GameStop 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-24

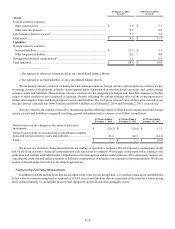

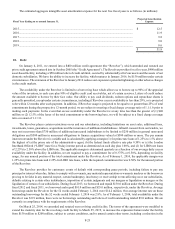

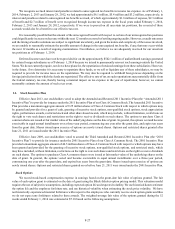

fee we are required to pay on the unused portion of the total commitment amount. The five-year, asset-based revolving credit

facility has a total commitment amount of $400 million, which is subject to a monthly borrowing base calculation, and is available

for the issuance of letters of credit of up to $50 million. The facility is secured by substantially all of our assets and the assets of

our domestic subsidiaries. We believe the extension of the maturity date of the revolving credit facility to March 2019 helps to

limit our exposure to potential tightening or other adverse changes in the credit markets.

In September 2007, our Luxembourg subsidiary entered into a discretionary $20.0 million Uncommitted Line of Credit (the

“Line of Credit”) with Bank of America. There is no term associated with the Line of Credit and Bank of America may withdraw

the facility at any time without notice. The Line of Credit is available to our foreign subsidiaries for use primarily as a bank

overdraft facility for short-term liquidity needs and for the issuance of bank guarantees and letters of credit to support operations.

As of February 1, 2014, there were no cash overdrafts outstanding under the Line of Credit and bank guarantees outstanding totaled

$4.3 million.

11. Leases

We lease retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable

agreements that expire at various dates through 2034 with various renewal options for additional periods. The agreements, which

have been classified as operating leases, generally provide for minimum and, in some cases, percentage rentals and require us to

pay all insurance, taxes and other maintenance costs. Leases with step rent provisions, escalation clauses or other lease concessions

are accounted for on a straight-line basis over the lease term, which includes renewal option periods when we are reasonably

assured of exercising the renewal options and includes “rent holidays” (periods in which we are not obligated to pay rent). Cash

or lease incentives received upon entering into certain store leases (“tenant improvement allowances”) are recognized on a straight-

line basis as a reduction to rent expense over the lease term, which includes renewal option periods when we are reasonably assured

of exercising the renewal options. We record the unamortized portion of tenant improvement allowances as a part of deferred rent.

We do not have leases with capital improvement funding. Percentage rentals are based on sales performance in excess of specified

minimums at various stores and are accounted for in the period in which the amount of percentage rentals can be accurately

estimated.

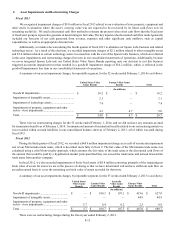

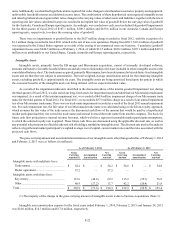

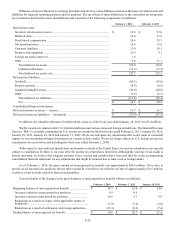

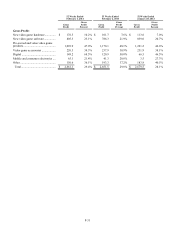

Approximate rental expenses under operating leases were as follows:

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

52 Weeks Ended

January 28, 2012

(In millions)

Minimum.................................................................................... $ 381.6 $ 385.4 $ 386.9

Percentage rentals....................................................................... 9.4 9.3 12.3

$ 391.0 $ 394.7 $ 399.2

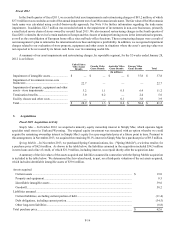

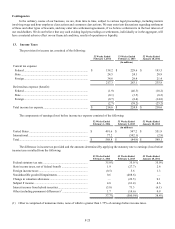

Future minimum annual rentals, excluding percentage rentals, required under leases that had initial, noncancelable lease

terms greater than one year, as of February 1, 2014, are approximately:

Fiscal Year Ending on or around January 31, Amount

(In millions)

2015.............................................................................................................................................................. $ 332.5

2016.............................................................................................................................................................. 243.2

2017.............................................................................................................................................................. 162.6

2018.............................................................................................................................................................. 103.3

2019.............................................................................................................................................................. 67.8

Thereafter ..................................................................................................................................................... 130.0

$ 1,039.4

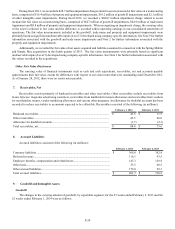

12. Commitments and Contingencies

Commitments

We had bank guarantees relating primarily to international store leases totaling $18.7 million as of February 1, 2014 and

$21 million as of February 2, 2013.

See Note 11 for information regarding commitments related to our noncancelable operating leases.