, depending on facility

usage, for any unused portion of the total commitment under the Revolver. As of February 1, 2014, the applicable margin was

1.25% for prime rate loans and 2.25% for LIBO rate loans, while the required commitment fee was 0.50% for the unused portion

of the Revolver.

The Revolver provides for customary events of default with corresponding grace periods, including failure to pay any

principal or interest when due, failure to comply with covenants, any material representation or warranty made by us or the

borrowers proving to be false in any material respect, certain bankruptcy, insolvency or receivership events affecting us or our