GameStop 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

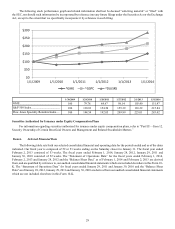

Growth in the electronic game industry is generally driven by the introduction of new technology. Gaming consoles are

typically launched in cycles as technological developments provide significant improvements in graphics, audio quality, game

play, Internet connectivity and other entertainment capabilities beyond video gaming. The current generation of consoles (the Sony

PlayStation 4, the Microsoft Xbox One and the Nintendo Wii U) were introduced between November 2012 through November

2013. The previous generation of consoles (the Sony PlayStation 3, the Microsoft Xbox 360 and the Nintendo Wii) were introduced

between 2005 and 2007. The Nintendo 3DS was introduced in March 2011, the Sony PlayStation Vita was introduced in February

2012 and the Nintendo 2DS was introduced in October 2013. Typically, following the introduction of new video game platforms,

sales of new video game hardware increase as a percentage of total sales in the first full year following introduction. As video

game platforms mature, the sales mix attributable to complementary video game software and accessories, which generate higher

gross margins, generally increases in the subsequent years. The net effect is generally a decline in gross margin percent in the first

full year following new platform releases and an increase in gross margin percent in the years subsequent to the first full year

following the launch period. The launch of the next-generation Sony PlayStation 4 and the Microsoft Xbox One should negatively

impact our overall gross margin percentage in future years. Unit sales of maturing video game platforms are typically also driven

by manufacturer-funded retail price reductions, further driving sales of related software and accessories. Historically, new hardware

consoles are typically introduced every four to five years. We experienced declines in new hardware and software sales throughout

the first few months of fiscal 2013 due to the age of the older generation of consoles. With the introduction of the new consoles

in the fourth quarter, sales of new hardware have increased.

We expect that future growth in the electronic game industry will also be driven by the sale of video games delivered in

digital form and the expansion of other forms of gaming. We currently sell various types of products that relate to the digital

category, including digitally downloadable content ("DLC"), Xbox LIVE, PlayStation Plus and Nintendo network points cards,

as well as prepaid digital and online timecards. We expect our sales of digital products to increase in fiscal 2014. We have made

significant investments in e-commerce and in-store and Web site functionality to enable our customers to access digital content

easily and facilitate the digital sales and delivery process. We plan to continue to invest in these types of processes and channels

to grow our digital sales base and enhance our market leadership position in the electronic game industry and in the digital

aggregation and distribution category. In fiscal 2011, we also launched our mobile business and began selling an assortment of

tablets and accessories. We currently sell tablets and accessories in all of our stores in the United States and in a majority of stores

in our international markets. We also sell and accept trades of pre-owned mobile devices in our stores. In addition, we intend to

continue to invest in customer loyalty programs designed to attract and retain customers.

In November 2013, we acquired Spring Mobile, an authorized AT&T reseller operating over 160 stores selling wireless

services and products, and acquired Simply Mac, an authorized Apple reseller selling Apple products and services in 23 stores.

We also opened 31 stores under the Aio Wireless brand. Aio Wireless is an AT&T brand selling pre-paid wireless services and

products. We expect to expand the number of Spring Mobile and Simply Mac stores which we operate in future years. We also

expect to expand our pre-paid stores with AT&T under either the Aio Wireless brand or the Cricket brand following AT&T’s

acquisition of Leap Wireless.

Critical Accounting Policies and Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of

America (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. In preparing these financial statements, we have made our best estimates and judgments of

certain amounts included in the financial statements, giving due consideration to materiality. Changes in the estimates and

assumptions used by us could have a significant impact on our financial results, and actual results could differ from those estimates.

Our senior management has discussed the development and selection of these critical accounting policies, as well as the significant

accounting policies disclosed in Note 1 to our consolidated financial statements, with the Audit Committee of our Board of Directors.

We believe the following accounting policies are the most critical to aid in fully understanding and evaluating our reporting of

transactions and events, and the estimates these policies involve require our most difficult, subjective or complex judgments.

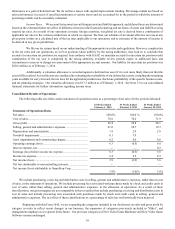

Revenue Recognition. Revenue from the sales of our products is recognized at the time of sale, net of sales discounts

and net of an estimated sales return reserve, based on historical return rates, with a corresponding reduction in cost of sales. Our

sales return policy is generally limited to less than 30 days and as such our sales returns are, and have historically been, immaterial.

The sales of pre-owned video game products are recorded at the retail price charged to the customer. Advertising revenues for

Game Informer are recorded upon release of magazines for sale to consumers. Subscription revenues for our PowerUp Rewards

loyalty program and magazines are recognized on a straight-line basis over the subscription period. Revenue from the sales of

product replacement plans is recognized on a straight-line basis over the coverage period. Gift cards sold to customers are recognized