GameStop 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

as a liability on the consolidated balance sheet until redeemed or until a reasonable point at which breakage related to non-

redemption can be recognized.

We also sell a variety of digital products which generally allow consumers to download software or play games on

the internet. Certain of these products do not require us to purchase inventory or take physical possession of, or take title to,

inventory. When purchasing these products from us, consumers pay a retail price and we earn a commission based on a percentage

of the retail sale as negotiated with the product publisher. We recognize these commissions as revenue on the sale of these digital

products.

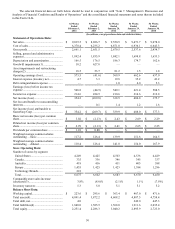

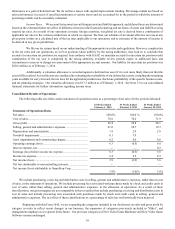

Merchandise Inventories. Our merchandise inventories are carried at the lower of cost or market generally using

the average cost method. Under the average cost method, as new product is received from vendors, its current cost is added to the

existing cost of product on-hand and this amount is re-averaged over the cumulative units. Pre-owned video game products traded

in by customers are recorded as inventory at the amount of the store credit given to the customer. In valuing inventory, we are

required to make assumptions regarding the necessity of reserves required to value potentially obsolete or over-valued items at

the lower of cost or market. We consider quantities on hand, recent sales, potential price protections and returns to vendors, among

other factors, when making these assumptions. Our ability to gauge these factors is dependent upon our ability to forecast customer

demand and to provide a well-balanced merchandise assortment. Any inability to forecast customer demand properly could lead

to increased costs associated with inventory markdowns. We also adjust inventory based on anticipated physical inventory losses

or shrinkage. Physical inventory counts are taken on a regular basis to ensure the reported inventory is accurate. During interim

periods, estimates of shrinkage are recorded based on historical losses in the context of current period circumstances. Our reserve

for merchandise inventories was $76.5 million as of February 1, 2014.

Property and Equipment. We had net property and equipment of $476.2 million as of February 1, 2014. We review

our property and equipment for impairment when events or changes in circumstances indicate that their carrying amounts may

not be recoverable or their depreciation or amortization periods should be accelerated. We assess recoverability based on several

factors, including our intention with respect to our stores and the stores' projected undiscounted cash flows. If the results of the

recoverability test indicate that an asset or asset group is not recoverable, an impairment loss is recognized for the amount by

which the carrying amount of the asset exceeds its fair value, as approximated by the present value of their projected discounted

cash flows. We recorded impairment losses on our property and equipment of $18.5 million, $8.8 million and $11.2 million in

fiscal 2013, fiscal 2012 and fiscal 2011, respectively, based on the results of our impairment tests.

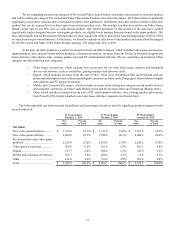

Goodwill. We had goodwill totaling $1,414.7 million as of February 1, 2014. Our goodwill results from our

acquisitions and represents the excess purchase price over the net identifiable assets acquired. We are required to evaluate our

goodwill and other indefinite-lived intangible assets for impairment at least annually or whenever indicators of impairment are

present. This annual test is completed as of the beginning of the fourth fiscal quarter, and interim tests are conducted when

circumstances indicate the carrying value of the goodwill or other intangible assets may not be recoverable. Goodwill is evaluated

for impairment at the reporting unit level. We have five operating segments, including Video Game Brands in the United States,

Australia, Canada and Europe, and Technology Brands in the United States, which also define our reporting units. Our reporting

units are based upon the similar economic characteristics of operations within each segment, including the nature of products,

product distribution and the type of customer and separate management within those regions.

We use a two-step process to measure any potential goodwill impairment. The first step of the goodwill impairment

test involves estimating the fair value of each reporting unit based on its discounted projected future cash flows. If the fair value

of the reporting unit exceeds its carrying value, then goodwill is not impaired; however, if the fair value of the reporting unit is

less than its carrying value, then the second step of the goodwill impairment test is needed. The second step compares the implied

fair value of the reporting unit’s goodwill with its carrying amount. The implied fair value of goodwill is determined in step two

of the goodwill impairment test by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation

used in a business combination. Any residual fair value after this allocation represents the implied fair value of the reporting unit’s

goodwill. If the carrying amount of the reporting unit’s goodwill exceeds the implied fair value of its goodwill, then an impairment

loss is recognized in the amount of the excess.

We utilize a discounted cash flow method to determine the fair value of reporting units. Management is required to

make significant judgments based on our projected annual business plans, long-term business strategies, comparable store sales,

store count, gross margins, operating expenses, working capital needs, capital expenditures and long-term growth rates, all

considered in light of current and anticipated economic factors. Discount rates used in the analysis reflect a hypothetical market

participant’s weighted average cost of capital, current market rates and the risks associated with the projected cash flows. Terminal

growth rates were based on long-term growth rate potential and a long-term inflation forecast. The impairment testing process is

subject to inherent uncertainties and subjectivity, particularly related to sales and gross margins which can be impacted by various

factors including the items listed in "Item 1A. Risk Factors" within this Form 10-K. While the fair value is determined based on

the best available information at the time of assessment, any changes in business or economic conditions could materially increase

or decrease the fair value of the reporting unit’s net assets and, accordingly, could materially increase or decrease any related