GameStop 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-16

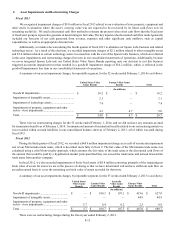

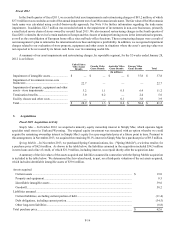

Fiscal 2011

In the fourth quarter of fiscal 2011, we recorded total asset impairments and restructuring charges of $81.2 million, of which

$37.8 million was recorded as a result of the annual impairment test of our Micromania trade name. The fair value of the Micromania

trade name was calculated using a relief-from-royalty approach. See Note 9 for further information regarding the trade name

impairment. In addition, $22.7 million was recorded related to the impairment of investments in non-core businesses, primarily

a small retail movie chain of stores owned by us until fiscal 2011. We also incurred restructuring charges in the fourth quarter of

fiscal 2011 related to the exit of certain markets in Europe and the closure of underperforming stores in the international segments,

as well as the consolidation of European home office sites and back-office functions. These restructuring charges were a result of

our management’s plan to rationalize the international store base and improve profitability. In addition, we recognized impairment

charges related to our evaluation of store property, equipment and other assets in situations where the asset’s carrying value was

not expected to be recovered by its future cash flows over its remaining useful life.

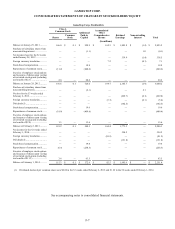

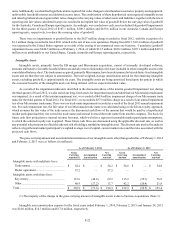

A summary of our asset impairments and restructuring charges, by reportable segment, for the 52 weeks ended January 28,

2012 is as follows:

United States

Video Game

Brands

Canada Video

Game Brands

Australia Video

Game Brands

Europe Video

Game Brands Total

(In millions)

Impairment of intangible assets........................ $ — $ — $ — $ 37.8 $ 37.8

Impairment of investments in non-core

businesses ......................................................... 22.7———22.7

Impairments of property, equipment and other

assets - store impairments ................................ 3.2 1.1 0.5 6.4 11.2

Termination benefits......................................... 3.0 0.2 — 2.4 5.6

Facility closure and other costs ........................ — — 0.1 3.8 3.9

Total.................................................................. $ 28.9 $ 1.3 $ 0.6 $ 50.4 $ 81.2

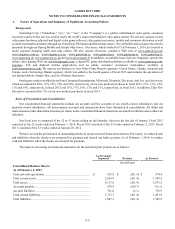

3. Acquisitions

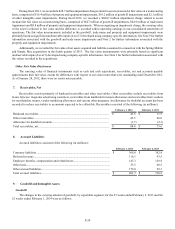

Fiscal 2013 Acquisition Activity

Simply Mac -- In October 2012, we acquired a minority equity ownership interest in Simply Mac, which operates Apple

specialist retail stores in Utah and Wyoming. The original equity investment was structured with an option whereby we could

acquire the remaining ownership interest in Simply Mac's equity for a pre-negotiated price at a future point in time. Pursuant to

this arrangement, in November 2013, we acquired the remaining 50.1% interest in Simply Mac for a purchase price of $9.5 million.

Spring Mobile -- In November 2013, we purchased Spring Communications, Inc. ("Spring Mobile"), a wireless retailer, for

a purchase price of $62.6 million. As shown in the table below, the liabilities assumed in the acquisition included $34.5 million

in term loans and a line of credit, of which $31.9 million, including interest, was repaid shortly after the acquisition date.

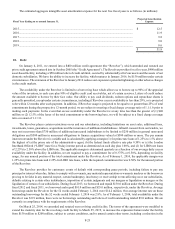

A summary of the fair values of the assets acquired and liabilities assumed in connection with the Spring Mobile acquisition

is included in the table below. We determined the fair values based, in part, on a third-party valuation of the net assets acquired,

which includes identifiable intangible assets of $39.6 million.

Assets acquired

Current assets ...................................................................................................................................... $ 19.0

Property and equipment ...................................................................................................................... 8.5

Identifiable intangible assets............................................................................................................... 39.6

Goodwill.............................................................................................................................................. 50.2

Liabilities assumed .................................................................................................................................

Current liabilities, excluding current portion of debt.......................................................................... (11.4)

Debt obligations, including current portion ........................................................................................ (34.5)

Other long-term liabilities................................................................................................................... (8.8)

Total purchase price................................................................................................................................ $ 62.6